Global research consultants Wood Mackenzie has identified the key Brazilian infrastructure projects ready to take shape as the country develops the subsalt hydrocarbons of the Santos basin over the next 20 years.

Some are under construction already, some are at the planning stage, but many are conceptual with uncertainties ahead. Even with potential for delays, WoodMac says it is certain that the Santos basin will turn Brazil into a global oil and gas power-house over the coming decades.

Starting with fairly limited infrastructure, the analysts say over the next 10 or 20 years, national oil company Petrobras will lead the way in transforming the vast (200,000 sq km [77,220 sq mi]) Santos basin into an intricate network of production platforms, offshore storage facilities, oil and gas pipelines, and, possibly, some sophisticated gas facilities (such as floating LNG and floating GTL) with technologies not yet commercially proven.

The fields discovered to date are expected to ramp up oil production from Santos from a very minor 4,000 b/d of oil in 2008, to some 675,000 b/d in 2015 and perhaps 1.3 MMb/d in 2020. Gas production will ramp up similarly, although the pace will be more directly dictated by market growth.

First off the ground will be the commissioning of the Mexilhão gas field, in January 2010, WoodMac says. Phase 1 of the BS-500 Pole development will start up later in 2010, tying back to the Mexilhão facility. In early 2011, the Tupi pilot test will come onstream, involving an FPSO vessel and a new gas pipeline to Mexilhão. Petrobras also is working toward installing two more EWTs in the subsalt area, on the Guará and Iara fields. Here is an overview of work under way:

- Mexilhão, a 2-tcf gas field will go onstream in 2010

- BS-500 Phase 1 will start up in early 2010, with 1 tcf of gas and 300 MMboe

- Tupi extended well test (EWT) came onstream in May 2009 and a larger, 100,000 b/d pilot test is scheduled to start-up in late 2010 or early 2011

- Guará and Iara EWTs are expected to begin by 2011, but these have not yet been contracted, and similar pilot tests to that on Tupi will follow.

Assuming all goes well with the Tupi EWT and pilot, as well as financing (not an easy task in today’s environment), the infrastructure should rapidly expand after 2012 as Petrobras and its partners ramp up production from the subsalt. However, other projects elsewhere in the basin also should start to come onstream, notably more conventional light oil and gas plays in shallow water, as well as expansion of Mexilhão and BS-500.

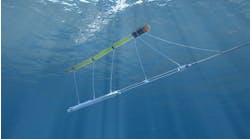

Besides Tupi, eight other subsalt fields have been discovered so far in the Santos basin. Development of these fields will likely be on a phased, modular basis similar to Tupi, with both FPSOs and DCUs being used, depending on specific circumstances. Existing discoveries will require a minimum of perhaps 30 production modules (including those on Tupi), much more if reserves are proved up at the higher end of expectations, WoodMac says.

Each module will be more-or-less a stand-alone development, but significant synergies are expected in the areas of oil pipelines (although most oil is expected to be tanker-loaded offshore, at least in the early years) and gas pipelines, as well as in day-to-day operations and logistics. Also, should more novel methods of gas commercialization be chosen, it would make sense to have just one or two central processing hubs.

A key challenge facing Petrobras and its subsalt partners is how to dispose of the gas in a commercial and environmentally friendly manner. Wood Mackenzie currently models peak oil production at the Tupi field of 900,000 b/d in 2023, at which time the field could be producing some 1.2 bcf/d of gas. Of that gas, some will be used for in-field fuel requirements and another 10% or so is CO2 that will need to be stripped out (creating a major disposal issue). Ideally, the CO2 could be re-injected to help with pressure maintenance and this is to be examined by Petrobras.

But, even so, there will still be some 900 MMcf/d of gas (4 tcf of reserves) that could be expected to be available for commercial sale from Tupi (although this would be reduced if gas injection was implemented for pressure maintenance).

The gas issue is magnified because the Júpiter field in Santos is believed to be gas-rich. The CO2 content is higher (believed to be over 20%, although data so far released on this field is minimal) but, even after stripping out contaminants and accounting for in-field usage, initial estimates made by Wood Mackenzie suggest that the field could contain around 13 tcf of sales gas.

Some of the gas commercialization concepts under evaluation include conventional pipelines to shore, floating LNG, compressed natural gas (CNG), floating gas-to-liquids (GTL), and gas-to-wire (GTW). Indeed, the size of the gas resource is such that there would be room for several gas transportation options to run in parallel. The first two options are the most likely, but judging by the Mexilhão experience, pipelines will face serious challenges in obtaining environmental permits for the onshore lines and gas plants, as well as technical challenges such as hydrate formation given their depth and length (300 km [186 mi]).

Also, floating LNG is not yet a proven technology, although this is perhaps as good an area as any to test it, the analysts say.

In many ways the subsalt fields are well positioned in that they lie equidistant from Brazil’s two key gas demand centers, São Paulo and Rio de Janeiro, and also with easy access to markets in the Atlantic basin should the LNG export option be pursued. Closer to home, gas hungry neighbor Argentina would be an obvious market, depending on whether or not imports from Bolivia materialize.

Editor’s note: This article is a summary of a report recently published by Wood Mackenzie titled Brazil’s Santos basin: an emerging giant.