Offshore EPC contracting activity to remain buoyant in 2025

By Mark Adeosun, Westwood Global Energy Group

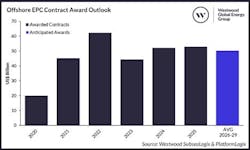

In 2024, engineering, procurement and construction (EPC) contracting activities related to offshore oil and gas field development and carbon sequestration projects remained resilient, with EPC award value for associated subsea equipment and offshore platforms totaling approximately US $52 billion. This represents an 18% year-over-year increase despite a 33% year-over-year decline in the number of project final investment decisions (FIDs) recorded.

The disconnect between the FID count and EPC award value trend between 2023 and 2024 is due to the award of large ticket items such as Petrobras’ P-84 and P-85 floating production, storage and offloading (FPSO) units, with an EPC value of over US $8 billion. There were other belated EPC awards – for example, Shell’s Sparta had the FID announced in December 2023 but the EPC award for the floating production semisubmersible (FPSS) unit was only confirmed to Seatrium in January 2024. Furthermore, major subsea umbilical riser and flowline (SURF) contract awards by Petrobras across its Buzios-9, Buzios-10 and Buzios-11 projects, as well as the Mero-3 HISEP project, supported the increase in EPC award value, although these projects already had their FIDs announced in prior years.

Overall, Westwood recorded over 250 subsea tree unit awards in 2024, with the Americas accounting for approximately 65%. ExxonMobil’s Whiptail development offshore Guyana represented the most significant single project in 2024 based on subsea tree demand.

For floating production system (FPS) units, including FLNGs, Westwood recorded 11 EPC awards, with a total throughput capacity of 1.57 MMboe/d (1.3 MMb/d oil and 1.8 Bcf/d of gas) and 8 MMpta of LNG capacity. Seven of the units sanctioned were newbuilds, three were conversions, and only one was an upgrade contract for an existing unit.

As expected, the Middle East dominated the fixed platforms market, accounting for 58% of the 66 fixed platforms (topsides and jackets) EPC awards recorded in 2024. While Saudi Aramco announced that it suspended the expansion of its maximum sustainable capacity (MSC) from 12 MMb/d to 13 MMb/d in January 2024, which led to the cancellation of several contract release and purchase orders (CRPOs), the Saudi NOC still accounted for approximately 38% of fixed platform EPC contracts awarded on a global basis in 2024.

EPC expectations for 2025

Looking ahead to 2025, Westwood forecasts offshore oil and gas-related EPC contract award value to experience a marginal 1% year-over-year increase, totaling US $54 billion, underpinned by 53 greenfield and brownfield field FIDs. This marginal growth is due to high supply chain cost, which has plagued the industry since 2022 and led to several project delays as E&P companies continue to optimize their field development concepts and revise project timelines. Furthermore, the softening of near-term Chinese oil demand has been driving a bearish sentiment across the global oil market, with OPEC+ agreeing this past December to extend its voluntary output cuts into 2025. This is an indication that the oil market may soften further as we enter 2025, hereby impacting the sanctioning of projects with high breakeven cost, and operators opting to retender rather than sanction projects. Despite these concerns, Westwood anticipates that contracting activities in 2025 will be driven by the demand for over 290 subsea tree units; 18 floating production units (including four FLNG units), with a total throughput capacity of 1.9 MMboe/d (959 Kb/d of oil and 3.2 Bcfd of gas) and 15.1 MMpta of LNG capacity; over 90 fixed platforms; approximately 3,650 km of SURF systems; and approximately 2,660 km of line pipe.

In 2024, the FPS market accounted for 44% (US $23 billion) of offshore EPC contract awards as a result of Petrobras’ P-84 and P-85 units; TotalEnergies’ GranMorgu FPSO; and ExxonMobil’s Jaguar FPSO offshore Suriname and Guyana respectively. In contrast, Westwood anticipates the FPS market to account for only 33% of offshore EPC contract award in 2025. This is because eight of the 18 units expected to be sanctioned will be contracts to upgrade and redeploy existing units, as operators continue to explore ways to reduce upfront field development cost.

For major FPS contracts expected in 2025, Eni is expected to be the most active in offshore E&P, with its Baleine Phase-3 development (Ivory Coast); the Geng North project offshore Indonesia; and its Coral Norte development offshore Mozambique. Other major FPS projects scheduled to be sanctioned in 2025 include Shell’s Gato do Mato project (Brazil); Petrobras’ Barracuda-Caratinga replacement FPSO (Brazil); UTM Offshore’s Yoho FLNG unit (Nigeria); Petronas’ Kelidang Cluster offshore Brunei; and Nisga'a Nation’s Ksi Lisims LNG project off the coast of Canada. It is pertinent to state that the sanctioning timeline of all these projects has been subject to revision in the past.

Regional trends

Regionally, Africa and the Americas will drive offshore EPC contracting activity in 2025, accounting for 26% and 25% respectively, with the Middle East accounting for 24% of forecast EPC award value. Key awards to watch in Africa include Eni’s Coral Norte offshore Mozambique and its Baleine Phase 3 project offshore Ivory Coast; ExxonMobil’s Owowo project and Erha North–Phase 3 development; as well as TotalEnergies’ Preowei field offshore; and infill drilling activities at Chevron’s Agbami development offshore Nigeria.

In the Americas, Shell’s Gato do Mato (Brazil); Repsol’s Polok & Chinwol project (Mexico); Pemex’s Zama project (Mexico); Navitas Petroleum’s Sea Lion project (Falkland Islands); as well as Petrobras’ continued investment in the presalt basin will present EPC contracting opportunities. In the US GoM, Westwood anticipates that the region will continue to thrive on subsea infill drilling and fast-track developments over the near term. No FPS unit is expected to be sanctioned in the US GoM in 2025. However, subsea tieback projects to existing facilities such as Beacon Offshore’s Shenandoah Phase 2, Murphy’s Longclaw and Kosmos Energy’s Tiberius are all scheduled to progress.

In the Middle East, TPAO’s Sakarya Phase 3 is a key subsea project to watch, with the operator also planning to sanction a floating production unit for the project in 2025. Offshore Saudi Arabia, Saudi Aramco’s brownfield development across the Abu Safah, Berri, Safaniya, Marjan and Zuluf fields will continue to support contract awards across several CRPOs (contract release and purchase orders). QatarEnergy’s North Field Compression Phase 2 Project and Bul Hanine redevelopment project will drive contracting activities offshore Qatar. ADNOC’s Lower Zakum Long Term Development–Phase 1 development; the Umm Shaif-Long Term Development Phase 2; and Eni’s Abu Dhabi Offshore 2 project will represent key offshore EPC contracting opportunities offshore the UAE in 2025.

Looking beyond 2025

Beyond 2025, continued investment in the following areas will represent significant EPC contracting opportunities: Petrobras’ presalt basin; ExxonMobil’s Starbroek block (Guyana); the Eastern Mediterranean; deepwater Namibia; the East African Ruvuma-Rufiji gas basin; and long-delayed gas projects in the Asia Pacific region such as Inpex’s Abadi project (Indonesia) and Woodside Energy’s Browse development (Australia).

Westwood’s projected EPC contracting activities over the 2026-29 period is underpinned by a relatively robust hydrocarbon demand from OECD countries and a relatively stable oil demand from China, which should support oil prices to average over US $70 per barrel and a softening of supply chain inflationary pressures, which will be favorable for project economics. Should these scenarios hold, annual oil and gas-related EPC award value is projected to average US $50 billion over the 2026-29 period.

However, potential upside remains, with projects such as the Greater Sunrise development offshore Timor-Leste offering promise as the JV partners continue negotiations with the Australian and Timor-Leste Governments to progress a new PSC, petroleum mining code and fiscal regime. Also promising are the recent exploratory success offshore Colombia such as Shell’s Glaucus and Petrobras’ Sirius gas discoveries that are currently not included in offshore EPC contracting opportunity over the forecast.

About the Author

Mark Adeosun

Research Manager, Offshore Field Development

Mark Adeosun is currently the Research Director for Westwood Global Energy Group’s SubseaLogix and PlatformLogix market analytic tools. Since joining Westwood in 2013, he has worked directly with as well as advised several clients within the oilfield services supply chain, as part of both analytic and commercial advisory projects.