FSO likely first choice for GoM

Some industry experts agree that the first ship-shaped floating facility employed in the Gulf of Mexico will be a floating storage and offloading (FSO) unit.

Teekay Navion Shuttle Tankers’ Separate Storage Shuttling (SSS) concept. This solution incorporates a production facility, an FSO, and a shuttle tanker.

Development scenarios using a floating production unit with oil export via FSO and shuttle tanker (and gas export to shore by pipeline) are looking attractive for ultra-deepwater regions such as Walker Ridge, Alaminos Canyon, Keathley Canyon, Lund, and Lloyd Ridge, according to William David Hartell, project manager for major projects in the GoM with Marathon Oil Co.

Hartell spoke at theDeep Offshore Technology Conference & Exhibition in Brazil last month.

The MMS reached a decision to accept applications for use of FPSOs in the Gulf almost four years ago. Leading up to its decision, the regulatory agency conducted several environmental and safety impact studies and concluded that “environmental risks associated with FPSOs are comparable to other types of production systems currently accepted for use in deepwater.”

This groundbreaking announcement was thought to pave the way for the first FPSO for the GoM. But so far, not a single FPSO has been proposed, and it is possible that regulatory risk may be inhibiting use of the first unit, said Hartell.

Given this perception and the apparent hesitation of operators to propose an FPSO, it is likely that an FSO-type unit will be the first choice. Hartell pointed to certain commercial considerations to support this premise.

”In a given deepwater FSO development scheme, the gas could still be piped to shore, but the oil could be more economically exported with shuttle tankers to avoid potential high tariffs incurred through the use of hundreds of miles of pipeline for transport to market,” he said. “Oil tariffs to market from ultra deepwater locations could reach $5-6 per barrel, while FSO and shuttle costs should be less.”

The tanker owner would also have the flexibility to transport oil to the best market and “avoid the impact of market differentials or significant quality bank penalties in oil pipelines,” Hartell said.

Gas export options in deepwater developments have to be carefully considered as well, especially given that the MMS will only allow developments to proceed if they include plans to eventually produce or market any associated gas.

Hartell said, “Gas processing options for export are driven by the distance to where the product is to be marketed--mainly the choice of pipeline vs. non-pipeline options.

Picture illustrates a floating production host (i.e. TLP, spar, semisubmersible, or FPSO), tied to an FSO.

“Distances of up to 800 miles make the pipeline option attractive, but distances of over 200 miles in the ultra deepwater make it possible to consider CNG storage options with short shuttle distances to offloading locations.Ultra-deepwater pipeline costs can exceed $2-3 million per mile.”

The gas from projects with distances to market from 800-1,600 mi could be stored as CNG and exported in shuttles. Development projects with export beyond 1,600 mi may consider processing the gas to LPG, methanol, LNG, or GTL aboard floating host production facilities with shuttling to market, he said.

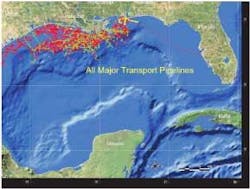

Existing GoM pipeline infrastructure.

Today, several options exist for feasible deepwater production in the GoM. But as the gap expands between existing infrastructure and new deepwater discoveries, industry operators will eventually have to consider using FPSOs or FSO-based development solutions with shuttle tankers.

Chevron hands out Tahiti, Blind Faith awards

Chevron has selected Mustang Engineering to perform engineering, procurement and project management support services for theTahiti spar’s topsides oil and gas processing facilities. The company previously completed the FEED studies for the topsides.

Chevron says construction of the truss spar is underway with first steel cut for the hull on October 16. Technip is fabricating the spar’s hull and mooring systems at their yard in Pori, Finland. Meanwhile, fabrication has started on the facility’s topsides modules at Gulf Marine Fabricators’ yard near Corpus Christi, Texas.

Delivery of the completed spar is expected by mid-2007, with first production fromTahiti anticipated in mid-2008.

Chevron is dishing out contracts for itsBlind Faithproject as well. The operator selected Gulf Island LLC to fabricate the topsides for theBlind Faithsemisubmersible production platform. Gulf Island plans to begin construction work in 1Q 2006 and expects to deliver the completed topsides in 2007. The contractor will use its facilities in Houma, Louisiana to complete the project.

Chevron has also selected FMC Technologies to supply subsea systems for the project. The total contract value is worth approximately $39 million. The company’s initial scope of supply includes three high-pressure, high temperature subsea trees and associated structures, production control systems and other related equipment. Deliveries will be completed over several months and are scheduled to start in 1Q 2007. First production fromBlind Faithis scheduled in the first half of 2008.•