With the oil price stabilizing and confidence returning to the industry, companies are now positioning for growth and sustainability, albeit with a renewed sense of capital discipline. New orders for subsea trees and floating production systems this year are expected to increase year-over-year, suggesting a trend in not only short-cycle brownfield development, but also the most lucrative greenfield deepwater plays. Moreover, service cost inflation in onshore unconventional wells may encourage operators to shift more capital to offshore.

Deepwater plays

One region that is poised to benefit from this trend is Latin America. New research from Wood Mackenzie suggests that momentum will continue from the portfolio high-grading that drew companies to deepwater licensing and M&A in the region last year. The firm expects strong interest in the coming year from Asian NOCs and major international operators in Brazil’s presalt plays and Mexico’s deepwater, and from independent operators seeking lower-cost licensing opportunities in areas including Uruguay and offshore Argentina.

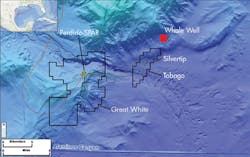

Shell’s Whale discovery is located in Alaminos Canyon in the US GoM. (Courtesy Shell)

In Brazil, the breakeven for the 3.3-Bboe Libra deepwater presalt field has declined in recent years, from $52/bbl in 2014 to $45/bbl in 2017, with a long-term target of $35/bbl, according to Wood Mackenzie. The firm suggests that this is competitive with the average wellhead breakeven price for some of the best shale plays. First oil was delivered last November from the field’s early production system. In December, Petrobras and partners sanctioned the first-phase FPSO, and plan to deploy up to four FPSOs for full-field development.

Elsewhere, Hess has reported a comparatively favorable breakeven of $35/bbl for ExxonMobil-operated Liza Phase 1 in deepwater Guyana. The operator has used an onshore project in the Deleware Basin with a $45/bbl breakeven, to illustrate the positive comparison. Early this year, ExxonMobil and partners made a sixth oil discovery (including Liza) on the Stabroek block offshore Guyana, bringing the total estimated resources to more than 3.2 Bboe. Analysts expect a second FPSO for Liza to be ordered in 2019.

Meanwhile, Shell and Chevron in late January announced major deepwater discoveries (Whale and Ballymore) in the US Gulf of Mexico. Both major operators view deepwater as an integral part of their long-term growth strategies. The recently announced US tax reform bill, which cuts the corporate tax rates from 35% to 21%, may encourage new capital to the region from domestic and international operators that seek deepwater acreage.

Drilling contractors

While subsea, floating production, and other offshore market segments are recovering, one of the hardest hit groups – drilling contractors – is still reeling from the downturn. Offshore’s annual top 10 drilling contractors survey, inside this issue, finds Transocean, with a total of 44 units, dropping to the fourth spot on the list (does not include the Songa Offshore acquisition that closed in late January). This marks the first time since 1999 that Transocean was not the largest offshore drilling contractor in the world. Another notable result is the dropping from the list of two long-time top 10 contractors, Rowan Companies and Diamond Offshore. The full survey results with analysis of the offshore drilling market by Cinnamon Edralin with IHS Markit, starts on page 19.

To respond to articles in Offshore, or to offer articles for publication, contact the editor by email ([email protected]).