Editor's note: This Data section first appeared in the May-June issue of Offshore magazine. Click here to view the full issue.

By Jeremy Beckman, London editor

NORTH AMERICA

KBR has a Letter of Intent from Equinor to perform the topsides FEED for a newbuild FPSO for the Bay du Nord project offshore Newfoundland. This will produce oil from various discovered fields in 650-1,170 m water depth in the Flemish Pass basin, 500 km north-east of St. Johns. KBR’s scope of work includes supporting Equinor with development of a combined cycle power system and other technologies to minimize the platform’s emissions and crew complement and maximize the use of digital solutions. Equinor is targeting first oil in the late 2020s.

The Canada-Newfoundland and Labrador Offshore Petroleum Board has included 28 parcels off eastern and south-eastern Newfoundland in its latest Call for Bids, which will remain open until November 1. Exploration licenses for successful applicants could be awarded early next year.

Shell Offshore has commissioned Worley to perform FEED and detail design studies for a lightweight floating production platform at the Sparta development, 170 mi off the Louisiana coast. Shell deployed Worley’s concept for two previous platforms: the company and partner Equinor expect to take FID on Sparta later this year.

Wintershall Dea’s recent Kan discovery in Mexico’s offshore Sureste basin could hold up to 300 MMboe in place, initial analysis suggests. The well, drilled by the Borr Ran jackup 25 km from the Tabasco coast in 50 m of water, encountered over 170 m net pay sands in the Upper Miocene. The Block 30 consortium, which includes Harbour Energy and Sapura OMV, will finalize an appraisal plan by the end of July.

Pemex has submitted a Unit Development Plan (UDP) for the giant Zama oilfield to Mexico’s National Commission of Hydrocarbons (CNH) for approval. Zama extends across two contiguous blocks: Pemex and the Block 7 partnership of Talos Energy, Wintershall Dea and Talos Energy agreed to form an integrated project team to take the development into the construction phase. Main components of the UDP are two fixed platforms, 46 dry-tree wells and two 68-km subsea pipelines exporting the oil and gas to new processing facilities at the onshore Maritima Das Bocas terminal.

SOUTH AMERICA

McDermott is working on the FEED for Shell’s Manatee gas development offshore Trinidad and Tobago, said to be one of the country’s largest discoveries. The work scope covers a wellhead platform, export pipeline system shore approach, midstream pipeline and onshore control room.

ExxonMobil and its partners have taken FID on the$12.7-billion Uaru project, their fifth FPSO-based development in the Stabroek block off Guyana, in 2,000 m water depth. MODEC is constructing the 250,000 b/d FPSO, named Errea Wittu: this will be connected to 44 production and injection wells at up to 10 subsea drill centers. Technip FMC will supply the subsea trees, 12 manifolds and associated controls and tie-in equipment, while Saipem will design, fabricate and install the connecting SURF facilities, using its FDS2 and Saipem Constellation vessels for the offshore campaign. Recently, the Stabroek licensees boosted their reserves with the Lancetfish-1 discovery well, drilled by the Noble Don Taylor drillship.

Petrobras has produced first oil from its revitalization project at the post-salt Marlim and Viador fields in the Campos basin off Brazil. The FPSOs Anna Nery, which started operations last month, and MODEC’s Anita Garibaldi MV33, are replacing nine platforms on the two fields and should eventually deliver 150,000 boe/d combined.

The company is also part of the Equinor-led consortium that has just taken FID on a $9.9-billion development in Block BM-C-33 in the pre-salt Santos basin, covering three accumulations discovered by Repsol in 2010. Collectively, Pão de Açúcar, Gávea and Seat hold over 1 BBoe recoverable: Repsol Sinopec Resources is the other member of the current consortium. Plans call for a 126,000 b/d FPSO with a gas production capacity of 16 MMcm/d, and facilities topside to process the gas and oil/condensate and specify these for sale without the need for further onshore processing. Sales gas will be exported through a 200-km offshore pipeline to reception infrastructure at the Cabiúnas terminal onshore in Macaé, with processed liquids offloaded via shuttle tankers.

WEST AFRICA

The refurbished FPSO Baleine (ex-Firenze) has sailed to Côte d’Ivoire for service on Eni’s Baleine field development in blocks CI-101 and CI-802. Following the upgrades, the facility can process up to 15,000 b/d of oil and around 25 MMcf/d of associated gas, with the latter to be exported to shore through a new subsea pipeline. Eni aimed to start production this month, less than two years after the Baleine 1X discovery well, and is also progressing Phase 2 towards start-up in December 2024.

AFC Equity Investment, owned by Africa Finance Corp, has negotiated a deal that makes it the sole shareholder in Aker Energy, which has a 50% operated stake in the Deepwater Tano Cape Three Points block offshore Ghana. Aker Energy has since submitted a Plan of Development to the Ghanaian Authorities for a phased project, initially focused on an FPSO and subsea production system on the Pecan field, 115 km offshore and in water depths of 2,400-2,700 m.

Aker Solutions will supply deepwater standard and configurable subsea production systems to TotalEnergies for three infill wells tied back to the Moho Nord field center off Republic of Congo. Moho Nord, 75 km offshore in 750-1,200 m of water, came onstream in March 2017 and is the country’s largest oil project to date.

Tullow Oil and Perenco have signed an asset swap agreement covering offshore and onshore fields in various licenses in Gabon. For Tullow, the arrangement would allow it to optimize its equity ownership in the offshore Tchatamba field cluster which it would seek to develop as a new core production hub.

NORTH SEA

Shell U.K. expects the FPSO Haewene Brim to produce more than 30,000 boe/d at the Pierce field in the UK central North Sea following upgrades at Aibel’s yard in Houston. The project will switch production from Pierce, which came onstream in 1999, from oil alone to gas and oil, with the gas exported through a new subsea pipeline connecting to the SEGAL pipeline system and onward to the St Fergus terminal north of Aberdeen.

NEO Energy is set to take control of the Greater Buchan Area licenses in the central UK sector after negotiating a 50% farm-in with current operator Jersey Oil & Gas (JOG). With NEO agreeing to part-fund JOG’s costs, this opens the way to a redevelopment of the shut-in Buchan oilfield and a phased development of various other discoveries in the area.

BlueNord (formerly Noreco) has applied for a license in the Danish sector containing the Elly-Luke gas discovery. If successful, an award could follow later this year, with work then starting on a technical review ahead of a possible 5-bcm development. In addition, BlueNord has formed a partnership with Semco Maritime to assess other oil and gas development opportunities, including taking on operation of existing fields.

BLACK SEA

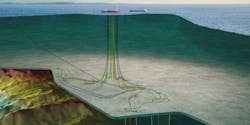

Turkish Petroleum Corp (TPAO) has started production from Sakarya, Turkey’s first deepwater gasfield development. The Phase One subsea-beach facilities came onstream only two and a half years after the discovery in August 2020, and should deliver up to 350 MMcf/d from the 10 subsea wells. Wood Mackenzie claimed an expanded Phase Two development could supply almost 30% of the country’s gas needs by 2030.

MEDITERRANEAN SEA

Panoro Energy has agreed to acquire Beender Tunisia Petroleum’s 40% stake in Sfax Petroleum Corp (SPC) for around $18 million. As SPC’s new outright owner, Panoro gains control of the Sfax Offshore exploration permit in the Cretaceous and Eocene carbonate platforms of the Pelagic basin. The permit contains three oil discoveries with combined recoverable reserves estimated at 20 MMboe and numerous prospects and leads with potentially much larger resources.

BP and Wintershall Dea have commissioned the Subsea Integration Alliance (Subsea 7 and One Subsea) to supply and install subsea equipment for the two-well Raven Infills tieback project in Egypt’s offshore West Nile Delta block, in water depths of around 800 m.

ADNOC and bp have jointly offered to acquire a 50% interest from Delek Group in NewMed Energy, a partner to Chevron in the Leviathan and Tamar gasfields offshore Israel. If accepted, this could represent the first step of their plan to form a joint venture company focused on gas developments, including in the East Mediterranean region.

ASIA-PACIFIC

Valeura Energy has resumed oil production from the Wassana field in the Gulf of Thailand, which had been shut down prematurely by previous operator KrisEnergy in 2020. Output has been ramping up steadily as the wells are activated sequentially, and a planned infill drilling campaign in Q3 could add a further 5,000 b/d.

INPEX Masala has submitted a revised Plan of Development to Indonesia’s authorities for the Abadi LNG offshore/onshore project. This would harness gas from the Abadi field in the Masela block of the Arafura Sea in Maluku Province, in water depths of 400-800 m. INPEX’s new plan, prepared with partner Shell, would employ carbon capture and storage to contain all the CO2 emitted during gas production. Pending approval for the revised plan, INPEX aims to initiate the FEED process and would then target FID later this decade, and first gas in the early 2030s. The projected LNG volumes of 9.5 MMt/y would be equivalent to more than 10% of Japan’s annual LNG imports, the company said.

Shell Australia has agreed to sell its interests in the Woodside-operated Browse project offshore north-west Australia to bp. The Browse Joint Venture has been seeking a development solution for the Brecknock, Calliance and Torosa fields 425 km north of Broome in the Browse basin. Woodside’s last update revealed a preference for two LNG/LPG/gas FPSOs and a 900-km export pipeline connecting to infrastructure serving the North West Shelf Project.