Offshore staff

ABERDEEN, UK – Three experienced UK North Sea professionals have formed Well-Safe Solutions, offering what they claim is an innovative and cost-efficient approach to decommissioning of subsea wells.

Alasdair Locke, who co-founded Abbot Group in 1992, will act as non-executive chairman. The other main shareholders are Paul Warwick, formerly executive director for Repsol, executive vice president for Talisman Energy and regional president of ConocoPhillips; and executive director Mark Patterson.

Their new company, which aims to attract £200 million ($261 million) in investment and create 400 new jobs, will offer a well abandonment service designed to help offshore operators address the challenges and comply with regulatory issues arounddecommissioning.

Well-Safe has secured funding fromScottish Enterprise, including investment from the Scottish Investment Bank and a regional selective assistance grant, in addition to the initial private funding provided by the main shareholders.

It will offer a full P&A capability from front-end engineering and design to project execution.

Patterson said: “The liability for late life, non-producing assets remains with the operator. This liability can be reduced via well P&A operations, but the timing on the decision to make these wells safe is heavily influenced by cost and the need for a new approach, working hand-in-hand with major operators.

“The market dynamics in oil and gas have changed significantly. Before the collapse in oil price, operators were focused on maximizing production, costs were very high and assets scarce and, with no real regulatory imperative, decommissioning was pushed back…

“Operators are now having to face up to the well abandonment challenge. They need to prioritize decommissioning activity and, with an increasing stock of ‘shut-in’ wells, more incentives, low asset utilization and therefore lower rates, the economics for P&A have become more compelling.”

Well-Safe will offer a campaign-based approach that will enable sharing of knowledge across operating companies, with “a differentiated contracting strategy that will leverage economies of scale and challenge the norm.”

It aims to dispense with the existing standard model of operators awarding contracts to multiple service providers and instead offer a ‘one-stop-shop’ for P&A needs.

“We will take care of the planning, logistics, and execution through our experienced personnel and our dedicated rigs or vessels via one, single contract,” Patterson said.

“By combining competitive asset day rates with long-term service and support contracts at a fixed day rate, we will be able to offer higher efficiency and utilization at lower cost.”

Well-Safe is looking to acquire assets to perform well abandonment work, including a semisubmersible rig, a jackup, and a lightweight intervention vessel.

“As owners of these assets, we can guarantee they will not be diverted to other drilling operations but used and mobilized exclusively for P&A activity,” Patterson continued.

“With this certainty over availability, we can secure long-term commitments from operators and have full control over scheduling of long-term well P&A campaigns.”

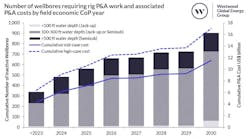

Expenditure on well abandonment in theUK continental shelf is set to double to £1.1 billion ($1.44 billion) this year, the company claims, with around 5,000 wells, of which 1,000 are subsea, to be decommissioned in the North Sea.

Well P&A activity is said to account for around 60% of the overall costs associated with decommissioning.

08/04/2017