Liza Phase 1 to start-up in 2020

Jessica Stump

Assistant Editor

Exploration success in the Stabroek block not only has boosted the offshore industry through the downturn but also has transformed one of South America’s smallest countries. In July, ExxonMobil increased its estimate of the discovered recoverable resources across the 26,800-sq km (10,348-sq mi) Stabroek block offshore Guyana from 3.2 Bboe to more than 4 Bboe. This followed testing of the Liza-5 appraisal well, the Ranger discovery, inclusion of Longtail, the eighth discovery on the block, into the Turbot area evaluation, and completion of the Pacora discovery assessment.

One month later, ExxonMobil reported the ninth deepwater oil discovery on the block, Hammerhead. This discovery, according to analyst Westwood Global Energy Group, has opened a new play in sandstone reservoirs of Tertiary age. These are younger and distinct from the previously successful Cretaceous age reservoirs in the Liza sandstone play and Ranger carbonate plays.

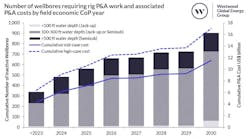

Keith Myers, president, Research at Westwood, said the new Tertiary play could lead to the emergence of a possible 10 Bbbl-plus offshore province, second in scale this century only to the emerging presalt province off Brazil. This scale of resource could support plateau production of more than 1 MMb/d for a decade or more, he added.

Considering Guyana’s small population of about 800,000, this would make the country the world’s biggest per capita oil producer, Myers suggested, with this level of production at $70/bbl generating $32,000 per capita of gross annual oil revenue, before costs and oil company profits. However, the oil companies involved – ExxonMobil, CNOOC, and Hess – must work out their role in supporting the transformation of resources of this scale into sustainable development, he warned.

The collective discoveries on the Stabroek block to date have established the potential for up to five FPSOs producing more than 750,000 b/d by 2025. (Map courtesy ExxonMobil)

ExxonMobil affiliate Esso Exploration and Production Guyana Ltd. (EEPGL) is operator and holds a 45% interest in the Stabroek block, along with Hess Guyana Exploration Ltd. (30%) and CNOOC Nexen Petroleum Guyana Ltd. (25%).

The country’s first development, Liza Phase 1, is on track to deliver first oil in 1Q 2020, less than five years from discovery. Liza is about 190 km (118 mi) offshore in water depths of 1,500 to 1,900 m (4,921 to 6,234 ft). Sanctioned in June 2017, the $4.4-billion Phase 1 project includes an FPSO designed to produce 120,000 b/d of oil from four subsea drill centers with 17 wells: eight producers, six water injectors, and three gas injectors. The first phase will develop about 450 MMbbl of oil. In May, the drillship Noble Bob Douglas started development drilling.

Construction of the FPSO and subsea equipment is under way in more than a dozen countries. According to contractor SBM Offshore, conversion of the VLCC Tina into the FPSO Liza Destiny at Keppel Shipyard in Singapore is progressing well. As of August, the first dry dock session has been completed, and activities are now under way on conversion of the hull, module fabrication, and package delivery. The FPSO Liza Destiny is expected to be 340 m (1,115 ft) in length, 60 m (190 ft) wide, and have an oil storage capacity of 1.6 MMbbl.

Liam Mallon, president of ExxonMobil Development Co., said local content plays a key role in the project’s rapid development. “Guyanese businesses, contractors, and employees have been an essential element of our exploration, drilling, and development progress,” Mallon said. “Our focus is on enabling local workforce and supplier development and collaborating with the government to support the growth and success of Guyana’s new energy industry.”

Around 50% of the company’s employees, contractors, and subcontractors for the project are Guyanese, with the percentage set to increase as operations progress. Last year ExxonMobil spent roughly $24 million with more than 300 local suppliers and opened the Centre for Local Business Development in Georgetown to promote the establishment and growth of small- and medium-sized local businesses. To date the center has provided access to training and capacity-building support for more than 275 local businesses.

The drillship Stena Carron has drilled the nine discoveries so far offshore Guyana. (Courtesy ExxonMobil)

As for future developments, the partners are planning to sanction Liza Phase 2 by the end of this year. It will use a second FPSO, more wells and associated subsea equipment than Phase 1. Start-up is targeted for 2022. EEPGL has contracted SBM Offshore to perform front-end engineering and design (FEED) for the FPSO. Following completion of the FEED and subject to government approvals and project sanction, the contractor will then construct, install, lease, and operate the FPSO for a period of up to two years. Thereafter, ownership and operation of the FPSO will transfer to EEPGL.

The second Liza FPSO design is based on SBM Offshore’s Fast4Ward concept, a newbuild, multi-purpose hull combined with various standardized topsides modules. It will be designed to produce 220,000 b/d of oil with associated gas treatment capacity of 400 MMcf/d and water injection of 250,000 b/d. It will be spread moored in a water depth of around 1,600 m (5,249 ft) and will be able to store around 2 MMbbl of crude oil.

Also, the operator has contracted Saipem to perform detailed engineering, procurement, construction, and installation of the risers, flowlines, and associated structures and jumpers for Phase 2. It will also transport and install umbilicals, manifolds, and associated foundations for the production, and water and gas injection systems.

A third development, Payara, will target sanctioning in 2019 and use an FPSO designed to produce about 180,000 b/d as early as 2023. Together, these three developments will produce more than 500,000 b/d, according to ExxonMobil.

Earlier this year the Longtail well established the Turbot-Longtail area as a potential development hub that could recover more than 500 MMboe. Altogether five FPSOs could be in action by 2025 producing more than 750,000 b/d, the company said.

This month, a second drillship, the Noble Tom Madden, is expected to arrive in Guyana to accelerate exploration of high potential opportunities and appraisal drilling. It will begin drilling at the Pluma prospect about 27 km (17 mi) from Turbot.

Elsewhere offshore Guyana, Total has taken up an option to acquire a 25% interest from Eco (Atlantic) Oil & Gas in the Orinduik block. Subject to receipt of all regulatory approvals, Tullow Oil will continue to operate the block with a 60% interest, with Eco Guyana holding 15%.

The 1,800-sq km (695-sq mi) Orinduik block is about 170 km (106 mi) offshore in water depths of 70 to 200 m (230 to 656 ft). It is 11 km (6.8 mi) updip from Liza and 6 km (3.7 mi) updip from the Hammerhead discovery.

Gustavson Associates recently completed the first competent persons report. According to Eco (Atlantic) Oil & Gas, this indicated best estimate P50 resources of 2,913.3 MMboe from 10 leads identified across the block.

Colin Kinley, COO of Eco Atlantic, said: “The additional discoveries on Exxon’s Stabroek block, including the most recent Hammerhead-1 that is on our 3D survey, enables us to see the formations ramp up onto Orinduik. These have greatly helped us to further understand the play…

“The partners will carefully consider in the coming months the prioritization of the leads for drilling as we continue work on the drilling engineering and the environmental permitting.

“We have identified the potential for close to 2.5 Bbbl of recoverable oil and 2.45 tcf of associated gas. These are very meaningful numbers for all the partners and most importantly the people of Guyana.”

He added that three of the targets have an estimated probability of success calculated at 22.4%. The first well is due to be drilled early next summer. •