Offshore staff

LONDON – High-impact exploration has weathered a perfect storm of a pandemic, an oil price crash and an accelerating energy transition, and enters 2021 with a drilling program that should at least match 2020, according to Westwood Global Energy Group.

High-impact exploration started well in 2020 with the first quarter seeing the highest number of wells completed since 4Q 2014 and commercial success rates above 30%, the consultant said. It was not to last.

The world changed in 2Q with the COVID-19 pandemic taking hold, seeing oil prices crash and exploration budgets slashed. The impact of the pandemic became apparent in 3Q, with just seven high-impact wells completed, the lowest quarterly figure since Westwood’s records began in 2008.

Graeme Bagley, Westwood’s Head of Global Exploration & Appraisal, said the year closed with 72 high-impact wells completed, down from 99 in 2019, but at a similar level to that seen between 2016 and 2018.

The consultant estimates that ~17 Bboe was discovered from high-impact exploration in 2020, down slightly from 2019 but still more than 2017 and 2018 put together. Discovered oil volumes were the highest seen in the last five years (6.8 Bbbl) with 10 Bboe of gas also discovered. Commercial success rates remained above 30%, more than double that of 2016.

The three largest discoveries of the year were all claimed by Rosneft in the Kara Sea and West Siberia, with Russia accounting for~70% of the discovered volume, up from ~10-30% in 2017-2019 based on the figures reported by Rosneft.

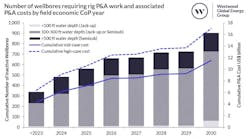

Current projections for 2021 suggest that activity should at least match the 70 wells in 2020 with the potential to be higher and up to 100, according to Bagley. Drilling plans are still fluid and will firm up in 1Q.

Exploration hot spots for 2021 are mainly in the Americas, particularly offshore Mexico, the Suriname-Guyana basin and offshore Brazil. Africa is expected to have another quiet year, with only a handful of high-impact wells being drilled. However, this does include the much anticipated multi-billion-barrel Venus prospect in Namibia. Northwest Europe should see 10-15 high-impact wells drilled which is a similar number to 2020.

An estimated ~26 Bboe is being tested by 76 wells that are considered ‘probable’ in 2021, weighted 75:25 oil to gas, Bagley said. This drops to ~8 Bboe split 65:35 oil to gas when the chance of success is considered, reflecting the higher risk nature of some of the oil prospects being targeted. As in previous years, additional discoveries may be announced in countries where drilling plans are less transparent, especially in Russia and the Middle East.

Total, Shell, and Exxon are expected to be the most active high-impact explorers in 2021, according to Bagley. Total has the widest geographic spread with wells possible in more than 10 countries. Shell is expected to have a focus in Mexico, although is also planning two high-impact wells in the UK and a frontier test in Sao Tome. Exxon is focused on just Brazil and Guyana, and CNOOC is focused on Guyana, Canada, and Mexico. Previously active companies such as Repsol and Tullow have cut high-impact drilling significantly in response to strategy changes.

Westwood has highlighted 20 wells in 2021 as ‘key wells to watch’. The wells selected fall in to four categories:

- Two are frontier basin tests which, if successful, can open multi-billion-barrel plays (Venus offshore Namibia, Perseverance offshore the Bahamas)

- Seven are testing new plays in proven basins, or testing extensions of proven plays in to deeper water that offer benefits of large volumes with follow on potential (e.g. Silverback in the Gulf of Mexico, Rencong in North Sumatra)

- Six are testing extensions to proven commercial deepwater plays with significant potential albeit at some risk (e.g. Ondjaba offshore Angola, Bulletwood offshore Guyana, Nemo offshore Brazil)

- Five are large prospects in proven plays which will be high value if successful (e.g. Edinburgh offshore UK, Dan Day offshore Vietnam).

High-impact exploration may have taken a few hits in 2020 from the ravages of a global pandemic, a crash in the oil price and the acceleration of the energy transition, but in no way is the game over, Bagley concluded.

01/11/2021