The third worst downturn in 35 years is giving way to the start of a new recovery; one we believe is predicated on massive global stimulus and vaccines to be powerful engines for global economic growth and oil demand in 2021. We forecast global E&P capex to increase by 7% in 2021 in the first coordinated upturn since 2018, with international accounting for 81% of global spending and at +7.2% outpacing a projected 5.1% growth in North America. Spending in the US will lead Canada while the international recovery will be led by select Latin American companies and North America-based independents in key offshore developments such as Petrobras presalt and Guyana/Suriname. On an absolute basis, Asia remains the primary engine for international growth while Europe is leading the energy transition.

The offshore markets began 2020 with good momentum as Brent had climbed north of $60, jackup and floater marketed utilization was above 85% and nearing 80%, respectively, and companies were ready to harvest cash from improving day rates and utilization. But with the collapse of the oil price and prospects of lower demand, offshore customers moved swiftly to cut costs. Rig contracts were terminated where possible or put on standby, while rigs were released as contracts rolled and unexercised options lapsed.

The offshore rig count fell quickly without the stronger contract terms and longer duration favoring rig contractors that were the norm during the prior upcycle. While the rig count is still searching for a bottom, day rates have held up remarkably well as the industry reaccelerated rig attrition as part of one measure to reduce costs. Meanwhile, having greatly trimmed general and administrative expenses, maintenance and other costs over the multi-year downturn that began in 2014, several companies moved to restructure their balance sheets ahead of looming maturities (some for the second time). This restructuring cycle is still under way and we expect offshore-focused rig companies to emerge much better capitalized and with leaner cost structures and smaller fleets.

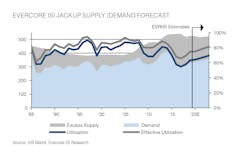

But for a brief lull in 2019 when contractors held onto rigs in anticipation of stronger demand, the industry has retired 121 jackups and 158 floaters since the offshore downturn began in 2014. Jackup attrition has not kept pace with newbuild deliveries as 135 newbuilds were delivered over the past seven years for a net 3% increase in global supply. However, the higher cost of cold stacking floaters (i.e. $40kpd vs. $5kpd) and the prohibitive cost of reactivation ($50-100M vs. $10-20M) were strong motivators for the industry to aggressively retire aging assets. Cash-constrained rig contractors also successfully deferred deepwater newbuild deliveries as none were delivered in 2020 and only 56 have been delivered since 2014 versus 158 retired for a net 33% decline in global supply.

Contracting activity came to a screeching halt for much of last year and fell by 43% for floaters and 45% for jackups from 2019 levels. But on a rig-year basis, jackup demand held up slightly better at 22% lower year-over-year versus 43% lower for floaters due to a 37% increase in the average duration for a new jackup contract to 16 months (versus a 4% increase for floaters to seven months). While rig contractors provided temporary day rate relief for their customers, especially in the Middle East, day rates for new contracts when disclosed generally held up at still very low levels or contained built-in escalators for costs and a market reset. Overall open tenders for new floater contracts remain very low near mid-summer levels, reflecting deferrals in new exploration and development projects. But tenders for jackups have rebounded a bit to slightly below levels at the start of 2020 due to an increase in development and other programs such as P&A.

We expect the offshore rig count to bottom imminently and begin trending slightly higher in 1Q 2021 as new contracts commence in Mexico and Suriname while incremental activity off Norway and Southeast Asia is scheduled for later in the year. Our estimates assume relatively high renewal rates for existing contracts in 2021, as we believe the oil price will continue to strengthen and exit the year at $60/bbl due to the imminent rollout of COVID-19 vaccines and a resurgence in global demand.

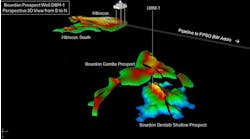

Key offshore developments are advancing such as Petrobras’ presalt and ExxonMobil in Guyana while other operators have plans to accelerate drilling programs in Ghana and India. We expect that some projects deferred in 2020 could receive a final investment decision over the next year or two, such as Total’s Mozambique LNG and Woodside’s Scarborough. Meanwhile, the expansion of offshore wind and carbon capture beyond Europe into Asia and North America could provide synergies for the offshore industry to leverage their skills and expertise.

With ADNOC Drilling (a non-competitive state-owned rig operator) revitalizing its aging fleet, the supply of newbuild jackups should keep dwindling without adding to global supply. Assuming a slowdown in rig retirements to 12 jackups and eight floaters for 2021, we forecast that the marketed utilization for rigs under contract could improve for jackups and floaters to 77% and 71%, respectively. The improvement for floaters is driven by lower supply, as we forecast demand to increase by a relatively modest 4% on average. Meanwhile, the marketed utilization for all rigs with future contracts at 74% for floaters and 79% for jackups is down only 600bps from the July 2019 peak and 770bps from the January 2020 peak, respectively. A relatively modest step up in demand could go far to rebound the marketed utilization above the 80-85% range where day rate improvements occur.