Steve Robertson

Georgie MacFarlan

Douglas-Westwood

Dr Michael Smith

Energyfiles Ltd.

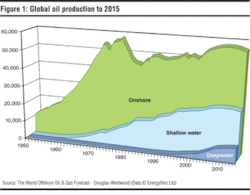

Deepwater oil and gas production is increasing rapidly and output is expected to more than double over the period to 2010.

From 3 MMb/d in 2005, deepwater oil production will grow to over 6.7 MMb/d in 2010, while deepwater gas production (currently modest but expanding rapidly) will increase from 60 to 108 bcm (1-1.9 MMbbl equivalent) over the same period.

To put this in context, deepwater oil production currently accounts for only 10% of total offshore oil production, but over the next 10 years, its total share relative to shallow water output will grow rapidly, accounting for around 25% of offshore production by 2015.

Africa is expected to be the leading deepwater development area over the 2006-2010 period, accounting for some 40% of the global deepwater spend. Since the first brace of deepwater “elephants” -- Shell’s Bonga on OPL 212 off Nigeria and Total’s Girassol on Block 17 off Angola, discovered in the spring of 1996 -- Africa has emerged as perhaps the most significant deepwater region in the world, with some stunning successes.

The first floating production system to be installed in African deepwater was Total’s landmark Girassol project off Angola in 2001, and this was followed by ExxonMobil’s Xikomba in 2003 and then Kizomba A’s TLP and FPSO.

There are a variety of deepwater development projects under way for the period to 2010, including ExxonMobil’s Erha, Bosi, and Akpo projects, Chevron’s Agbami and Total’s Usan/Ukot, all of which are located off Nigeria. In Angolan waters, BP is moving ahead with its Greater Plutonio development in block 18 and studying development options for the series of discoveries in block 31, while Total develops its Rosa and Lirio finds via a subsea tieback to the Girassol FPSO.

With so much activity occurring off Nigeria and Angola, it is easy to overlook Egypt’s emerging deepwater status. In the West Delta Deep Marine (WDDM) concession, BG has enjoyed some spectacular exploration successes and with the Saffron/Scarab development has established itself as one of the industry leaders in the adoption of subsea production technology. The development marked Egypt’s first subsea completion, not to mention one of the world’s longest subsea tiebacks. Further west, Apache has finalized a key sales agreement with the Egyptian government that will allow the development of the Abu Sir, El Max, El King, and Al Bahig discoveries to go ahead.

The Latin America region is dominated by Brazil in terms of deepwater activity. National operator Petrobras has established itself as a pioneer in the use of innovative technology to achieve production from water depths in excess of 1,800 m. Over the period to 2010, the operator is expected to move into water depths exceeding 2,000 m and achieve yet more industry “firsts,” with the installation of Sevan Marine’s Sevan Stabilized Platform (SSP) cylindrical mono-hull design FPSO on the Piranema field. Elsewhere, the operator will continue with the development of the Roncador, Marlim Leste, Marim Sul, and Albacora Leste fields, while pursuing new finds such as Golfinho. Overall, the region is expected to account for 20% of deepwater development capex over the 2006-2010 period.

GoM infrastructure

With a few notable exceptions, deepwater fields in the Gulf of Mexico tend to be fairly small relative to those in other deepwater hotspots such as Brazil or West Africa, for example. The region’s extensive offshore infrastructure, in the form of production platforms and export pipeline networks, and the relative proximity of supply and service centers have a significant influence on E&P activity, turning otherwise marginal prospects into viable commercial propositions. These factors also mean that project lead times tend to be shorter than in other regions.

In addition, the use of subsea tiebacks to floating production systems has resulted in “hub and spoke” developments, allowing production from several small (otherwise uneconomic) fields to go ahead, produced via a single floating production system. Construction is currently underway on the Atwater Valley Producers’ Independence Hub, a semisubmersible unit that will produce from the Spiderman, Jubilee, Merganser, Vortex, San Jacinto, Atlas and Atlas NW, Cheyenne and Mondo fields in the DeSoto Canyon and Lloyd Ridge areas. A second hub to produce from other nearby fields is also planned.

The North America region is expected to account for some 25% of deepwater development capex over the 2006-2010 period.

The Golden Triangle” of deepwater, namely the Africa, GoM, and Brazilian areas, will still account for 85% of global deepwater expenditure over the forecast period but the rapid emergence of Asia as a significant deepwater region should not be overlooked. Indonesia, Malaysia, and India all have development prospects on screen for the 2006-2010 period, and the region should account for 10% of deepwater capex during this time.

Advances in technology, particularly in mooring systems and innovative hull designs, are allowing production from greater water depths to be viable on both a technical and economic basis.

Over the next five years, some $28 billion is likely to be spent on deepwater floating production systems, $40 billion on drilling and completing subsea wells, and $14 billion on flowlines and control lines, while subsea hardware and surface completed wells could account for a further $10 billion.

The deepwater “shopping list” for the forecast period includes over 1,300 subsea trees, 283 templates and manifolds, 71 platforms and some 13,000 km of pipelines. Annual expenditure in the deepwater business is expected to reach $20 billion by 2010, with the overall spend for the 2006-2010 period totaling $94 billion.

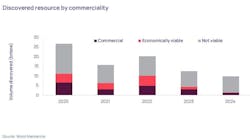

Due to lack of opportunity, exploratory drilling has been on a declining trend since 1997, and this trend is forecast to continue through to 2010, albeit with a modest price-led resurgence in later years (Fig. 4). Even deepwater exploratory drilling, which grew rapidly up to 2001, has been relatively flat due to a shortage of new areas to exploit. But, it is forecast to pick up in later years as ultra deepwaters become commercially more attractive.

Offshore development drilling saw almost unbroken growth through 1991 to 1999 before beginning to decline as new field development opportunities in many of the shallow-water areas of the world dwindled. With surging oil prices, shallow-water development drilling stabilized through to 2005, but further declines are now forecast. Meanwhile total development drilling will be supported by rapid growth in deepwater drilling, especially in West Africa and the GoM.

Over the last five years, it is estimated that $160 billion was spent on shallow-water drilling, representing 83% of all drilling expenditure. Meanwhile, $33 billion was spent on deepwater drilling. Over the next five years, it is forecast that $197 billion will be spent on shallow-water drilling, while $65 billion will be spent on deepwater drilling.

Within the deepwater sector, 37% of expenditure is directed toward engineering services, 25% is earmarked for support, and 5% goes toward geoscience. But it is surprising to many that rigs only comprise 33% of total well costs even in deepwater.

Nevertheless, the increase in deepwater relative to shallow water is substantial. While shallow waters are seeing increased expenditure almost solely because of rising prices and rising unit well costs, especially after 2007 (Fig. 5), deepwater expenditures reflect a real increase in activity. This is of global importance to the rig contractors and associated drilling services. From a mere 2% of global expenditure in 1991, almost all located in Brazil, the deepwater share had increased to 19% by 2001 and is forecast to reach nearly 30% by 2010.

Authors

Steve Robertson manages Douglas-Westwood’s oil and gas research activities. Georgie MacFarlan is an analyst for Douglas-Westwood. Dr. Michael R. Smith is CEO of Energyfiles (www.energyfiles.com).

Acknowledgement

In this article, the authors present key findings of Douglas-Westwood’s study, “The World Deepwater Market Forecast”, in conjunction with related information from “The World Offshore Drilling Spend Forecast” and “The World Oil and Gas Forecast”, both published by Douglas-Westwood in association with Energyfiles. Further information is available at www.dw-1.com.