Larger companies shift focus to E&P

Mike Lewis

Jason Nunn

Mike Rodgers

PFC Energy

An analysis of Gulf of Mexico deepwater bidding activity shows smaller GoM competitors expanding their deepwa-ter acreage holdings at a greater rate than the larger, more established competitors.

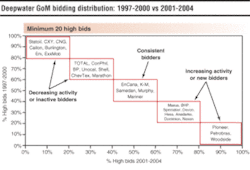

Pioneer, Petrobras, and Woodside, for example, are each among the third tier of deepwater GoM bidders and have submitted the large majority of their bids (at least 90%) in the more recent time period (see related graphs). On the other hand, six of the 10 top-tier bidders (BP, ChevronTexaco, ConocoPhillips, ExxonMobil, Shell, and Unocal) submitted between 73% and 80% of their high deepwater bids in the earlier time period.

After peaking at nearly 1,250 high bids in 1997, annual deepwater bidding activity (as measured by the number of apparent high deepwater bids) dropped sharply through 2000, after which deepwater bidding has remained roughly stable at an annual average of about 400. In the 18 individual sales the US Minerals Management Service conducted from 1997-2004, nearly 7,600 blocks have been leased, over half (55%) of which are situated in water depths of at least 400 m.

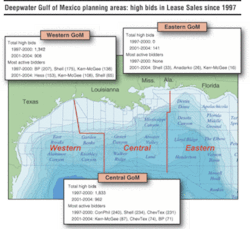

With respect to regional bidding dispersion, the Central GoM Planning Area has accumulated the greatest number of high deepwater bids since 1997 (2,795), followed by the Western GoM (2,250). Lagging considerably behind is the Eastern GoM (141), due to the comparatively few lease sales held since 1997 (one in 2001 and a second in 2003), as well as the relatively remote location of much of the region's offered acreage. For both the Central and Western regions, the bulk of bidding activity took place in the first half of the eight-year time period under examination (66% and 60%, respectively).

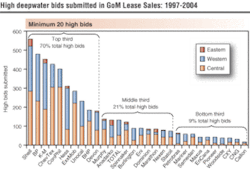

As can be seen on the accompanying graph, 30 companies have submitted high bids on at least 20 deepwater blocks since 1997. The top 10 companies – those with at least 180 high deepwater bids submitted since 1997 (on a pro forma basis) – account for 70% of all high deepwater bids submitted over the corresponding period. With few exceptions, these companies are also the industry's leaders with respect to net oil and gas reserves portfolios in the deepwater GoM (based on the projects we have modeled to date).

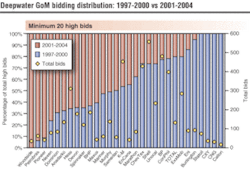

An interesting observation regarding these top three tiers of companies concerns the comparative timing of high bid submissions. For the top 10 companies as a group, nearly three-quarters of all high bids submitted since 1997 were done so prior to 2001. This figure drops to 56% for the second tier of companies as a group, while the third tier of companies has submitted a narrow majority of their combined high bids (51%) since 2001. This suggests an emergence of companies with generally smaller deepwater GoM portfolios as the larger companies reduce their collective effort on acreage acquisition and sharpen their focus on exploration and development activities on their exisiting portfolios. Supporting this pattern is the fact that the bottom third of the companies listed accounted for only 6.6% of all high deepwater bids submitted over the 1997-2000 period. This share nearly doubles (to 13%) when looking at the more recent 2001-2004 timeframe. When comparing the same two time periods, the top tier of high bidders saw their collective share of deepwater bids drop from 73.9% to 63.9%.

The diagrams on page 60 position the same 30 companies based on the timing of their individual high deepwater GoM bids submitted since 1997. The ensuing patterns again generally support the notion of smaller GoM competitors expanding their deepwater acreage holdings at a greater rate than the larger, more established competitors. Pioneer, Petrobras, and Woodside, for example, are each among the third tier of deepwater GoM bidders and have submitted the large majority of their bids (at least 90%) in the more recent time period. On the other hand, six of the 10 top tier bidders (BP, ChevronTexaco, ConocoPhillips, ExxonMobil, Shell, and Unocal) submitted between 73% and 80% of their high deepwater bids in the earlier time period.

For information, contact Mike Lewis at (202) 721-0319 or [email protected].