Offshore staff

NEW YORK CITY – Three of the leading oilfield/downhole service companies are reporting increased business from growing offshore exploration and drilling activities, according to Evercore ISI’s latest Offshore Oracle report.

The firm said that the rise of offshore activity was accretive to Schlumberger’s 2Q 2022 revenue and margins internationally and in North America, which benefitted from higher GoM exploration data licensing sales.

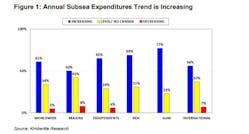

As reported by Evercore, Schlumberger says that it believes that an inflection is happening across all basins and with all customer types as operators are stepping-up spending offshore. The consulting firm says that this is in line with its recent research on the deepwater and subsea equipment market, which found that more than 60% of operators plan to increase their annual offshore spending over the next three years.

Schlumberger said that Latin America (Guyana, Brazil) was the first to see an activity increase offshore, but noted that exploration and appraisal activity is also improving off Colombia, offshore north of Brazil, and in the Atlantic margin and Namibia. According to Evercore, Schlumberger believes that production growth and capacity expansion are dual drivers for activity offshore Europe/Scandinavia, West Africa, Middle East, and Asia, as producers seek to offset the loss of Russian supplies.

Evercore says that Halliburton is targeting the drilling fluids, cementing and completion areas of the offshore market, and the firm says that the oilfield service provider is investing in automation and remote operations to improve safety and increase efficiency.

Baker Hughes is reportedly in the final stages of integrating its oilfield equipment and oilfield service segments. Evercore says that the company expects a recovery in offshore activity and project awards to drive a double-digit increase in oilfield equipment orders for 2022, with flexibles booking record orders in 2Q 2022 and more than $600 million in orders year-to-date.

07.26.2022