Offshore Staff

Houston

The use of CO2 enhanced oil recovery (CO2-EOR) in the Gulf of Mexico (GoM) can offer significant benefits to offshore operators. These include increased domestic oil production and federal revenues; a market for CO2 emissions captured from electric power and industrial plants along the Gulf Coast; and secure CO2 storage located away from population centers.

For the mature GoM oil fields in the shallow waters (less than 1,000 ft of water depth), there is considerable urgency for using CO2-EOR before these fields are abandoned and their platforms removed. A number of older deepwater oil fields are also nearing maturity and face similar abandonment issues.

For the newly discovered oil fields in the deepwaters of the GoM, there is an opportunity to apply CO2-EOR early in the life of these large fields, improving their economic viability and their availability for storing CO2.

Click image to Enlarge

In June, the National Energy Technology Laboratory (NETL), a division of the US Department of Energy, released "CO2-EOR Offshore Resource Assessment." The report, authored by Taylor Malone and Vello Kuuskraa of Advanced Resources International Inc., and Phil DiPietro of NETL, analyzes the economic and technical factors relating to the use of CO2-EOR offshore in the Gulf of Mexico.

The report found the economic viability of CO2-EOR in the GoM depends greatly on three factors: the price of oil, the cost of CO2, and the efficiency of CO2-EOR technology. As it now stands, the price of oil is the constraining factor. Assuming a price recovery in the near to medium term, this study provides a variety of sensitivity analyses that examine how these three factors affect the results of the GoM CO2-EOR resource assessment.

This assessment of GoM outer continental shelf (OCS) oil fields also considers: when in the life of the oil field the CO2 flood is initiated; how well developed and drilled is the oil field at the time of CO2-EOR implementation; what are the water and reservoir depths; and how much oil remains after primary/secondary oil recovery. In general, shallow-water oil fields have high (40% to 60%) oil recovery efficiencies. In contrast, deepwater oil fields have much lower recovery efficiencies and thus have considerably larger remaining oil volumes as the target for CO2-EOR.

This analysis incorporates considerations of oil field maturity and development status, water and reservoir depth, and oil recovery efficiency into a GoM offshore oil field/reservoir database and into the calculations of expected CO2-EOR performance and development costs. The assessment evaluated 60 deepwater GoM oil fields as well as the clusters of "anchor fields" (oil fields with more than 1 Bbbl of original oil in-place) that would be the destination of potential CO2 pipelines.

Resource assessment

The CO2-EOR assessment for the GoM OCS starts with a base case that assumes: (1) an oil price of $90/bbl; (2) CO2 costs of $50/metric ton (mt), delivered to the oil field at pressure (CO2 purchase price of $30/mt (at plant gate), and $20/mt for offshore transportation); and (3) current CO2-EOR technology. The study then examines how use of "next generation" CO2-EOR technology would impact the offshore GoM resource assessment.

Current technology

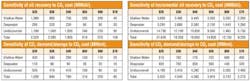

In the base case, the GoM OCS offers relatively modest oil recovery and CO2 storage opportunities from the application of CO2-EOR – 810 MMbbl of incremental oil and 310 million metric tons (MMmt) of CO2 demand and storage. However, lower CO2 costs and higher oil prices would improve the results while lower oil prices and higher CO2 costs would worsen results.

One important consideration exists when assessing GoM OCS CO2-EOR; is there enough CO2 available in the Gulf Coast area for large-scale implementation of CO2-EOR? The available natural (geologic) CO2 supplies along the Gulf Coast are limited and already committed to onshore CO2-EOR projects. As such, the use of CO2-EOR offshore in the GoM would need to rely on CO2 captured from power and other industrial plants.

Analysis by the US DOE/National Energy Technology Laboratory shows that 94 MMmt/yr of CO2 is currently vented from large (more than 3 MMmt/yr) power and industrial plants along the Gulf Coast. With an EOR demand (under current CO2-EOR technology) for CO2 of 310 MMmt over a 30-year time period, about 10 MMmt/yr (0.5 bcf/d) would be required. This represents only a fraction of the annual CO2 emissions from large point sources in the Gulf Coast area, primarily petroleum refineries (45 MMmt/yr), fossil fuel power plants (41 MMmt/yr), and other industrial facilities (8 MMmt/yr).

Sensitivity of results to CO2 costs. The volumes of economically viable incremental oil recovery and CO2 demand from the GoM OCS, using current CO2-EOR technology, are highly sensitive to the availability and cost of CO2 delivered to offshore oil fields.

The study notes that a key priority is to continue the research and development for lowering the cost of CO2 capture because CO2 costs above $60/mt, in the best case, would make the use of current technology CO2-EOR in the GoM OCS uneconomic.

Conversely, with lower cost CO2 of $40/mt (possible with advanced CO2 capture technology and the use of empty offshore natural gas pipelines for CO2 transportation), the oil recovery and CO2 storage potentials would increase.

Sensitivity of results to oil price. Because current CO2-EOR technology provides only modest volumes of additional oil, a higher oil price is generally required for economic viability. At an oil price of $135/bbl and a $70/mt CO2 price (the CO2 price is linked to the oil price), the oil recovery and CO2 storage volumes from the GoM OCS become significant – 2,820 MMbbl of incremental oil and 1,140 MMmt of CO2 demand (storage).

"Next generation" technology

"Next generation" technology with its higher oil recovery efficiencies will be an essential feature of offshore CO2 enhanced oil recovery and storage.

Shallow-water oil fields, with their strong natural water driver, achieve relatively high (40% to 60%) recovery of original oil in-place, leaving a much smaller target for CO2-EOR. "Next generation" CO2-EOR technology, with its higher reservoir sweep and oil displacement efficiencies, is needed to economically target these reduced volumes of residual oil.

Deepwater oil fields, with their high cost wells and facilities, will also need higher oil recoveries than offered by current CO2-EOR technology to become economically viable for CO2-EOR. However, in contrast with shallow-water oil fields, the primary/secondary oil recovery efficiencies in deepwater oil fields are considerably lower, providing a larger residual oil target.

Substituting "next generation" CO2-EOR technology for current CO2-EOR technology, while keeping oil price ($90/bbl) and CO2 price ($50/mt), leads to a more than tenfold increase in oil recovery and CO2 demand (storage) for offshore oil fields in the GoM.

Economically viable incremental oil recovery from the GoM OCS becomes 14,920 MMbbl with "next generation" CO2-EOR technology compared to 810 MMbbl with current technology. Economic demand (storage) for CO2 by the offshore CO2-EOR industry is 3,910 MMmt with "next generation" CO2-EOR technology, compared to 310 MMmt with current technology.

The higher volumes of economically viable oil recovery from the GoM OCS from using "next generation" CO2-EOR technology are due to: more oil recovered per dollar of invested capital (i.e., spending more to implement "next generation" technology provides more oil recovery and higher overall financial returns); and the more favorable CO2 to oil ratio of 0.24 mt of CO2 per barrel of recovered oil, compared to 0.38 mt of CO2 per barrel of recovered oil with current CO2-EOR technology, lowers the cost per barrel.

Use of "next generation" CO2-EOR technology leads to much higher CO2 supply requirements, 3,910 MMmt over a 50-year time period (taking into consideration the time lapse for finding and developing undiscovered oil fields). This is about 80 MMmt of CO2 per year, equal to about 4 bcf/d. With annual Gulf Coast CO2 emissions from large point sources of 94 MMmt/year sufficient CO2 supplies are available but would need to be captured and then transported offshore.

As important, the analysis shows that the GoM OCS oil fields provide sufficient long-term CO2 storage capacity for all of the CO2 emissions generated from large point sources along the Gulf Coast.

Sensitivity of results to CO2 costs. Lower delivered costs of CO2 enable more of the offshore oil resource to become economic under "next generation" CO2-EOR.

Sensitivity of results to oil prices. Even though "next generation" CO2-EOR technology provides higher volumes of oil recovery, offshore CO2-EOR is still a high cost option that would benefit from higher oil prices.

With an oil price of $135/bbl (CO2 costs of $70/mt), the incremental oil recovery more than doubles to 38,060 MMbbl compared to 14,920 MMbbl under a $90/bbl oil price.

Similarly, with an oil price of $135/bbl (CO2 cost of $70/mt), the demand (storage) for CO2 more than doubles to 10,700 MMmt compared to 3,910 MMmt under a $90/bbl oil price.