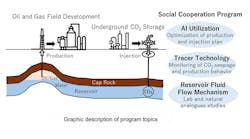

Three essential steps to maximize value from mature fields

By Alex Garcia and Guillaume Fauchille, Baker Hughes

Operators are always in search of the next elephant, but extracting the most value from existing fields can add value in less time with less capital investment. Approximately 70% of oil and gas production today comes from mature assets, and that number is likely to increase through this decade.

In the years ahead, oil and gas producers will focus on squeezing more hydrocarbons from brownfield reservoirs in much the same way as one squeezes a lemon to get the last drop.

A different perspective

Looking at production in terms of existing assets makes sense for several reasons. One of the most compelling is that brownfield production increases can be achieved in a shorter cycle than greenfield developments—yielding returns from weeks or months of planning instead of requiring years. Another driver is purely economic. The lifting cost per barrel from a mature field, while it differs by region, is normally less than $10.

Achieving greater sustainability is another reason for taking a second look at production from mature assets. Producing a greenfield barrel requires exploration, drilling campaigns, a production platform and other facilities, all of which increase the carbon footprint of operations. Typically, mature fields have a lower carbon footprint due to the reuse of existing infrastructure and possibly more efficient extraction methods that have been refined over time.

It is not easy to manage the duality of energy sector imperatives: providing secure and cost-effective energy supply to a world that requires more energy, while reducing emissions. Oil and gas will continue to be part of the world energy mix for the foreseeable future, and the energy the industry brings to the world must be affordable, secure, sustainable and efficient. It is possible to tackle this challenge by extending field life, which is critical in a market where mature oil and gas assets must contribute meaningfully and efficiently to the world energy mix.

It is understood that aging reservoirs can contribute to shorter cycles, lower costs and lower carbon production if there is a way to manage the technical, operational and economic challenges that can derail efforts.

Rethinking delivery

Recognizing the potential value of maximizing brownfield production, Baker Hughes began building a three-step strategy around mature assets solutions that includes an integrated spectrum of services. The first step in the process is to provide the customer with a single point of contact who pulls together a team of subject matter experts with relevant skillsets to the project and plays an important role in streamlining and simplifying communication between supplier and customer.

With the power of integration from the subsurface to the surface unleashed, the next step is to implement new commercial models that create win-win outcomes, eliminate silos and create optionality.

Impact of integration

Traditional sourcing methods for intervention services make it difficult to cut costs because the only avenue open to operators is to negotiate prices for individual services. Setting lower prices for coiled tubing, wireline units, etc. at the front end of an intervention program has value. However, beyond the point of contract awards, it is challenging to capture additional savings.

Integration changes the playing field

The usual approach to an intervention campaign is for multiple companies to perform discrete services without communicating effectively or working toward common objectives. The job eventually is completed, but there is limited room for achieving efficiencies.

Integration allows the process to be reimagined from start to finish.

Instead of the energy company connecting products and services in the field, the company can work with one partner that manages a spectrum of services, incentivized to improve delivery.

Changing the model changes the results.

Eliminating silos

Once internal integration is established, the next step is to apply a commercial model that promotes efficiency for all team members. With this approach, vendors are no longer focused on an isolated segment of the value chain but are motivated to work together to improve performance across the project.

It might sound overly optimistic, but it works.

In a recent P&A project for a 61-well program, Baker Hughes took on overall management, integrating its proprietary products and solutions as well as all third-party services.

The process began with establishing a baseline for performance, with incentives paid for work completed ahead of schedule. Good performers were rewarded with a higher day rate while low performers received a lower rate, and all the efficiencies had to be achieved without compromising safety.

With skin in the game, every participant in the project had a reason to improve performance.

The result was that the team delivered 76 wells in the time allocated for the 61-well program, which was about 25% more wells than were planned.

Leveraging technologies to drive efficiency

The third step is to incorporate technologies that enable faster, more effective processes and better performance.

One example is the PRIME technology platform, which is designed to enable seamless integration of data and intervention tools to transform task range and performance. It allows for delivery of high-performance tractor conveyance and provides in-well drive section configurability, improving string versatility and optimizing tractor speed. In-well speed control and digital telemetry allows production logging acquisition while using a tractor to allow real-time adjustments to drive performance.

In an application in the Middle East, this technology executed a multiphase production logging job in a sour environment in a highly deviated well, tractoring more than 14,000 ft at speeds up to 64 ft/min to determine the source of downhole gas ingress.

Another tool is a vessel-deployed wellhead cutting system with a much smaller footprint than other vessel-deployed technologies. It requires only two people to operate it instead of the usual six- to eight-person team, and it burns less fuel than traditional systems. When the cutter was deployed on the Norwegian Continental Shelf from a small vessel to remove a wellhead on an abandoned well, it was able to make the cut in only 35 minutes in an operation that took 2.5 hours from tool deployment to recovery.

A third technology option allows wells to not only produce less water with less energy but to produce more oil and gas without intervention. Targeting only the water phase of produced fluids, this technology allows a strong ionic bond to be formed with the formation rock. It cuts up to 75% of water production and lowers lifting costs. It also reduces CO2 emissions associated with treatment processes and disposal of unwanted water.

In Colombia, this technology was used on 30 wells, decreasing produced water by as much as 900 bbl/d and improving hydrocarbon production by 43%, with the performance sustained for more than two years following the treatment.

The impact these technologies have had on efficiency and cost savings is significant, and the value generated will continue to increase as more advanced tools are introduced and integrated.

Conclusion

The potential to extend this approach is limitless. Although projects to date have been localized, it is evident that this approach can be scaled to the field level for even better results.

Ongoing investment to expand the number of integrated services and disseminate the new commercial model could change the face of operations, delivering safety and ESG gains as well as time and cost savings.