Global energy investments stable for next six years, Rystad claims

Offshore staff

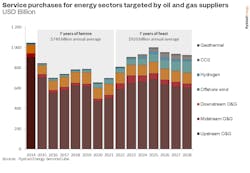

OSLO, Norway — Global expenditure on oil and gas and energy developments should average more than $920 billion annually during 2022-28, according to Rystad Energy, hitting a peak of $1 trillion in 2025.

And even if a downturn in oil and gas sets in after 2025, oilfield service (OFS) suppliers should be able to ride this out by branching into other sectors, the consultant claims, such as geothermal energy, hydrogen, offshore wind, and carbon capture, utilization and storage.

All these segments look set to grow in nominal terms, Rystad added, led by suppliers targeting equipment and materials and others providing operations and maintenance services.

Suppliers are careful not to overinvest in more capacity as rigs, vessels, plants and other units in the supply chain are affected by natural wear and tear. This has led to improved prices over the past year for offshore rigs, land rigs, frac fleets, proppant, oil country tubular goods, vessels and subsea infrastructure.

In 2022 the post-pandemic recovery and high gas and oil prices encouraged oil and gas companies to raise their investments by 20%. Energy security concerns led to higher demand for goods and services from suppliers, and the OFS industry sold out of certain rigs, casing and tubing steel, Rystad added.

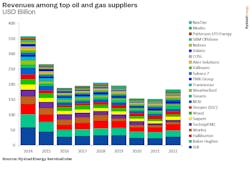

The OFS industry has struggled since 2014, first with an oversupply of oil from US shale, OPEC’s “volume war,” Russia flooding the global market, and the two-year pandemic, all of which helped depress oil prices and upstream expenditure.

As a result, revenues of the largest oil and gas contractors fell by 60% from the peak of 2014 to the trough in 2021.

Suppliers have not been able to cut costs, adjust capacity or cope with their debt to an extent that would allow them to realize profitable businesses. Companies had been clinging on to their assets, Rystad claimed, in the hope of lifting their market share quickly in a future recovery scenario.

01.31.2023