Recoverable oil in downward spiral, report claims

Offshore staff

OSLO, Norway — The volume of global recoverable oil now totals about 1,572 Bbbl, according to Rystad Energy, down almost 9% on the estimate for 2021.

Recoverable oil corresponds to “remaining technically recoverable crude oil and lease condensate” and includes risked future discoveries.

Main reasons for the decline are the 30 Bbbl produced last year and a reduction in undiscovered resources of about 120 Bbbl.

The U.S. offshore sector has contributed the largest drop, with 20 Bbbl set to remain undeveloped due mainly to leasing bans on federal land.

The situation “could further destabilize an already precarious energy landscape," per Magnus Nysveen, Rystad Energy’s head of analysis. “Energy security is a matter of redundancy; we need more of everything to meet the growing demand for transport and any action to curb supply will quickly backfire on pump prices worldwide, including large producers such as the U.S."

He added, “Politicians and investors can find success by targeting energy consumption, encouraging electrification of the transport sector and drastically improving fuel efficiency."

Rystad Energy’s latest estimate put the total of undiscovered oil worldwide at 350 Bbbl, down from 1 trillion bbl in 2018, the chief cause being the collapse in investor appetite for exploration exposure, which has led to fewer government leases.

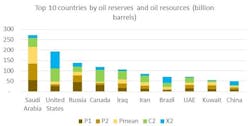

The consultant has calculated that all OPEC countries have proven reserves that are expected to last more than 10 years, as in Iraq, to more than 14 years in Saudi Arabia. Among non-OPEC member countries, Mexico ranks last with fewer than five years of proven reserves, while Canada’s reserves are projected to last almost 20 years.

Saudi Arabia leads globally in terms of recoverable oil with 275 Bbbl, followed by the U.S. with 193 Bbbl, Russia with 137 Bbbl, Canada with 118 Bbbl and Iraq with 105 Bbbl.

In South America, Brazil leads with 71 Bbbl recoverable oil, 10 times the volume of proven reserves, but down 4 Bbbl from last year.

The U.K. and Norway’s recoverable volumes have both fallen by 1 Bbbl to 10 Bbbl and 17 Bbbl, respectively.

However, the U.S. has added 8 Bbbl to its discovered resources.

07.01.2022