By Nick Tedre, Contributing Editor

Statoil is forging ahead with the Snøhvit project, which involves the first offshore development in the Norwegian sector of the Barents Sea. Approval was granted by the Storting in early March.

Snøhvit involves investments of NKr46 billion, making it one of the largest projects ever undertaken by the company. Gas will be produced in phases from three fields on the Tromsø Patch, Snøhvit, Askeladd, and Albatross, and sold in the form of Liquefied Natural Gas (LNG). In the initial phase, NKr8 billion will be spent on the offshore development and a NKr16 billion on construction of the LNG plant and other onshore facilities. Start-up is scheduled for October 2006.

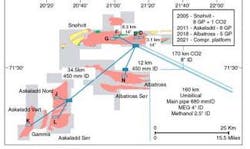

The three gas fields on the Tromso; Patch, Snohvit, Askeladd, and Albatross, will be developed in phases and tied back 160 km to land.

Getting the project off the ground is the culmination of years of work to put together a commercially sound scheme. Snøhvit was discovered in 1984 and the other fields in the early 1980s. Exporting the gas as LNG was selected at an early stage as the alternative to transporting it down to the North Sea network by pipeline. This solution would have been prohibitively expensive. This is Nor-way's first LNG export project.

For a period last year, Statoil held back submission of the development plan while it sought clarification of tax terms from the finance ministry. Under the scheme finally agreed, the whole project will be subject to the Norwegian offshore tax regime, with a marginal rate of 78%, but depreciation will take place over three years. "This gives us economics in line with the tax structure we originally suggested," says Egil Gjesteland, Statoil's senior vice president for E&P Norway, who heads the project.

The scheme, which the government intends to apply to all future projects involving onshore LNG plants, will require amendment of the petroleum tax law. The environmental group Bellona has lodged an objection with the watchdog of the European Economic Agreement governing Norway's cooperation with the European Union on the grounds that that the scheme violates the terms of this treaty. The matter is expected to be resolved later this spring.

The three fields, which lie in water depths varying from 250-340 meters, contain recoverable gas reserves totaling 190 bcm. Snøhvit is by far the largest of the fields, and the richest in condensate. Askeladd is due to be brought on stream in 2011 and Albatross in 2018. Nine wells will initially be drilled on Snøhvit, eight producers and a CO2 injection well. The total wellstream production rate will be 20.8 MMcm per stream day. Snøhvit also contains oil in thin layers, but no economic way of developing these reserves has been found.

All eight Snøhvit producers will be on stream at start-up. The contract for drilling, which will take around 18 months, will probably be let late this year, according to Gjesteland.

The wells will be housed on three templates. Two templates with three producers each will be located in the eastern part of the field, and one, with two producers and the CO2 injection well, in the western part. At each template the wellstream will be manifolded into a flowline, which will connect to the export pipeline via a pipeline-end manifold. The 26.8-in. export pipeline will run 160 km to Melkøya Island.

There will also be a 4-in. line for continuous MEG injection, a 2.5-in. line to deliver methanol for start-up/shut-down purposes, an 8-in. line to carry CO2 separated out at the terminal back to the field for injection; and an umbilical with power, control, and hydraulics. The major offshore work, including pipelay, is scheduled for 2005. The first contracts should be let in late summer, according to Leif Arne Høyland, who is responsible for the offshore development.

Protection structures will be installed to make all the subsea installations trawl-proof as the area is important for fishing. The pipeline has been routed away from fishing areas, and in locations where trawling takes place it will be rock-dumped. The smaller lines will be trenched along their whole length.

The development extends existing technology since the field will be the farthest to be remotely controlled from shore, and with the longest multiphase pipeline. While this development stretches technology, it does not involve any unproven technology, Gjesteland says. Power supply will also be a challenge. Power will be transferred to the field at 3 kV, much higher than the usual 0.8 kV. A subsea transformer will therefore be required at the field.

Multiphase meters will be installed on all the wells to measure the gas and water contents. Testing of various meters is being carried out at Statoil's Kårst&oshalsh; facilities in collaboration with another Statoil project, the Mikkel development in the Norwegian Sea. A very large slug catcher, with capacity to handle slugs with a volume of 2,700 cm, will be installed at the terminal.

In the final stages of development, in around 2021, compression of the wellstream will be required at the field. It is currently envisioned that this facility will be installed on a platform, and provision for this has been made in the budget. By that time, however, subsea compression may well be a proven technology offering an economically more attractive option.

In terms of the schedule, the onshore works represent the critical part, according to Gjesteland. The LNG plant will be located on the uninhabited Melk Island, which lies just 3 km from Hammerfest, the world's northernmost city, on Norway's northern coast. Substantial preparatory civil works are required, including leveling and reclaiming some of the land from the sea. Due to the lack of industrial infrastructure in this remote area, the plant itself will be built on a barge with dimensions of 150 by 54 meters, floated to Melk Island and installed in a dry dock. The contract for the plant, which could be built in Norway, will be let next spring, with delivery scheduled in spring 2005. Two large LNG storage tanks will be built at the site, and one storage tank each for condensate and liquefied petroleum gas (LPG).

LNG capacity will be 5.7 bcm/year, along with condensate capacity of 1 MMcm/year and 250,000 tonnes/year of LPG. Detailed design of the terminal is being carried out by German company Linde. The gas will be liquefied at a temperature of -163°C using a process jointly developed by Statoil and Linde. The process has been tested at a pilot plant installed by the two companies at Mossel Bay in South Africa. The results proved better than theoretically expected, Gjesteland says. The process incorporates a new type of heat exchanger, which has also been acquired by Woodside Petroleum in Australia, where first use of this equipment will take place.

Before the gas enters the LNG trains, the wellstream will undergo a sophisticated pre-treatment process to separate out the condensate, LPG and CO2. Although a proportion of the CO2 is to be injected into the subsurface, some will be emitted into the atmosphere.

At the land terminal, the wellstream will pass through a slug catcher and pre-treatment process, during which CO2 will be extracted, before the gas enters the LNG trains.

Along with its partners Amerada Hess, Norsk Hydro, RWE-DEA, and Svenska; Statoil has signed LNG sales contracts with El Paso Global Company of the US for the equivalent of 2.4 bcm of gas a year, and Iberdrola of Spain for 1.6 bcm. These sales will also include the share held by the State's Direct Financial Interest (SDFI), which is managed by Petoro. The other two partners, Gaz de France and TotalFinaElf, will lift their own share of LNG at annual rates equivalent to 690 MMcm and 1.06 bcm respectively.

On behalf of the partners which have signed LNG sales contracts, Statoil has agreed charters for three 145,000 cm LNG carriers. One is with Leif H&oshalsh;egh & Co and Mitsui OSK Lines, which will build their carrier at Mitsubishi Heavy Indus-tries in Japan, and the other two with Kawasaki Kisen Kaisa and Mitsui, which will build the vessels at Kawasaki Heavy Industries and Mitsui Engineering & Shipbuild-ing Co, also in Japan. Gaz de France and TotalFinaElf will make their own lifting arrangements – they require the equivalent of one vessel. Approximately 70 LNG cargoes will be shipped a year.

Although the fields are perhaps the most northerly yet to be developed, lying between latitudes 71°N and 72°N, weather conditions are not so different from those on the Halten Bank off mid-Norway, where Åsgard and other fields are in production. The Troms&oshalsh; Patch benefits from the warming effects of the Gulf Stream, there is no drifting ice and waves are not unusually high.

Because of the environmental sensitivity of the area, the environmental impact assessment was among the most exhaustive ever carried out, Gjesteland says. Statoil worked closely with concerned parties in the preparatory phases of the project, so there were no great surprises in the comments delivered by stakeholders during the public consultations, held last year.

Environmental groups such as Bellona are opposed to all offshore oil and gas activities in the Barents, but local industry, trade unions, and politicians are keen to see the project go ahead for the industrial and employment benefits it will bring. For the local population there will be a lot of consultancy and subcontract work, minor construction, road-building, and installation of power and water supplies. Statoil wants to involve local industry as much as possible, and will encourage the main contractors to use local subcontractors, Gjesteland says. There will be peak manning of 1,200 in the construction phase in 2004-2005, and 180 fixed jobs in the operations phase.

The sales contracts are not expected to exhaust the gas reserves, so there should be scope for extending the contracts or agreeing on new ones. Statoil also intends to explore for additional gas reserves, which can be tied back to the terminal, where there will be scope for adding a further LNG train. Statoil recently acquired more acreage in the Barents through an asset swap with ExxonMobil. According to the Norwegian Petroleum Directorate, there are significant amounts of undiscovered gas in the region.

Interests in Snohvit are Statoil, 22.29%; Amerada Hess, 3.26%; Gaz de France, 12%; Petoro/SDFI, 30%; RWE-DEA, 2.81%; Svenska Petroleum, 1.24%; and TotalFinaElf, 18.4%.