Offshore staff

HAMILTON, Bermuda– Borr Drilling Ltd. has announced a binding tender agreement to offer to purchase all outstanding shares of Paragon Offshore Ltd. Total acquisition price is estimated at $232.5 million.

The Borr board of directors has approved the transaction and major shareholders have expressed support for the deal. The transaction is expected to close on March 26, 2018, and is subject to customary closing conditions.

Borr CEO Simon Johnson said: “We are acquiring an experienced organization, solid management systems, and quality assets at attractive prices. By integrating a very capable operating platform, Borr will be qualified based on the historical track record to tender, win contracts, and operate in most jurisdictions.”

As of January, Paragon had a fleet of 32 drilling units: 31 jackups and one semisubmersible. In March, the semisubMSS1 is scheduled to start a long-term contract for TAQA in the North Sea. The 2013-built jackup Prospector 1 and five of Paragon’s older jackups are working in the North Sea, India, and Middle East. Four more jackups including the 2014-built Prospector 5 are under contract or committed. The remaining 21 jackups are stacked in different locations.

Chairman Tor Olav Troim added: “As almost 50% of the global rig fleet is more than 30 years old, responsible owners should take steps to rationalize their fleets and consolidate the fragmented market. Borr wants to be at the forefront of this initiative. Borr will, as communicated, focus on operating modern, high-spec assets.

“In view of this strategy the board will evaluate the future of the uncontracted older jackups which are part of the Paragon fleet. Based on the anticipated high reactivation cost, safety standards, and drilling efficiency it is likely that most of these units will not be marketed for new drilling contracts.”

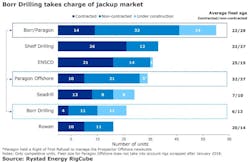

Upon completion of the acquisition, Borr will become the largest jackup owner in the world, with 57 jackups.

According to analyst Rystad Energy, the company will also be the second-largest provider of offshore rigs, measured in fleet size, just four units behind the newly-mergedEnsco-Atwood. This move brings together the fourth and sixth largest jackup providers to create an entity controlling 10% of the world’s jackups.

Oddmund Føre, vice president of oilfield service research at Rystad Energy, said: “Borr’s strategy has always been to consolidate the jackup market and focus on operating modern high-spec rigs. Hence, they put a very low value on the older rigs which is reflected in the transaction price.”

Even though Borr might shed many of the rigs acquired, they will still be a leading provider of premium jackups, with 24 units built after 2000.

“The timing is perfect for Borr Drilling as the signs of a recovering market are starting to appear,” said Føre. “Contracted utilization for jackups has been holding steady at the low to mid-50% level since early 2017, but during fourth quarter 2017 we saw an increase in new mutual contracts, contract durations, and leading-edge day rates for premium jackups.”

02/22/2018