Dr. Leslie Bottomley

Douglas-Westwood Associates

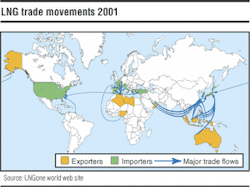

Because much of the world's stranded gas is in offshore fields, floating LNG (FLNG) production vessels have been proposed by some major oil and gas companies. Both floating natural gas liquefaction and re-gasification vessels could offer great business opportunities. A BP statistical review of world energy notes that world trade in LNG accounted for almost 143 bcm of natural gas, or 5.1% of the total world gas production in 2001. The movement has been increasing yearly as the demand for gas as a clean source of energy increases. The key is getting gas to markets economically. Demand from the industrially developed countries for the gas to fuel electrical power generation drives the business.

Getting the gas to market

The vast majority of the world's natural gas is transmitted from well to end-user via pipeline systems. However, there are huge resources of natural gas stranded – that is, distant from an economic pipeline route to market. Stranded gas has been estimated at over 60% of the total proven world gas reserves. According to 2001 figures, this could amount to 3,300 tcf. As many of these proven gas fields have only been found when looking for oil, it is almost certain that many other non-associated gas fields exist in the world waiting to be discovered.

In many cases, liquefaction of natural gas is the only commercially viable way to move large amounts of natural gas to the end user. The gas has to be taken from the well, cleaned, and liquefied to significantly reduce its volume (to about 1/600) so that it can be pumped as a liquid into huge thermally insulated LNG tankers, some holding up to 137,000 cu m.

Liquefaction involves staged compression and cooling to around -161° C (-258° F), hence the need for efficient thermal insulation to maintain the gas as a liquid under only slight pressure. Offloading takes place at land-based collection terminals. LNG moves into storage tanks ready for re-gasification, after which the gas can be fed directly into the gas distribution grid.

Globally, there are 19 operational land-based LNG processing plants with a name plate capacity of over 110 million tons per year and mostly with fixed pipeline gas feeds directly from the gas fields. This is an established business that has been in operation since the 1960s. Long-term gas supply contracts are put in place even before the LNG train is constructed. The world's LNG transport fleet similarly has been built to order for a specific gas contract, which in many cases can run for 20 to 30 years. Financial institutions have funded this traditional business structure against the security of such long-term supply contracts.

LNG fleet expansion

The LNG business is changing, evidenced by the rapid expansion of the LNG world tanker fleet. The July 2002 Petroleum Review indicates 60 new LNG tankers are under construction and a further 16 are on order. At an estimated $160 million per ship, this yields an estimated capital investment of almost $10 billion for the 60 newbuilds and creates an additional carrying capacity of around 8.6 MMcm of LNG. This is the creation of a real spot market for LNG, and as not all these ships are tied up to long-term gas supply contracts, it is bound to make the financial community a little nervous. According to the Petroleum Economist, major players in this business – Shell, BP, and the BG group – are gearing up to drive this market with their consolidation of the various aspects of the supply chain from liquefaction plants, LNG tankers, and import terminals.

Royal Dutch Shell has been particularly keen to employ FLNG vessels at some of their more remote fields. Armstrong Technologies has also proposed FLNG. The liquefied gas could be held on LNG storage barges ready for offloading into LNG tankers.

FLNG production vessel operation parallels that of FPSOs used for offshore oil that can be redeployed to new locations as fields deplete. However, FLNG vessels would be quite special, combining the requirements of a full-scale LNG manufacturing plant with the cryogenic storage needs of an LNG tanker. A whole new technology requiring different engineering skills is necessary, especially regarding the aspects of transferring low temperature liquids around a moving vessel.

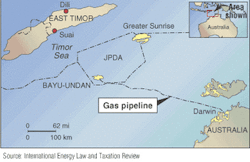

Other possibilities for FLNG include the Snøhvit development off Norway and the huge gas fields off the coast of Venezuela (the Paria peninsula in Plataforma Deltana). FLNG production could quickly capitalize on offshore remote gas fields without long-term planning of onshore LNG manufacturing plants. Many other opportunities exist for emerging nations with little infrastructure to build a world scale LNG supply industry.

Offshore LNG vessels are already being planned for gas fields off the West African coast. Bechtel Engineering is reportedly planning an FLNG vessel that can process up to 8,000 cm/d of natural gas from which LNG tankers could hook up and offload directly from small cryogenic storage barges moored to the FLNG vessel.

Floating re-gasification

Getting the gas out of the ground, converted to liquid, and moved to an LNG tanker is one challenge. Getting it directly to the customer is quite another. LNG import terminals transfer liquid gas into a county's gas distribution grid, but terminal capacity and placement of the terminals limit distribution.

Japan, the world's largest LNG importer, has 23 import terminals in operation and is building more to meet its domestic needs. In the US, all of the import LNG terminals in operation are on the East coast, while there is a great deal of demand for gas on the West coast. The location of the import terminals restricts the supply of gas into the country.

A floating re-gasification terminal (FRT) could offer a better alternative. An FRT positioned offshore at a suitable distance, between 5 and 12 mi from shore, could connect directly into the local gas distribution grid through a relatively short and inexpensive pipeline system. Tankers could deliver LNG directly into the FRT, which could send the gas into the pipeline. This would eliminate the need for cryogenic storage. The LNG tankers could just line up, like aircraft waiting to land at an airport, to deliver their cargo. This type of approach would truly open the market for LNG.

Opportunities exist all over the world in the longer term, but the immediate needs are in the US, Europe (especially the UK, which will have a gas import requirement by 2006 or earlier), Australia, and China. Five to 10 FRTs could be employed quickly with many more to follow.

Gas-to-liquid conversion

Another complementary technology with significant growth potential is the conversion of natural gas into the final liquid end product. Gas-to-liquid (GTL) conversion relies on the Fischer-Tropsch reaction discovered in the 1920s and was used initially to convert coal gas to fuel for military use.

Greater Sunrise development off Australia.

The main driver for this technology is the demand for clean fuels with low sulfur levels, low aromatics, and low particulate emissions. Environmental legislation in the next few years both in the US and Europe will demand that diesel fuel meet strict limits that can only easily be met with GTL technologies. Cheap gas is required for the GTL plants to be economic, and stranded gas is an ideal source.

Many major oil and petrochemical companies have built pilot plants and have plans to build full commercial scale plants over the five to ten years. Shell has been operating a commercial GTL plant in Bintulu, Malaysia, that now produces around 12,500 b/d of clean diesel fuel amongst small quantities of other hydrocarbon liquids. Sasol in South Africa has been operating several small-scale plants that use both natural gas and coal to provide the feed gas for conversion into diesel or gasoline.

The future

There could be over 1.2 MMbbl of fuel being produced by GTL plants around the world within eight years. The potential for floating GTL vessels is great.

It is clear that LNG will be a major supplier of natural gas into the world market and that a truly spot market for LNG will develop. The use of FLNG processing facilities will be a key element in the creation of this global energy supply business. The emerging GTL global industry is complementary to the LNG business and offers potential for less-well-developed countries to earn valuable foreign revenue from their natural resources.

Author

Dr. Leslie Bottomley is the author of The World LNG & GTL Report to be published by Douglas-Westwood later in 2002. Further details can be obtained from [email protected] or via the D-W website, www.dw-1.com.