Subsea processing/boosting choice for deep, ultra deep, harsh environment production

Gene Kliewer - Technology Editor, Subsea & Seismic

Subsea processing, separating, compressing, and pumping are on the leading edge of offshore production technology, especially for deep and ultra deepwater, and also harsh environments. The practice and art of placing such equipment subsea still are in their early stages of use. Nevertheless, the attractions are sufficient that both operators and equipment suppliers are developing subsea systems to accomplish tasks heretofore done above water.

Earlier this year,Offshore published the first ever Worldwide Survey of Subsea Processing, Separation, Compression, and Pumping Systems poster. That poster can be seen online at http://downloads.pennnet.com/os/posters/subseaprocessing_02608.pdf and is contained in the March 2008 issue of the magazine. That poster illustrated and quantifies what is available and already in use. New technology is dynamic, however, so Offshore has gone to several companies to learn what is driving this technology and to get a peek at what the future holds.

Right now, the technology is on a plateau along its industry learning curve. What is needed to move the applications forward is a larger installed base with the attendant comfort level required by the industry before there is common application of any new technology.

For the time being, “nothing new is needed,” says Tom Choate manager, Systems Engineering, INTEQ. “We are at the point where it is time to use (the existing technology) knowingly and with thorough application engineering.”

We need a change in mindset from the operators, adds Neil Holder, VP, Sales & Marketing, Aker Solutions. Experience is needed; more frontrunners to apply the technology. “That brings a willingness to invest in continuing evolvement and deployment of the technology. It might take a change in contracting/business models on the part of operators,” Holder says.

“The technology exists,” says David Morgan, director, Subsea Processing, Cameron. “Some is qualified to some fashion, but the building blocks are there. We need more user base for operator comfort level.”

“Most of all we need more fields where subsea processing is being seriously investigated and evaluated early enough to be considered in the operator’s decision process, and with less penalty for ‘technical uncertainty’ until the installed base produces more reliable uptime/risk data,” says Martin Sorensen, director, Subsea Power & Processing, VetcoGray, now a GE Oil & Gas business.

Driving factors

Some factors currently driving the progress are obvious. Subsea facilities are viewed as a path to bring production to market faster while extending life of the field. Also, such hardware is likely to make otherwise marginal fields economically viable. The shortest answer is simply “more oil.” Here are technical reasons supporting these promises.

“The idea is to get more energy into the flow stream to get more oil from the reserves,” says Morgan. “In deeper waters likewise, free flow the gas and pump the liquids to reduce the head on the well,” in order to increase production.

As with many technological changes, necessity formed part of the equation. For example, BP’s King field in the Gulf of Mexico would not be as productive without multi-phase pumping (MPP), and Shell’s Perdido project “was not going to happen without separation and pumping,” says Choate.

There is another obvious factor at play. Putting the equipment on the seabed cuts topside requirements.

“The rewards are obvious with savings in topside facility costs,” says Jan Olav Hallset, managing director, Poseidon Innovation, part of the Poseidon Group in Stavanger, Norway. This reduced cost raises, “the ability to develop marginal fields.”

“Topside capacity issues are addressed when seawater reinjection is the operation,” says Morgan. “You can separate the production from the water and reinject the water so you do not have to process it. Plus, there is seldom space for more water or more processing hardware on existing platforms, particularly in the North Sea.”

Brownfield operations are included in VetcoGray’s view of the technology.

“By applying subsea boosting and/or separation, in the majority of cases related to brownfields, the operator increases production, meaning earlier and faster earnings from the field,” says Sorensen. “In addition, the recovery rate increases, meaning more earnings over time from existing infrastructure and better use of the reserves.”

Biggest advances

Regardless of the rate of technology uptake into the industry overall, there are significant numbers of working applications proving the concept of subsea boosting and processing.

Two of them are mentioned above, namely King and Perdido.

“The biggest advance in the GoM is the application of MPPs and the use of ESPs (electrical submersible pumps) in seafloor applications,” says Choate of INTEQ. “In the North Sea, StatoilHydro’s full-blown separation/water handling/pumping/compression systems are state of the art.”

For Hallset at Poseidon, the biggest advances to date are subsea boosting and injection pumps, and high-voltage, high-power switching equipment, umbilicals, and connectors.

He also cites StatoilHydro’s Tordis, Ormen Lange, and Snøhvit projects as important advancements.

Sorensen at VetcoGray put the subject into perspective:

“The oil and gas industry has not traditionally been dominated by major technological breakthroughs, but rather careful step-by-step, forward-moving and integrating novel ideas and new technology system solutions consisting of well proven technology and products.

“However, some industry pioneering projects have brought seabed boosting and separation over its first hurdle, such as: the first subsea MPP for the Prizioso field in 1992; the Troll C subsea separation and produced water injection pilot project in 1999; Pazflor as it is the first separation and boosting based field development entirely reliant on the subsea processing functionality; and Ormen Lange where a series of key building blocks for subsea gas compression is being qualified for the next major step in subsea functionality.

“VetcoGray technology played a key role in the Troll C project, developing the first commercially scaled and longest running pilot subsea separation system launched in 340 m (1,115 ft) water depth whereas GE Oil & Gas’ rotating equipment technology is pushing boundaries in the Ormen Lange project through the development of the first subsea compressor able to operate at 900 m (2,953 ft) below sea level.”

Incremental advances can have far-reaching impact. For instance, notes Holder of Aker Solutions, proving pump technology up to 2.5 MW of power to be reliable is significant.

Limiting factors

In the face of its benefits and current applications, and beyond the user base, subsea processing and boosting has some other issues still being worked out. Cost is one. Size and weight of the equipment is another. These are being addressed for subsea hardware just as they have been addressed for platform mounted equipment.

Retrofit, shallow water

Two areas where subsea technology is not typically thought of are in retrofitting existing fields and in shallow water. That could change with time, as well. Cameron, for instance, has several projects which target brownfields. The MARS (Multiple Application Reinjection System) is used to tie back King field by tapping into existing christmas trees with new flowlines without extended shut-in of the field. The system uses isolation valves on the tree and manifold to manage flow during connection. Cameron also is working on an EOR system to improve on raw seawater to charge a reservoir. “Find similar water in another well and send that over as the EOR water in place of seawater,” says Morgan. “That will match the existing reservoir chemistry better. The whole thing is ‘process cooled’ meaning it has no oil loop, just pump and power cable.” Produced fluids as ambient seabed temperature cool the system.

As for shallow water, Choate points out that, for instance, MPPs can add pressure to offset pressure drop regardless of whether the drop is due to elevation or friction. And, operators may find over time that adding subsea equipment in shallow water for boosting and subsea-to-beach solutions becomes less expensive than adding new surface facilities or refurbishing existing platforms.

Subsea market to pass $5 billion

Expenditure on subsea processing systems is increasing rapidly and is expected to total some $5.1 billion over the 2008-2017 period, predicts Douglas-Westwood Ltd. and OTM Consulting. The prospect of improved recovery and production is driving operator uptake. So much so that in 2009 there could be as many seabed pumps installed as were installed in total over the 2003-2007 period, the report continues.

Global subsea processing market by component 2003-2017.

“A total of 186 seabed boosting applications are expected to account for 61% of this 10-year total, in addition to 32 forecast separation systems, we expect 1,275 multiphase meters and eight wetgas compressors,” says Steve Robertson, Douglas-Westwood’s Oil and Gas manager. “Africa is expected to be the leading regional market with a mid-range projected capex of $1.4 billion over the 2008-2017 period, followed by Latin America ($1.2 billion), Western Europe ($1 billion), and North America ($936 million).”

In the same report, George Trowbridge, associate director at OTM, says, “Again we have seen that the oil companies are continuing to embrace subsea processing. In previous years we have seen interest in subsea processing being driven primarily by a desire to increase production. In this latest edition, increasing production is still the main motivation for oil companies to use subsea processing but more firms are considering subsea processing as an enabling technology to help produce technically challenging fields (e.g. heavy oil).”

In the latest study, almost all the oil companies interviewed expected to install subsea processing in the near future with every region expected to see some subsea processing activity in the short to medium term.

New package added to subsea systems

Ellen C Moore, CPSM - Aker Solutions

As operators move into deep and ultra deepwater, the decision to produce will rely heavily on the amount of recoverable reserves. Even untapped reserves may prove uneconomic for production if the amount of recoverable oil or gas does not achieve the required economic baseline.

Understanding the need for maximum hydrocarbon extraction, Aker Solutions began to deliver separation and processing solutions to topside facilities more than 30 years ago. As subsea production grew, the company began research and development of more effective and economic processes to increase production. The result is the FlexSep system. FlexSep separates and reinjects produced water subsea into the production reservoir to free capacity in the flowline to the host. This can boost production flow and increase hydrocarbon recovery. Dewatering also can create operational robustness that contributes to extended field life and greater return on investment.

The FlexSep typically consists of a dewatering separator – usually a horizontal gravity separator with a common oil/gas outlet – and a water injection pump. Multiphase boosting can be added to the oil/gas outlet to reduce the pressure in the separator and to further reduce flowing wellhead pressure. On the water side, desanding and deoiling can be added, depending on the requirements of the water injection well. For heavy oil applications and oil continuous flow, a compact electrostatic coalescer can be added upstream from the gravity separator vessel to aid dewatering and to reduce retention time in the separator vessel.

The oil/water interface level is controlled by the speed of the water injection pump. Due to the weight of the vessel, a special nucleonic level detector has been developed. This detector can be retrieved separately from the vessel, increasing availability and maintainability of the system.

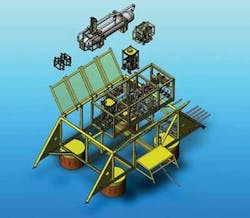

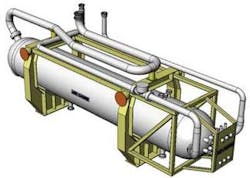

Dewatering separator illustration.

For heavy oil, Aker Solutions has qualified the CEC Compact Electrostatic Coalescer for subsea use. CEC is a flow-through device that causes droplet growth when an oil continuous emulsion flows turbulently through an alternating electric field. This improves performance of the downstream dewatering vessel.

The water injection pump, Aker Solutions’ LiquidBooster, has a glycol-filled motor so contaminants from the motor cooling fluid do not affect the injectivity of the water injection well.

If the water injection well is used to boost pressure in the production reservoir, it often is desirable to minimize the content of oil and solids in the water injection stream. Aker Solutions has a separately retrievable desander module for solids removal down to 10 micron size. Solids can be injected into the hydrocarbon flowline to the host. Similarly, a separately retrievable deoiler cyclone module to remove oil down to less than 40 ppm in water is available. LiquidBooster will be a critical component in production of StatoilHydro’s Tyrihans field when the water injection pump comes onstream in 2009. LiquidBooster is expected to increase oil production by 10% in Tyrihans.

MultiBooster multiphase pump is a twin screw pump with a large tolerance for variations in gas void fraction. This pump can be added to boost hydrocarbon flow to the host and to reduce pressure in the subsea separator, and subsequently, the flowing wellhead pressure. This can further enhance accelerated production and increased recovery.

MultiBooster pumps are functioning in the Gulf of Mexico (GoM) since deployment last fall and successfully operated in the King field for BP. Two of these pumps broke world records for pump operation in water depths in excess of 5,440 ft (1,700 m) and a step-out of more than 18.1 mi (29 km) from the platform.

The deoiler cyclone module is part of Aker Solutions’ CySep system for compact dewatering of a water continuous inflow. The separation system consists of high-efficiency cyclonic stages and is available for a water continuous flow. A gas-liquid cyclone is followed by a bulk oil-water hydrocyclone stage, a pre-deoiler hydrocyclone, and a deoiler hydrocyclone. Each stage reduces oil content in the water to improve working conditions for each subsequent stage. The rejects are combined with the gas flow from the initial gas/liquid cyclone and routed to the host. In case of an oil continuous inflow, a gravity separator stage is required.

A patented method to stack the hydrocyclone stages, TubeSep, enables a very compact footprint for subsea installation.

All aspects of the FlexSep system have been qualified for subsea installation and operation through several development projects: Tordis SSBI with StatoilHydro, SPC (Seabed Processing Collaboration) with BP, Chevron and ABB, DEMO2000 Sand Management, DEMO2000 DeepBooster, Marlin Subsea Separation with Petrobras, and CySep development with StatoilHydro, Total, and NFR.

Dewatering separator

The FlexSep dewatering separator consists of the following components/subsystems:

- Pressure vessel made from quench-tempered, high-tensile strength carbon steel and customized to each application (example: liquid rich wellstream, light hydrocarbon liquid, dewatering application)

- Internally clad for corrosion resistance

- State-of-the-art internals with regards to performance and robustness; welded in where possible

- Internals kept to a minimum to avoid blocking/fouling and resulting interventions

- All internals designed to avoid solids accumulation

- Bottom of vessel is flushed with process fluid (water) to avoid solids accumulation and caking

- Redundant nucleonic level monitoring/profiling system, with alternative principle as back-up.