Eldon Ball • Houston

Subsea market growth ahead

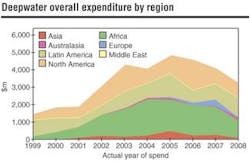

The deepwater subsea market can be expected to grow significantly over the next five years, with West Africa, North America, and Europe leading the way in total expenditures, according to a recent study by Infield Systems.

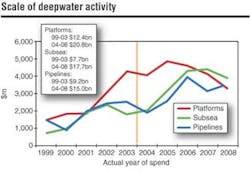

Infield sees the spending for "platforms, subsea, and pipeline" supplies and services increasing from an aggregate of $29.3 billion from 1999 – 2003 to a total of $57 billion from 2004-2008. (See also Deepwater drilling analysis suggests significant increase in activity, page 40.)

Smaller markets, such as Asia and Australasia, will grow rapidly, says Will Rowley, director of analytical services for Infield, but in smaller dollar amounts, since they are moving from a smaller base.

"The industry sees a lot of opportunities developing in the deepwater and ultra-deepwater regions," Rowley says. "We think the peaks and valleys of activity reflected in our charts will smooth out over time because of the effects of equipment and personnel constraints. We think that will cause a dampening effect on timing that will smooth out the bumps."

Analysis of spending by equipment and service sector shows platform expenditure (includes floaters of all types) growing from $12.4 billion in 1999 -2003 to $20.8 billion in 2004-2008. Likewise, the subsea sector (refers to trees, templates, and manifolds in the context of the study) is expected to rise from $7.7 billion to $17.7 billion, while pipeline spending will increase from $9.2 billion in 1999-2003 to $15 billion over the next five years.

In geographic terms, the forecast shows Africa with a 41% of market share over the next five years, with expenditures moving from the current focus on surface facilities toward a growing emphasis on subsea and pipeline equipment. Infield expects this trend to increase along with a move to more tiebacks to existing facilities. The forecast for Africa could be very conservative if a second wave of floaters materializes, Rowley says.

Infield's forecast shows North America with 26% of the market for 2004-2008, and with an increasing trend to deeper water. Spending for subsea and pipeline equipment gains market share in the GoM as well.

Industry reaction to opportunities can happen more quickly in the GoM, Rowley points out, because of the existing infrastructure of equipment and trained personnel. This means that projects can be initiated and completed in a shorter time frame in the Gulf, Rowley explains, compared to somewhere like West Africa or even the North Sea.

"Operators who are used to the ability to move quickly in the GoM can become a little frustrated when working in other areas," Rowley says. "Independents coming to the North Sea area good example. They're almost too nimble for the area."

The projections of activity were based on $18-22/bbl oil, and that hasn't changed, despite the increase in prices. "Some of the operators were burned several years ago," Rowley explains, "and they haven't forgotten it. From every indication we've had, their planning is still based on that range – about $18-$22 a barrel."

Infield focused its forecast on the deepwater (>500 m) and ultra-deepwater (>1,500 m) market worldwide, with geographical and equipment sector breakdowns.

The forecast by equipment type shows drilling and completion with 56% share of the worldwide market, pipelines at 33%, and equipment at 8%.

One of the most common questions accompanying Infield's presentations concerns cost reductions, Rowley says.

"We keep expecting to see costs come down in deepwater operations," he says, "but they haven't yet. That's the most frequent question we get. When – or better yet how – are costs going to come down? We're working on that one."

Infield's definitions

Subsea market: all activity directly related to fields and developments that involve a well completed on the seabed. This includes the drilling of the well, its completion, subsea production equipment, associated control lines and flowlines, to and from the well or field. Excluded are subsequent flowlines, control lines, and any associated equipment on or in relation to any host facility.

Subsea drilling and completion costs: the cost of drilling and preparing a production well to receive the seabed production equipment. Included within this are the drilling rig costs, casing and other downhole costs, and the final wellhead onto which the subsea tree or template is then mounted.

Subsea (production) equipment costs: any subsea trees, templates, and manifolds required to effectively produce a subsea well.

Subsea control lines: all associated command and control equipment required to operate subsea trees and manifolds, including control pods, electro, hydraulic, optical fiber, etc. from the host facility to the subsea production equipment. Default expenditure allocation is by year installed.