François Thiébaud, DORIS Group

Again, another crisis for the offshore industry, or rather, two crises, with COVID-19 and the oil price slump. However, DORIS is confident it can adjust to these unexpected market conditions, as it has done over the past 55 years, thanks to its diversified activity and R&D investments.

Despite the recent developments, climate change remains a worldwide concern, and the reduction of greenhouse gases (GHG) in oil and gas production is now part of the group’s design remit, from conceptual to detailed design stages. One current project involves reducing GHG generation onboard four FPSOs off West Africa: DORIS is preparing recommendations to that effect.

Another global priority is the replacement of hydrocarbons with other sources of energy. The group is participating in various initiatives, including carbon-free generation of hydrogen. Its UK subsidiary ODE is collaborating in the DOLPHYN project (Deepwater Offshore Local Production of HYdrogeN) to design the process equipment, electrical system, and overall technical safety requirements for the production of hydrogen from seawater.

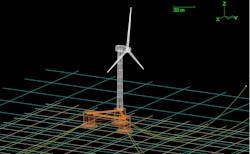

The facilities will be installed on a semisubmersible, supporting a wind turbine to provide carbon-free energy, with the hydrogen piped to shore. Preliminary studies are complete and in February, the UK government launched the project’s next phase which involves developing a 2-MW prototype. Later, with a full-scale unit, a single offshore 10-MW floating wind turbine should be able to produce sufficient low-carbon hydrogen to heat around 2,500 homes, fuel over 120-240 buses, or run eight to 12 trains.

Offshore wind farms

Renewables are also part of the solution. DORIS has developed two innovative concepts for floating wind, with the Nerewind semisubmersible suitable for deeper water, and the Articulated Wind Column (AWC) for intermediate depths. The group’s first project in this field dates back to 2002 with a pre-front-end engineering design (pre-FEED) study for a wind farm offshore Zeebrugge, Belgium.

Since then, the group has provided engineering and associated services to developers for projects such as Ormonde, Scroby Sands, and Wikinger. The experience led the group to expand this service to Asia, with an office in Taiwan in 2016, followed by activities in Japan, Korea, Vietnam, and Boston, and prospects for further developments.

Facility life extensions

At the same time, the group remains active in more traditional oil and gas activities. One of the industry’s main challenges today is extending the lives of existing facilities that have reached their originally designed lifespan of 20-25 years, but which can still produce available reserves. DORIS is assisting several initiatives in Africa and the Middle East to assess the remaining life of equipment and structures and to recommend life extension modifications.

Cost reduction remains the primary driver of most operators, and much more so in periods of depressed oil prices. One significant lever is the reduction of opex by converting facilities that were designed only a few years ago to operate manned to unmanned service. Through ODE, the group held operation and maintenance contracts for several platforms in the southern North Sea for over 15 years. It is now Duty Holder of two greenfield developments, and has expanded its Aberdeen office to target central North Sea operations. One idea is to design facilities with a once-yearly visit specification, such as the 2018 design the group produced for a wellhead platform offshore Argentina.

New facilities can also be designed with disrupting technology and commercial choices, such as small-scale FLNG development in which DORIS is presently involved for various West Africa prospects.

Digitalization

Finally, and most importantly, the industry is finally catching up on the digitalization journey several years after the automobile, aerospace, and other sectors. Digitalization leverages huge amounts of data that oil and gas operators have compiled over the years in their operations through sophisticated instrumentation packages and control systems. Yet much of this data is either used ‘live’ or more often, not at all. It is rarely used through statistical analyses because the data is stored in multiple databases (PI, SAP, SharePoint, EMDS, etc.) with no linkage between them. But when assembled in a single location, the data can be mined to reduce opex and capex by decreasing design margins and potentially increasing revenues though production improvements.

DORIS is developing solutions for digital twins with a view to producing prescriptive analytics for operators. This initiative started several years ago with ‘intelligent 3D-models,’ and is now moving into the pilot phase for actual greenfield and brownfield facilities. The group has also provided several digitalization proof of concepts to oil and gas clients from California to Africa to the North Sea.

The present crises will change many industry activities to a new ‘normal,’ but DORIS aims to prepared for the next wave of upheavals via continued R&D initiatives and the contributions of its worldwide subsidiaries. •