Report: Offshore spending driving global upstream capex

Offshore staff

NEW YORK CITY – The global upstream capex is expected to remain robust in 2024, primarily driven by offshore spending, according to Evercore ISI’s latest Offshore Oracle report.

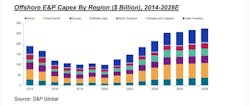

The report, which cites S&P Global data, says that the global upstream capex is anticipated to grow by 15.6% this year to reach $213.2 billion.

Offshore growth is broad-based, says Evercore, and the largest growth is expected in Africa (+34.3% to $27.3 billion), Latin America (+225% to $51.9 billion), and Russia and the Caspian (+21.1% to $3.3 billion).

The offshore growth trend is expected to continue through the decade, with total upstream offshore capex reaching $274 billion by 2028, implying a CAGR of 6.5%.

Shallow-water E&P capex is likely to peak in 2025 at ~$140 billion, while deepwater E&P capex growth will continue with momentum reaching $142 billion in 2028 from to $87.4 billion in 2023 (the deepwater segment is expected to experience a higher growth rate vs. shallow-water).

Meanwhile ultra-deepwater rig rates are expected to keep rising, the firm says. While contracting activity for floaters remains slow compared to last year, “we note [that] average floater rig days are in line with 2023 at ~312 days.” Dayrates for ultra-deepwater rigs “are looking robust,” says Evercore, averaging in the high $400,000-range year-to-date.

As reported by Evercore, four rig contracts announced this year so far have exceeded $500,000/day, including the Deepwater Asgard (Transocean, $505,000/day), the Deepwater Atlas (Transocean, $505,000/day), the West Capella (Seadrill, $545,000/day), and the Deepsea Aberdeen (Odfjell Drilling, $504,000/day).

06.04.2024