Offshore wind energy offers silver lining for vessel market

Demand for conventional offshore service vessels (OSVs) in the energy industry was on a modest but steady recovery heading into 2020 on the back of increasing upstream offshore activity, with vessel rates and utilization expected to climb upwards. This outlook was thrown into disarray as the pandemic took hold toward the end of the first quarter of 2020, sending global oil demand into an unprecedented tailspin. The impact on the supply chain was immediate and profound, and the offshore vessel domain was no exception. Rystad Energy has analyzed drivers behind the OSV market, revealing that there is a silver lining for the true workhorses of this industry, the anchor handling tug supply (AHTS) and the platform supply vessel (PSV).

Work relating to rig moves, in particular, showed a steep decline from 2014 to 2020, settling last year at only about 50% of the levels seen in 2014. This trend has taken a toll on the AHTS fleet, as more than half their work portfolio of these units stems from rig-related assignments. Mobile offshore drillings rigs are needed for a variety of activities – exploration, development drilling, workovers, intervention and for plugging and abandoning wells – all of which are subject to significant cutbacks by operators when oil prices are low.

Vessel activity relating to platform jobs has displayed much more resilience. This is primarily activity at producing fields with sound economics and a desire by operators to keep the wheels turning in order to maintain production and thereby ensure cash flow. This favors the PSV portion of the OSV fleet, as approximately 75% of demand in this segment involves serving platforms on standby mode as wells as taking care of logistics. Still another challenge is that demand for offshore drilling rigs is expected to shrink in 2021 before the stage is set for a comeback in 2022.

The oil and gas industry has been through many years of cost optimization, and now sits on a playbook with a vast number of viable offshore projects offering robust economics. We expect that many of these greenfield projects will be sanctioned over the next few years, supplemented by incremental activity stemming from brownfield work. Exploration is the component that appears most likely to lag behind as the E&Ps aim to nurse their balance sheets back to health.

The overall outlook is that demand for drilling rigs is expected to increase by a compound annual growth rate (CAGR) of 5% from 2021 to 2025. This sets the scene for a much-needed boost for the AHTS segment, which we also believe will see brighter days in the years to come.

While vessel owners are facing one of the most difficult periods of the decade, they are now forced to deploy timely and creative strategies in their fight for survival. Emerging offshore wind markets may be the industry’s savior, offering struggling offshore players – both vessel owners and operators – the opportunity to diversify into new areas.

Platform supply vessels, offshore construction vessels (OCVs) and other multi-purpose vessels are increasingly utilized to satisfy the need for accommodation and walk-to-work (W2W) services, which are both crucial for the operation of offshore wind. A lack of accommodation facilities at offshore wind farms and limited competition from the helicopter market means that personnel transport to wind turbines is a highly complex operation and not feasible in many regions – often, substations are an easier landing point.

As more projects move farther away from shore, offshore challenges such as travel distance, stronger winds, and higher waves can severely affect the productivity of crews, operational schedules, and maintenance strategies. Therefore, vessels that combine good accommodation capacity, dynamic positioning (DP) systems and W2W gangways are increasingly in high demand. This is especially true during winter periods, when the utilization of vessels that can operate at average wave heights (Hs) of 3 m (10 ft) have been shown to increase annual accessibility up to 92%, compared with only 74% when the Hs is 2 m (7 ft) at max. These competitive advantages are especially significant for projects located beyond 60-70 km (37-43 mi) from shore. The UK is expected to see the strongest growth in capacity from wind farms located more than 60 km from shore, followed by Germany, in the 2020-2025 period.

And even before the offshore vessels get engaged with construction of the offshore wind site there is a need for their services in the early stages and planning of the project. With slight modifications, such as the installation of lightweight equipment on free deck space, PSVs can also become very valuable assets in supporting or executing geotechnical surveys. These surveys represent the largest single investment in the site characterization process, typically taking place three to five years before project construction, and require extensive experience in marine operations and equipment, particularly as projects move from the shallow-water regions to increasingly deeper waters.

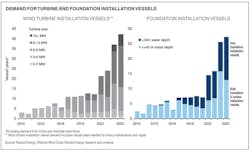

When you get to the construction phase, the demand for specialized installation vessels will soar, because we know that the turbine and project sizes will grow. The market for vessels capable of safely and efficiently installing large offshore wind components is quickly being out-paced by the growing demand of the global development pipeline. Not only has the number of offshore wind projects grown exponentially in recent years, average turbine size has also seen a significant increase, and we expect these growth trends to continue.

When translating the volume of offshore wind projects into vessel years for installation scopes, we estimate that the demand for foundation and turbine installations in 2020 is approximately eight and 13 years, respectively. On the supply side of the equation, there are currently 32 active turbine installation vessels (in addition to five that have been ordered) and 14 dedicated foundation installation vessels (in addition to five that have been ordered). For the past few years, this has effectively resulted in a relatively oversupplied market, especially in Europe. However, the scale is clearly expected to tip toward an undersupply of installation vessels by the mid-2020s. Extending the timeline toward 2030, we expect installation vessel demand to be four to five times higher than today’s figure.

So to strengthen their commercial offering for a future that is all about energy transition the vessel owners need to make their move. One adaptation for legacy vessels will be the enhancement of class notation of some units through increased cabin capacity and upgraded crane capacity. These units, however, will need to compete with fit-for-purpose newbuild capacity that will be tailormade for the tasks at hand. And in the case the vessel owners choose to invest large sums of capital in highly specialized installation vessels it would probably be wise to consider a multi-disciplinary approach. The reason being that these vessels will have to serve the initial greenfield phase of wind projects, in addition to maintaining and periodically replacing the active base of equipment.

There will be brighter days ahead for the offshore vessel owners as we expect a lot of work to be handed over to the offshore vessel owners that choose to diversify into new areas. It is now up to the industry itself get on the green wave for the long journey.