Learning process is ongoing as floating wind technology emerges

Editor's note: This feature first appeared within the 2024 Offshore Wind Special Report and published within the July/August issue of Offshore magazine.

By Jean-Baptiste Rougeot and Sarah McLean, Spinergie

Not too long ago, floating wind was being heralded as the new Eldorado with a wave of positivity following the pioneering projects in Northern Europe. Since these projects got off the ground, however, there has been a visible slowdown, with many developers hitting the brakes on projects and a general reduction in acreage awards. While the high costs of developing floating wind projects have been one of the main drivers of the slowdown, additional contributing factors include the logistic challenges surrounding installation and maintenance in deeper waters and the lack of suitable sites being identified.

In response to the slowdown, there have been some signs of hope for the fledgling sector. In the UK, following the disastrous outcome for offshore wind in CfD Round Five, changes were made ahead of this year’s Round Six. For the round, the UK government raised the administrative strike price by 66% for offshore wind projects (from £44/MWh to £73/MWh) and by 52% for the special sub-category of floating offshore wind projects (from £116/ MWh to £176/MWh). This is significant as the high ceiling will allow for the deployment of larger turbines in areas with higher wind potential, leading to greater utilization and a scale-down of costs per unit of electricity generated.

Also in the UK, floating wind projects stemming from the Innovation and Targeted Oil & Gas (INTOG) leasing round are beginning to move forward. Salamander is at the advanced planning stage, with the consent application submitted in May of this year. Meanwhile, Green Volt has had onshore and offshore consent granted.

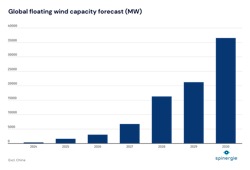

Globally, Spinergie has indexed demand for almost 36,500 MW of floating wind capacity by the end of 2030 (excluding China), with the majority of projects located within the North Sea or the Mediterranean. By analyzing the performance and behaviors surrounding previous installation and maintenance campaigns, developers of future projects can apply these lessons to ensure efficient operations and, subsequently, lower overall costs.

Existing floating wind farms and subsequent heavy maintenance campaigns

The most mature floating wind projects are located in Northern Europe, with Kincardine the first to undergo heavy maintenance in 2022 and 2023. In the second quarter of 2024, Hywind Scotland began its heavy maintenance campaign.

At Kincardine, the repair scopes saw the turbines disconnected, towed to Maasvlakte and returned once the works were complete. Analysis of these operations, in comparison to the installation campaign, highlighted the potential benefits of using a dedicated maintenance marine spread to allow for more efficiency. Vessel days during the turbine reconnection phase at maintenance were more than the average eight net vessel days observed during installation. This can be attributed to a new marine spread being used for maintenance, which, therefore, did not benefit from the learning curve and experience gained during installation.

The marine spread during the June 2022 maintenance period was also affected by the exceptional situation faced by the North Sea anchorhandling tug supply (AHTS) market at that time, where the vessels with the largest bollard pull were being contracted at more than US$200,000 per day—the highest rates for over a decade. This had a massive impact on the costs for the Kincardine maintenance scope with the marine spread alone costing more than US$4 million. From this, it can be deduced that developers should consider maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease exposure to spot market rates while also benefitting from an experienced fleet.

The Kincardine, and now Hywind Scotland, maintenance campaigns have also highlighted important considerations surrounding port capacity. Despite both projects being located off the coast of northeast Scotland, installation and maintenance operations have been completed using facilities in mainland Europe due to the lack of suitable deepwater ports in the UK.

A port requires sufficient room and a deepwater quay to be suitable for operations and maintenance in floating offshore wind. It must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Furthermore, the distance to the wind farm is a key element in reducing towing time to minimize transit and non-productive turbine time. As the floating wind sector grows, there will be less availability. This has already been a problem faced during Kincardine maintenance, as Maasvlakte was already busy as a marshaling port for HKZ and Dogger Bank A. This highlights the importance of abundant quay availability both for installation (long-term planning) and also for maintenance (sometimes at short notice).

However, it is hoped that not all heavy maintenance campaigns will require turbines to be dismantled and towed inshore in the future, with two methods identified. The first method is for a crane to be included in the turbine nacelle to lift the component that requires repair directly from the floater. This is what can currently be seen with onshore turbines. The second method is self-elevating cranes to be used on site, with several examples already in development.

Lessons continue to be learned as the installation of new projects continues

Outside the North Sea but remaining in Europe, the 25-MW Provence Grand Large (PGL) project is the first floating wind farm to be installed in the Mediterranean Sea. Using tension-leg platforms, and as the first project in the deeper waters of the Mediterranean, it serves as a good example for proving the technical feasibility, and potentially also the economic viability, of floating wind in the region.

A few differences have been observed during the installation of PGL, compared to other completed floating wind farms. The Mediterranean's favorable sea and wind conditions, coupled with the wind farm's close proximity to the marshaling port (33.5 km), used as nacelle outfitting and towing base, enabled the towing of each wind turbine to be completed in under a day using a smaller marine spread.

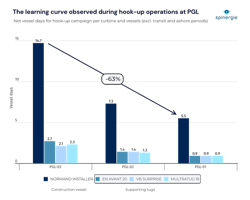

PGL debuted an anchor system not previously used in a commercial floating wind farm. Three suction anchors, which limit seabed disturbance, and three anchor lines had to be installed for each turbine. Tensioned mooring line technology ensures that the lines do not touch the ground, thus ensuring overall stability and the area's environmental protection. These anchor lines also minimize the spacing of the anchoring system and, thus, the space taken on the seabed. This is the first time such a system has been used for a floating wind farm. The installation took an average of 7.9 net days per turbine (excluding transit and ashore periods), with the first taking 11 days and the third taking 7.2 days, demonstrating a clear learning curve.

Compared with other floating wind farms, the hookup required smaller vessels and took longer. However, the construction vessel spent almost three times less time hooking up between the first and last operations. Several factors may explain the progressive improvement in time spent at each turbine. Because of the project's experimental nature, the first operation was carried out extremely carefully to ensure success. Additionally, the crew learns and improves as the process progresses, enabling performance gains to be observed.

Conclusions

Spinergie observes that while floating wind does face challenges, those are not insurmountable. As an emerging technology, the learning process is ongoing. With every wind farm reaching commissioning, the market learns more about what worked and what didn’t during installation. The learning curves continue during maintenance operations.

Moving forward, floating wind will rise in prominence as it is incorporated into the net zero projects of countries excluded from utilizing fixed technologies due to the water depths around their coasts. By embracing floating offshore wind, Greece, Italy and Spain will all see significant boosts to their net zero efforts. In the fledgling US market, the outcome of upcoming projects offshore California will also prove interest to the global market due to the unique combination of a market new to both offshore wind outright and floating wind.

For now, all eyes are on France’s recently awarded Pennavel (A05 Bretagne Sud auction); with a proposed reference tariff of €86.45/MWh (the second lowest among six bids), further optimizations will be needed to achieve proper economics. The market will also be closely watching South Korea, where large floating projects are expected to reach FID between now and next year. If achieved, this will clearly encourage the offshore floating wind market to finally pick up.

There is no disputing that floating wind will remain a complex and costly technology. However, as this technology matures, lessons are learned from each installation or maintenance campaign. These lessons and datapoints will help future developers, especially those in emerging countries, make the most efficient decisions for their projects.

About the Author

Jean-Baptiste Rougeot

Jean-Baptiste Rougeot is Spinergie's offshore energy analyst manager, a role he has served in since January 2021.

Prior to joining Spinergie, he served in various engineering roles with Subsea7 for more than 13 years.

Sarah McLean

Sarah McLean is a lead content writer with Spinergie. She joined the company in September 2022. She previously served as a senior rigs analyst with Esgian and IHS Markit.