Tax incentives are a catalyst for floating offshore wind decarbonization projects

Editor's note: This story first appeared in the 2023 Offshore Wind Special Report, which published within the September/October 2023 issue of Offshore magazine.

By Kenneth Fossoey, Odfjell Oceanwind

There are several measures that the UK government can take to realize decarbonization projects like floating wind, and Norway and the UK have looked to incentivize decarbonization projects through the tax system.

Norwegian tax package

The Norwegian petroleum tax system has been relatively predictable and symmetrical over the last decades with a 78% tax rate.

Following the COVID-19 outbreak, there was a major concern in Norway that E&P investment activity could be reduced by more than 50%. Oil prices fell to record lows and with a pessimistic outlook. The Norwegian government was quick to announce a new tax package to maintain the activity in the E&P sector and to stimulate new investments. These rules would be temporary and apply for projects sanctioned within a deadline of year-end 2022. Although the tax package also applied to decarbonization projects, there was no distinguishment between the two types of projects.

The tax package was considered a huge success where projects with a total investment size of ~25 billion EUR ($26.7 billion) were sanctioned. Although the tax package in principle also improved the economics for decarbonization projects, such as floating offshore wind, the benefits for E&P projects were far higher. All decarbonization projects were either postponed or stopped as capital, resources and supply chain were diverted to ensure that more profitable E&P projects would reach the deadline.

UK tax package

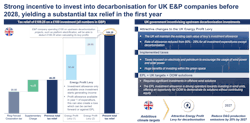

The UK has taken a quite different approach than Norway in terms of the tax system. First of all, while Norway introduced an incentive in the downturn, the UK introduced a windfall taxation measure as a consequence of the upturn from rising oil and gas prices. The headline tax rate was increased from 40% to 75% in the updated Energy Profits Levy (EPL) announced in November 2022. This brought the tax rate close to the Norwegian rate. Hence, it affected investments already done in comparison to the Norwegian tax package that only targeted future projects and represented quite a transfer of value from the E&P companies.

The UK government, though, put in place an attractive temporary investment incentive under the EPL where decarbonization projects have higher tax depreciation rates than E&P investments and with a 2028 time cap. Hence, this is a good way to use the tax system to accelerate decarbonization projects like floating offshore wind.

The incentive under the EPL is considered a highly effective tool to stimulate decarbonization. However, there are concerns that the fallout from the windfall taxation effectively blocks most of the potential investments that this incentive could have yielded.

Conclusion

The tax system could be an effective tool to achieve decarbonization. Odfjell Oceanwind believes the Norwegian approach with stimulating investments, without penalizing, is the right conceptual approach to drive decarbonization. The UK has found a good way to distinguish between decarbonization and E&P projects in the design of the incentive. However, the significant increases in tax rates may cause some uncertainty for long-term investors.

Based on Odfjell's first-hand experiences, there are four recommendations to ensure an effective tax system:

- Predictability: a key topic for investors in assets is long-term predictability on regulatory terms and headline tax rates;

- Differentiation: stronger incentives to invest in decarbonization projects than in E&P projects;

- Timing: early movers should be rewarded; and

- Energy security: incentives should be focused on initiatives that add energy production.

The Norwegian tax package yielded zero decarbonization projects with renewable production. It will be exciting to see how many projects the EPL incentive will yield.