Westwood shares insights on California's Pacific Wind leasing round

By Bahzad Ayoub, Westwood Global Energy Group

In December 2022 California held its first offshore wind leasing round – Pacific Wind. This was an exciting moment for the global floating as well as US and California wind industry – offering another opportunity to acquire acreage and to develop commercial scale floating wind projects in these nascent markets.

Although this was the third US lease auction to be held in 2022, additional considerations were required to be taken by bidders, including the development of a floating solution, the challenging permitting process and no binding commitment to purchase offshore wind from the state of California. The question was how much developers were willing to pay with these uncertainties in place.

Pacific Wind saw a total of five lease areas provisionally awarded to RWE Renewables, California North Floating LLC (a special purpose vehicle of Copenhagen Infrastructure Partners), Equinor, Central California Offshore Wind LLC (a 50:50 joint venture of Ocean Winds and Canada Pension Plan Investment Board) and Invenergy. According to the US Bureau of Ocean Energy Management (BOEM) the leases will provide for at least 4.6 GW of offshore wind capacity.

This is seen as another significant step for the US in its attempt to meet an offshore wind target of 30 GW by 2030 and 15 GW of floating offshore wind by 2035. Alongside this national target, in August 2022, the California Energy Commission voted to adopt a floating offshore wind target of 2 GW to 5 GW by 2030, and 25 GW by 2045 as part of the state’s broader push to decarbonize its electricity grid. This was an increase from the original 2045 target of 10 GW to 15 GW. The state of California requires floating offshore wind projects as the deep waters surrounding its coasts prevent the development of fixed bottom wind farms.

A record-breaking benchmark

The auction took place over two days and generated $757.1 million in revenue for the Office of Natural Resources Revenue (ONRR), a unit of the US Department of the Interior. A multiple factor bidding auction system was used, with the winning bidders being selected via a combination of a monetary bid and a non-monetary factor. Bidders who committed to a monetary contribution to programs or initiatives that support workforce training programs for the floating offshore wind industry, the development of a US domestic supply chain for the floating offshore wind energy industry, or both, received a 20% credit in the lease sale. Bidders could also enter into two types of community benefit agreements (CBAs) receiving a 5% credit for each CBA in the auction.

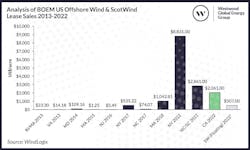

This was a record-breaking floating offshore wind auction round, both in terms of total revenue that was generated, as well as the average amount that was paid per acre. This was also the first uncapped, option fee auction for floating wind acreage to date, creating an interesting benchmark for future lease auctions.

Prices paid per acre varied between the five winning bidders. The highest price paid per acre was $2,490 and this came from RWE Renewables, whilst Equinor paid the lowest price per acre, which equated to $1,624. The average acreage of the Humboldt lease areas was 17% lower than Morro Bay, however, the average price paid for the two leases located in the Humboldt was almost 42% higher than the average prices paid for the three Morro Bay leases. According to the National Renewable Energy Laboratory (NREL) the Humboldt lease areas have higher average wind speeds, shallower average water depths and are located closer to the shore, broadly creating more favourable conditions both for the construction and operation of a wind farm, and so would support the premium paid for the Humboldt acreage.

Overall acreage went for an average price of $2,061, almost 30% lower than Carolina Long Bay and 76% lower than New York Bight. In comparison to the floating offshore wind lease areas awarded in the 2022 ScotWind round, the average price paid in the Pacific Wind Lease auction was $1,554 higher, however ScotWind was capped at GBP404.7 ($567) per acre.

Not quite New York Bight

Initial interest for the Pacific Wind lease round was high, with a total of 43 bidders being pre-qualified by BOEM to participate in the auction. But when compared to last year’s prices paid in the New York Bight lease round, Pacific Wind has come in significantly lower. Several factors are at play here.

New York Bight sites are in relatively shallow waters, allowing for the use of established and cheaper fixed-bottom turbines in comparison to floating wind turbines that will have to be used offshore California. The use of floating wind turbines will also mean that additional investments will be required to upgrade port infrastructure that will be used during the construction and operation phases of the wind farms.

Offshore wind purchase commitments from the states of New York and New Jersey also reduced the risk for developers bidding in the New York Bight auction – a commitment not made by California. At the time of the auction, New York and New Jersey had a combined offshore wind solicitation target of 16.5 GW by 2035. In comparison to this, California has yet to establish an offshore wind purchasing target.

The complex permitting process and lack of grid infrastructure in California are additional elements that developers would have had to consider in their bid calculations, as these two factors add more layers of difficulty and increased costs in the development of offshore wind projects in the state of California in comparison to other states. New York and New Jersey are essentially further ahead in their offshore wind journeys therefore these potential issues have been more greatly refined (although not fully solved either).

Finally, east coast states have benefited from the early mover advantage and work has already begun on the establishment of infrastructure developments and the creation of an offshore wind supply chain. Therefore, projects being developed across differing east coast states could share these supply chains and jointly take advantage of the infrastructure developments. The projects that will be built on the California lease sites will have to start with a blank page and the creation of a west coast offshore wind supply base will be a large undertaking.

This background partly explains why despite the initial high interest, the ultimate winners of the lease areas include companies that already have a foothold in the US market. This auction was for those who knew what they were doing or could manage these developments as part of a larger portfolio.

Confidence as winners increase capacities

Now the auction process is closed, confidence is running high. The winning bidders have already announced increased potential capacities for their lease areas. Equinor and Ocean Winds have announced their respective sites will have a total capacity of up to 2 GW and RWE has announced a potential capacity of up to 1.6 GW. Invenergy has also stated their site has a potential of capacity of over 1.5 GW, whilst Copenhagen Infrastructure Partners has announced a potential capacity of up to 1 GW at their lease site.

The projects developed at these lease sites could account for a total of 8.1 GW, should they meet the increased potential capacities that have been announced by the winning bidders. This shows that developers clearly believed they could get much more capacity out of each site, which in turn supported their bidding plans. This potential 8.1 GW would account for 32% of the state’s 2045 offshore wind target.

After champagne, what now?

The Pacific Wind lease sale is the starting gun that was required in California for the establishment of an offshore wind sector. However, the lease winners will have to drive down a long and winding road before their project’s come to fruition. The development of gigawatt plus commercial floating wind projects is unlikely to occur until the end of the decade in markets with an established fixed-bottom portfolio such as the UK. Therefore, it will be even more difficult in a country such as the US, which only has 45 MW of operational fixed-bottom capacity. The hard work has only just begun, with an in-tray including (but not limited to) the need to select the most effective floating solution, the creation of a whole new supply chain, upgrading port capacity, and working through permitting.

Nevertheless, the awarding of these lease sites is a positive first step for the offshore wind sector in both the state and the country. These projects will set the example for developing future floating wind projects both offshore California and potentially other states in the US.

About the author: Bahzad Ayoub is senior analyst of offshore wind with Westwood Global Energy Group.

02.02.2023