Offshore staff

ABERDEEN, UK – Westwood Global Energy Group says it has examined Asia-Pacific (APAC) offshore wind engineering, procurement, construction and installation (EPCI) spend over a ten-year period utilizing market intelligence from its WindLogix application.

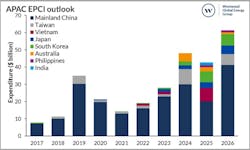

The results showed spending in the forecast period 2022-2026 at $199 billion, representing a 123% increase on the previous five years (2017-2021).

Over the past five years, EPCI spend has been dominated by mainland China with 90% market share. From 2022-2026, Westwood expects increased spending from Japan, South Korea, and Australia, in line with the offshore wind targets that Japan and South Korea have set for 2030.

Mainland China’s steady increase in offshore wind power has been largely driven by a rapidly evolving policy landscape. In May 2019, the National Development and Reform Commission (NDRC) released a new policy for the phase out in national subsidies for both onshore and offshore wind.

For offshore wind, this regulation means that projects already approved by 2018 will continue to receive the Feed-in-Tariff (FiT) if they are fully grid-connected before the end of 2021. Projects approved in 2019 and 2020 will receive a reduced tariff.

From Jan. 1, 2022, the subsidy for offshore wind from the central government was completely terminated and projects are to be built on grid parity prices based on the regulated price for coal plants, varying by province and region, if no support is available from the provincial government. This resulted in the dramatic rush to install capacity in 2021, and consequently a spike in EPCI expenditure sanctioned in 2019.

Despite the huge 2021 buildout in offshore wind construction, mainland China continues its unabated development of wind farms. Mainland China has a pipeline of 82GW from now until 2030 and has a $130 billion EPCI expenditure outlook between 2022 and 2026, according to Westwood.

Westwood says that another key policy that is greatly influential is China’s carbon neutrality goal. In September 2020, President Xi Jinping announced that mainland China will “aim to have CO2 emissions peak before 2030 and achieve carbon neutrality before 2060.” Mainland China also hopes to achieve a combined 1,200GW of solar and wind capacity by 2030. The centralized carbon neutrality targets and policies that support the renewables power implementation will be the most important driver to motivate offshore wind investment in China going forward.

With guidance from the central government, mainland China provinces have set ambitious targets for offshore wind and contribution to the overall net zero ambition. Guangdong has set the most ambitious target of 18GW for their 14th Five Year Plan. This is followed by Jiangsu with 15GW and Fujian with 6GW. These provinces are very much on target with the majority of their projects in EPCI mode and a significant proportion are already operational. It is worth noting that provincial policies have been slow to replace the expired central government subsidy; only Guangdong, Shandong and Zhejiang have some form of policy help towards offshore wind development. Among them, Guangdong was the first to formulate very comprehensive subsidies which target projects that were approved in 2018 and online between 2022 and 2024.

As a result of withdrawn national subsidies and more limited provincial support, mainland China wind developers receive less for the amount of wind power they produce. They face wind farm component costs that eat into their margins, and the supply chain has responded to this challenge, resulting in a concerted effort to keep costs low. Recent turbine bid prices have dropped by an average 37.4% from 2019-2021 levels and some of these bid prices are for re-tenders of turbine contracts already fixed previously.

Outside mainland China, Taiwan is one of the most promising offshore wind markets. Taiwan launched its Round 3 auction Phase 1, where an associated 3GW capacity will come online in 2026/27. A total of 15GW will be made operational for the period 2026-2035.

As a result of the COVID-19 pandemic as well as being a new market to offshore wind, Taiwan has faced construction delays. The most recent example is the three-year delay for the Yunlin wind farm where Sapura Energy terminated a contract with Yunneng Wind Power, a WPD company, for the transportation and installation of monopiles. The contract has since been replaced by NPCC, which is entering the Taiwanese market for the first time. Local content rules were issued during the Round 3 auction Phase 1, where it will reach 60% for certain component categories. It remains to be seen if Taiwan can achieve its capacity target on time and within the constraints of its stringent local content policy.

Nevertheless, for both Taiwan and Vietnam, their EPCI expenditure is expected to increase 130% and 199% respectively for the 2022-2026 period, compared to the previous five years, Westwood says. Vietnam has been largely dominated by intertidal projects and there has been a series of large-scale offshore projects proposed by international developers such as CIP and partners’ La Gan project and Enterprize Energy’s Ke Ga project. Replacing coal-fired generation, offshore wind power is poised to become a key pillar of Vietnam’s energy transition. According to the latest version of the Power Development Planning PDP8 draft, offshore wind power has a target of 7GW by 2030.

While mainland China is expected to continue to dominate the market, the ambition of the APAC offshore wind industry is clearly growing and the breadth of countries contributing to this pipeline broadening by the day, Westwood says. Emerging markets such as Japan, South Korea, Australia and the Philippines are currently assessing, auctioning and allocating capacity.

05.11.2022