Offshore staff

LONDON – Various E&P companies have announced plans to reduce emissions from their operations and to mitigate climate-related business risks.

Some oilfield services (OFS) companies are also starting to set carbon-reduction targets, according to Westwood Global Energy Group.

Among Tier-1 OFS firms Schlumberger is targeting an interim 30% reduction in emissions by 2025, according to Peter Heath, consulting manager at Westwood. And the company is also supporting the Task Force On Climate-Related Financial Disclosures.

Baker Hughes is aiming for net zero by 2050. However, Halliburton and Weatherford are yet to publish specific Scope 1 and Scope 2 targets, which respectively cover direct emissions from operations and indirect emissions from purchased energy.

To date, Tier-1 OFS specialists have not embraced Scope 3 emissions (supply chain and customer emissions), as these are typically more difficult to influence and measure, Heath added.

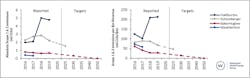

Most of the largest IOCs provide comprehensive emissions reporting, he continued, and among the OFS set, Halliburton, Baker Hughes and Schlumberger have all published annual emissions.

Weatherford has been less transparent, only publishing Scope 1 and Scope 2 to 2017 via a 2018 Carbon Disclosure Project report. At the same time, the company had the lowest absolute emissions of the Tier-1 OFS group in 2016 and 2017.

Baker Hughes Scope 1 and Scope 2 emissions per million dollars of revenue over the period 2016-2019 declined by 55%, (its revenue grew by 82% over the same period), while absolute emissions fell by around 15%.

This clearly shows a trend toward lower emissions intensity in operations, Heath said, driven by expansion of low-carbon technology solutions, including gas turbines and flare monitoring, designed to use less materials and which can be deployed faster than conventional technologies.

Schlumberger’s 2019 emissions fell by around 22%, although the reasons for this improvement are not apparent.

Halliburton’s Scope 1 and Scope 2 emissions between 2017 and 2018 rose by 140%, but this was largely due to reporting changes, with figures from 2018 onwards covering more of the company’s facilities, and emissions from heavy equipment.

Many smaller OFS players are not reporting any metrics, Heath added.

11/23/2020