OTC 2024: BP executive says Gulf of Mexico will remain key E&P region

Bruce Beaubouef * Managing Editor

HOUSTON – Oil and gas production from the deepwater Gulf of Mexico will remain a key component of BP’s overall energy portfolio, even as it invests in the energy transition, according to Andy Krieger, Senior Vice President—Gulf of Mexico and Canada for BP.

Krieger provided a detailed update on BP’s E&P efforts in the Gulf in a presentation entitled “A Focus on the Gulf of Mexico,” offered Tuesday morning at OTC 2024 in Houston.

“We’re going to invest in today’s oil and gas systems, and we will pragmatically invest in the energy transition. But we’re going to do so as a simpler, more focused, and a higher value company.” Krieger said that a key goal will be to move toward the production of 400,000 barrels per day of oil equivalent, “and the Gulf of Mexico will be at the front and center” of this strategy, he said.

“We are one of the region’s largest oil producers, and we will continue investment and exploration around five operated hubs: Atlantis, Mad Dog, Na Kika, Thunder Horse and Argos.”

“The Paleogene will drive the growth agenda in the Gulf of Mexico with new hub developments” and he noted that BP has significant discovered reserves in this play with its Kaskida, Tiber, and Guadalupe discoveries.

Krieger noted that its Argos platform began operations last year, “and this facility will strengthen our position for years to come.” The Argos semisubmersible floating production platform is the key component of the company’s recently commissioned $9-billion Mad Dog 2 project. “It’s one of our most advanced facilities deploying some of the latest technology.”

A key part of BP’s strategy in the Gulf will be to “maximize value around existing hubs,” and this will be achieved through a variety of new subsurface analytical techniques, well cost reduction measures, and enhanced recovery technologies.

“New seismic data reprocessing techniques have allowed us to build the right well, at the right time, in the right place.” Krieger noted that with 4D seismic technology, engineers can now see changes in both pressure and water movement through the course of time, and this type of analysis is “fundamental to improving capital efficiency. We can now produce injectors where they're needed, and better pinpoint the location of producers.”

He also noted that by working with its suppliers, BP has been able to improve its light well intervention capability to enhance well production, while at the same time achieving a 50% reduction in intervention costs in many cases.

“Another key is accessing all the reserves that we potentially can access,” and here BP is using horizontal well technology and may employ multilateral technology in the future. Also important is the use of the latest well completion designs – not only the traditional open gravel packs but also “potentially standalone screens in the future.” And BP is also using the latest facilities technology, such as low salinity water injection and subsea pumping. The company’s propriety LoSal enhanced oil recovery – a low salinity water injection system – will be deployed on the Argos platform, inaugurating its first use in the Gulf of Mexico.

Another key component of maximizing value around existing hubs will be infrastructure-led exploration, an approach which will enable new fields to be brought in through “fast-paced tiebacks” to existing production platforms. These types of reserves can be “brought online in a very timely manner with incredibly high rates of return,” he observed.

Krieger then returned to the topic of E&P in the Paleogene, “which will lead our growth through the end of the decade with new field developments.” He noted that BP currently has more than nine billion barrels of discovered resource in place in the Paleogene across five discoveries, with a potential to deliver 150,000 barrels per day by the early 2030s. “That’s nine billion barrels of discovered resource in place, it's already been penetrated, and doesn’t require further exploration.”

BP’s Kaskida and Tiber prospects, both undergoing studies and conceptual design reviews, are the most important near-term Gulf of Mexico field development projects that feature Paleogene reserves. And for these high-pressure, high-temperature fields, the successful development of 20k technology has been crucial, including improved hoisting capacity on drilling rigs, improved BOPs and well control technologies, and high-pressure subsea trees. All of this, and the use of ocean-bottom node seismic data, “gave us further confidence to proceed with these projects.” An FID is expected on Kaskida this year, and an FID is expected on Tiber in 2025.

The development of 20k technology “has been an interesting process to watch,” Krieger observed. “There has been a natural progression.” He noted that BP had achieved the 15k metric with its Thunder Horse facility in 2008, “and now the industry has achieved 20k, a natural progression and a demonstration of the innovation and the drive that our industry has.”

Krieger also noted that completion technology will be vital to successful Paleogene developments. With the use of multi-stage fracturing systems, “we have the ability to get initial production rates and individual well recoveries as high as those we have seen in the Miocene.”

With regard to FPUs and topsides technologies, Krieger noted that BP will likely follow the “design one, build many” model that other operators have advanced in recent years. “Topsides have typically been an expensive part of the field development,” Krieger said. But now, “bespoke topsides are a thing of the past. Going forward, FPUs will be smaller, simpler, and require fewer people.”

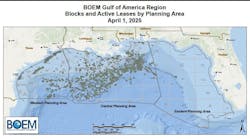

Krieger also noted BP’s “robust leasing strategy” in the Gulf of Mexico, stating that the company had more than 275 leases in the Gulf. And over the last 18 months, it has extended its lease position in the Paleogene. “We have a tremendous amount of running room” in the Gulf, Krieger observed. “The Gulf of Mexico will remain an enduring basin for BP, and we’re just getting started.”

05.07.2024