Gulf of Mexico deepwater discoveries tick up slightly

Operators announced five new discoveries in the deepwater Gulf of Mexico over the past twelve months, representing an increase over the three deepwater discoveries reported in 2020. As oil prices improved and the effects of the pandemic lessened, Gulf operators revved up their activity in deepwater drilling programs that had been placed on hold.

But, given the constraints that still lingered, operators tended to focus on development and appraisal drilling around existing infrastructure rather than explore in new areas. Most of the new discoveries came from near-field exploration around existing deepwater production hubs, a strategy that seems likely to continue in the new year. The five discoveries announced over the past twelve months are detailed below.

One of the key finds was the Puma West prospect in Green Canyon block 821, announced by bp last April. The well was drilled by bp on behalf of co-owners Chevron U.S.A. Inc. and Talos Energy. It is located west of the bp-operated Mad Dog field and is about 131 mi (211 km) off the coast of Louisiana in 4,108 ft (1,252 m) of water. The well was drilled to a total depth of 23,530 ft (7,172 m).

The well encountered oil pay in a high-quality Miocene reservoir with fluid properties similar to productive Miocene reservoirs in the area. Preliminary data supports the potential for a commercial volume of hydrocarbons, the company said.

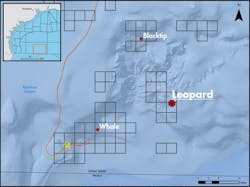

Another key discovery was made by Shell last May, when it announced that it had discovered oil at its Leopard prospect in Alaminos Canyon block 691. The Leopard well encountered more than 600 ft (183 m) net oil pay at multiple levels. Evaluation is ongoing to further define development options, the company said. Leopard is operated by Shell (50%) and co-owned by Chevron U.S.A. Inc. (50%). Transocean’s ultra-deepwater drillship Deepwater Thalassa drilled the discovery well in 6,800 ft (2,070 m) of water, Shell confirmed in an email to Offshore. Paul Goodfellow, Shell’s Deepwater Executive Vice President, said: “Leopard expands our leading position in the Gulf of Mexico and is an exciting addition to our core portfolio, especially given its proximity to existing infrastructure and other discoveries in the Perdido Corridor.”

Shell says that Leopard is an opportunity to increase production in the Perdido Corridor, where its Great White, Silvertip, and Tobago fields are already producing. Leopard is about 20 mi (32 km) east of the Whale discovery, 20 mi (32 km) south of the recently appraised Blacktip discovery, and 33 mi (53 km) from the Perdido host. Shell sanctioned the Whale deepwater development, also in the Perdido Corridor, last year.

Shell’s second major discovery in the Gulf last year was announced in December, when the company reported that it had made an oil discovery at the Blacktip North prospect in Alaminos Canyon block 336. The Blacktip North well encountered about 300 ft (91 m) net oil pay at multiple levels. Evaluation is ongoing to further define development options.

The Transocean ultra-deepwater drillship Deepwater Poseidon drilled the well, Shell confirmed in an email to Offshore. It was drilled to a total measured depth of 27,770 ft (8,443 m).

Blacktip North is operated by Shell Offshore Inc. (89.49%) and co-owned by Repsol E&P USA LLC (10.51%).

The Blacktip North discovery is ~220 mi (354 km) south-southeast of Houston. It is about 4.5 mi (7.2 km) northeast of the recently appraised Blacktip discovery, 25 mi (40 km) northeast of the Leopard discovery, 30 mi (48 km) northeast of the planned Whale host, and 42 mi (68 km) from the Perdido host. The Blacktip, Blacktip North, and Leopard discoveries are in the Perdido Corridor, where Shell’s Great White, Silvertip, and Tobago fields are already producing.

Shell’s Goodfellow said that: “the Blacktip North prospect is the latest example of discovering new resources in our advantaged corridors. Our strategic positions, like the Perdido Corridor, are at the heart of value creation in the Gulf of Mexico, and they represent an opportunity to use our existing infrastructure to unlock the full-value potential of our discoveries.”

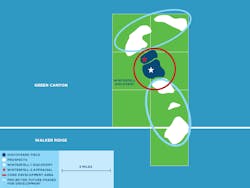

Elsewhere, Beacon Offshore Energy and Kosmos Energy reported two new deepwater well results in January, both relating to their Winterfell prospect in the Green Canyon area. Kosmos first reported that Beacon had made an oil discovery at the Winterfell prospect in Green Canyon block 944. According to Kosmos, Winterfell was designed to test a subsalt Upper Miocene prospect. The well encountered about 26 m (85 ft) of net oil pay in two intervals. The Winterfell well is in about 1,600 m (5,300 ft) of water and was drilled to a total depth of approximately 7,000 m (23,000 ft).

An affiliate of Beacon Offshore Energy LLC is the operator of the Winterfell well. Additional interest owners include Red Willow Offshore LLC, Ridgewood Monarch North LLC, CSL Exploration, LP, CL&F Offshore LLC, Houston Energy, L.P., Beacon Offshore Energy Exploration LLC, and Beacon Asset Holdings LLC.

Kosmos said it will now work with the partners on an appraisal plan and development options. The discovery is located within tieback distance to several existing and planned host facilities.

Quickly following the Winterfell announcement, Kosmos reported that Beacon had also completed drilling the Winterfell-2 appraisal well in Green Canyon block 943. The Winterfell-2 well was drilled to evaluate the adjacent fault block to the northwest of the original Winterfell discovery. It was designed to test two horizons that were oil bearing in the Winterfell-1 well, with an exploration tail into a deeper horizon.

The well discovered about 40 m (~120 ft) of net oil pay in the first and second horizons with better oil saturation and porosity than pre-drill expectations. The exploration tail has discovered an additional oil-bearing horizon in a deeper reservoir which is also prospective in the blocks immediately to the north. The results of this appraisal well further define the resource potential in the central Winterfell area, with the current estimate around 100 MMbbl gross, Kosmos said.

The Winterfell-2 well was drilled in about 1,600 m (~5,800 ft) of water and to a total depth of approximately 8,700 m (~28,500 ft). An affiliate of Beacon Offshore Energy LLC is operator of the Winterfell-2 well. Additional interest owners include Red Willow Offshore LLC, Ridgewood Monarch North LLC, CSL Exploration, LP, CL&F Offshore LLC, Houston Energy, L.P., Beacon Offshore Energy Exploration LLC, and Beacon Asset Holdings LLC.

Andrew G. Inglis, Kosmos Energy’s chairman and CEO, said: “The positive result from Winterfell-2 appraisal well demonstrates the greater potential in the Winterfell area. The well results are encouraging and provide the support needed to advance a low-cost, lower-carbon development scheme that could be brought online in around two years.”

In addition, Kosmos has farmed down an interest in the two blocks immediately to the north of the Winterfell discovery to the owners of the central Winterfell discovery in exchange for cash consideration and the retention of an overriding royalty interest. The company said this aligns the partnership and provides the ability to further scale the development with low-risk follow-on drilling. Kosmos will retain a 35% working interest in the two blocks. The Winterfell complex is located within tieback distance to several existing and planned host facilities, and the partnership is working to define the development plan.

Kosmos Energy has also said that it plans to drill the Zora infrastructure-led exploration well in the Gulf of Mexico later in the year.

Looking forward

More deepwater drilling could result from a number of project sanctions that are expected for the US Gulf of Mexico this year, if oil prices hold up. These include Chevron’s Ballymore, a field in the emerging Norphlet geologic play off East Louisiana/Mississippi; and Shell’s Rydberg field, also in the Norphlet, which is also being watched for a potential 2022 final investment decision. Two other projects that could get sanctioned this year include TotalEnergies’ North Platte field, an ultradeep play first discovered in 2012; and LLOG’s Leon/Castile fields, although some analysts expect that the FID for this one could slip into next year. In addition, Shell’s Blacktip field and Blacktip North field could be moved up in the development queue to this year, analysts have said.

Meanwhile, three large field development projects are scheduled to be placed online this year. They include Shell’s Vito field; bp’s Mad Dog Phase 2; and three fields operated by Murphy Oil: Khaleesi, Mormont and Samurai. The three Murphy fields will produce into a King’s Quay production hub. Khaleesi and Mormont will deliver first oil in the first half of this year, and Samurai in the second half of 2022. The hubs can be later used to accommodate future production from yet undiscovered fields located within a roughly 30-mile radius.

Besides the larger projects, a few smaller fields are expected to debut in 2022, all tiebacks or hook-ups to existing infrastructure. Two from privately held Gulf player LLOG Exploration are Taggart, which will tie into the Devil’s Tower, and Spruance, which will hook up to the Lobster facility. In addition, Shell’s Power Nap field is expected to be tied into the company’s Olympus platform sometime this year.

For more info visit the status of US Gulf of Mexico deepwater discoveries survey.