Semisubmersibles setting the standard in the Gulf of Mexico

A new generation of floating production platform is being built and designed for the deepwater Gulf of Mexico. Responding to the needs of a market that has seen two oil price collapses in the past six years, deepwater operators are choosing to deploy a semisubmersible production facility design that is smaller, lighter in weight, with more standardized features than in years past.

The semisubmersible design has become increasingly popular as the industry has moved out farther into deeper waters, since it is the most adaptable to water depth and topsides payload; facilitates topsides integration quayside; and can be competitively contracted.

Since 2014, seven deepwater projects have been sanctioned in the US Gulf of Mexico: Appomattox (Shell), Mad Dog 2 (bp), Vito (Shell), King's Quay (Murphy), Anchor (Chevron), Whale (Shell), and Shenandoah (Beacon Offshore). All of these will be semisubmersible platforms. Two of them, the Argos FPS (for Mad Dog 2) and the King’s Quay FPS, have entered the Gulf this year.

Semisubmersible platform design has become progressively smaller and leaner over the past seven years. Displacements of Appomattox, Argos, Vito, King's Quay, and Anchor are 125,000 mt, 101,000 mt, 38,000 mt, 38,000 mt, and 69,000 mt, respectively. These platforms have become progressively leaner in response to a drive to accelerate cycle times to first production and reduce project breakeven costs.

The Argos FPU arrived in the Gulf in April and is now at the Kiewit Offshore Services fabrication yard in Ingleside, Texas, for final preparatory work and regulatory inspections. Following this work, Argos will be towed out and installed about 6 mi (10 km) from the original Mad Dog spar, about 190 mi (306 km) south of New Orleans. The platform, which weighs about 60,000 tons, will operate in about 4,500 ft (1,372 m) of water. At peak, the facility is expected to produce up to 140,000 boe/d through a subsea production system from 14 production wells. Start-up is planned for 2Q 2022.

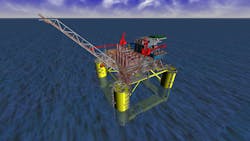

The King’s Quay semisubmersible FPS arrived into the Gulf in September, and it is also at the Ingleside yard for final preparatory work and inspections. The 21,498-metric ton (23,697-ton) King’s Quay FPS is designed to process 80,000 b/d of oil and 100 MMcf/d of gas. It will handle production from the Khaleesi/Mormont and Samurai fields in the deepwater Gulf. First oil is expected in the first half of 2022. The project is being executed by Murphy Exploration and Production. Owners of the semisubmersible facility include entities managed by Ridgewood Energy Corp., ILX III Holdings, LLC and Third Coast Super Holdings, LLC. The facility will be operated by Murphy.

Chevron’s Anchor field development project will also feature a lean-designed semisubmersible facility. Wood has been selected to deliver a detailed engineering design for the topsides and subsea system, while KBR has been awarded the FEED contract for the hull. South Korea’s Daewoo Shipbuilding & Marine Engineering will construct and fabricate the hull, while Kiewit will build the topsides. The semisubmersible platform is expected to have a production capacity of 75,000 b/d of oil and 28 MMcf/d of gas, with the potential for future expansion.

Meanwhile, Shell is in the process of deploying two standardized, lean-designed semisubmersible platforms to the deepwater Gulf.

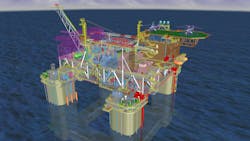

Shell issued the FID on its Vito project in April 2018, setting in motion the construction and fabrication of what it called “a new, simplified host design.” This new design, along with a streamlined subsea infrastructure, would give the project a breakeven price of less than $35/bbl. Located in the Mississippi Canyon area, the Vito development will consist of a semisubmersible host facility and eight subsea wells in approximately 4,000 ft of water. The Vito host platform will be a four-column semisubmersible floating production unit weighing 39,000 tons, with a topsides weighing 9,200 tons. Shell selected Sembcorp Marine to build the hull and topsides and provide integration services at its Tuas Boulevard Yard in Singapore.

More recently, Shell issued the FID on its deepwater Whale field in Alaminos Canyon block 773. Like Vito, the Whale production facility will have what Shell describes as a “simplified, cost-efficient host design.” The platform will include a topsides module and a four-column semisubmersible floating hull with a combined weight of 25,000 metric tons.

Shell says that the Whale platform features a 99% replicated hull and an 80% replication of the topsides from its Vito platform. By leveraging the engineering, construction, and supply chain of Vito, Whale is expected to achieve first oil 7.5 years after discovery, the company said. Sembcorp was again selected to build and integrate the topsides and hull, and this work will also take place at the Tuas Boulevard Yard, thus taking advantage of synergies from Vito’s supply chain and construction processes.

The Whale FPU will be adjacent to the Shell-operated Silvertip field, about 10 mi (16 km) from the company’s Perdido platform, and approximately 200 mi (322 km) southwest of Houston. It will operate in more than 8,600 ft (2,621 m) of water with 15 oil producing wells.

Vito is scheduled to begin production in 2022, while Whale is slated for first oil in 2024.

Adding to this list is the recently sanctioned Shenandoah project, a high-pressure, high-temperature development that will also feature a semisubmersible host facility. The Shenandoah field is 160 mi (257 km) offshore Louisiana in Walker Ridge blocks 51, 52, and 53, and is being developed by Beacon Offshore and ShenHai, a subsidiary of Israel’s Navitas Petroleum.

Beacon has signed a contract with South Korea’s Hyundai Heavy Industries (HHI) for the design, procurement, construction, and delivery of a semisubmersible floating production system. Navitas has indicated that the semisubmersible will be 299 ft (91 m) long, 299 ft wide, and 295 ft (90 m) high, and capable of producing 100,000 b/d. HHI says that it will spend the first year on engineering, and that construction will start in 3Q 2022. According to Navitas, the Shenandoah semisubmersible will be similar to the King’s Quay facility, which was also built by HHI. Work on the floating facility is scheduled to be complete by the end of September 2024, with installation in the field expected to take place in 4Q 2024.

In the deepwater Gulf of Mexico, the trend toward smaller and simpler floating production systems will almost certainly continue. Even as oil prices have rebounded, operators will continue to look for ways to lower capital costs, accelerate cycle times to first production, and increase cost and schedule predictability. In the Gulf of Mexico, about 80% of discoveries can be developed with a floating production system that can process about 80,000 boe/d.

The industry will also embrace standardized developments that will include platforms strategically sited to provide efficient host locations for multiple field developments. A standardized FPS is repeatable with design adjustments for reservoir and site-specific conditions.

And in the deepwater Gulf of Mexico, the semisubmersible platform design will continue to be preferred due to its better stability in harsh environments, greater range of water depth, payload capacity, and quayside integration capabilities.

Editor’s note: See the accompanying video, “Semisubmersibles setting the standard in the Gulf of Mexico,” at https:www.offshore-mag.com/videos.