Biden administration suspends federal oil and gas leasing

Offshore staff

WASHINGTON, D.C. – President Joe Biden has signed an executive order that directs the Department of Interior (DOI) to pause new oil and natural gas leasing on federal public lands and offshore waters, concurrent with a review of the federal oil and gas program.

The targeted pause does not impact existing operations or permits for valid, existing leases, which are continuing to be reviewed and approved, according to the DOI.

Industry associations were quick to respond and warn that the moratorium on oil and gas leasing would undermine environmental progress, cost American jobs, and shift the US to greater reliance on foreign energy, among other things.

National Ocean Industries Association President Erik Milito issued the following statement:

“This decision is contrary to law and puts America on a path toward increased imports from foreign nations that have been characterized as pollution havens. Any pause of American energy opportunities will do untold harm towards American economic, energy, and environmental progress. Reducing American offshore oil and gas development means lost jobs, increased greenhouse gas emissions, and less funding for outdoor parks and recreation activities for urban, underprivileged communities. There is no shortage of negative consequences from this leasing pause.

“The Gulf of Mexico is an American strategic asset, driving hundreds of thousands of jobs and billions of dollars of investment across every US state. Billions of dollars are generated for federal, state, and local governments. The Land & Water Conservation Fund, and the host of climate-mitigating and environmental justice programs it provides for, receives virtually its entire funding from offshore oil and gas revenues, including new lease bids. This decision could also hamper long-term energy affordability. As Americans continue to rely upon all sources of energy for maintaining a high standard of living, reduced supplies can put upward pressure on prices.

“While the executive order is framed as a step towards a climate solution, it pauses energy opportunities in a region that is already addressing climate and emissions goals. Gulf of Mexico production has a carbon intensity one half of other producing regions and the deepwater has the lowest greenhouse gas emissions of any source of oil and gas production. The innovators that define America’s offshore energy industry are already contributing to the continued advancement of climate change solutions.

“The Department of the Interior has a legal obligation to expeditiously develop America’s energy resources. Instead of fulfilling this obligation and capitalizing on an American environmental and emissions success story, this decision delivers an opportunity to China and Russia. As China and Russia seize jobs and investment, their energy, which is produced without the same level of regulations and standards as the US, could very well win permanent geopolitical importance to the detriment of the climate and the environment.”

American Petroleum Institute President and CEO Mike Sommers said: “We share President Biden’s goal for addressing climate change, marked by US innovation and powered by American energy and skilled union workers. Unfortunately, today’s executive action to halt leasing is a step backwards both for our nation’s economic recovery and environmental progress, threatening to cost thousands of jobs and much-needed revenue while increasing emissions by slowing the transition to cleaner fuels.

“With a stroke of a pen, the administration is shifting America’s bright energy future into reverse and setting us on a path toward greater reliance on foreign energy produced with lower environmental standards.

“Limiting domestic energy production is nothing more than an ‘import more oil’ policy that runs counter to our shared goal of emissions reductions and will make it harder for local communities to recover from the pandemic.”

Rystad Energy issued an update on how banning new federal leases changes the US upstream landscape.

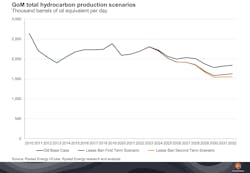

Should the leasing ban last for two presidential terms, Rystad Energy expects the constraining effect on oil production from the US Gulf of Mexico to gradually reach 200,000 b/d by 2030, or around 250,000 boe/d.

In the case the ban lasts for only one presidential term, the above effect would be 175,000 b/d by 2030 or about 200,000 boe/d.

Should a ban be extended in the possibility of a second Biden term, the barrels at risk begin to pile up and the effect becomes more long term.

Jarand Rystad, CEO at Rystad Energy, said “This ban will not influence short-term oil prices or even economics of oil E&Ps in the US, but it will be very dramatic for suppliers such as seismic companies, rigs and other exploration-driven oil service segments.

“The exploration departments within oil companies exposed to the GoM, like Equinor, may have to re-evaluate strategies and we could see exploration focus shifting to other ‘friendlier’ regions that are upcoming.

“Nations rich in fossil fuel resources that were competing with the US to attract investments may benefit.

“Last but not least, such a groundbreaking policy change by the US, a world leader country, could have a ‘contamination’ effect to other countries’ exploration agenda. It remains to be seen if there will be chain-reaction policy changes elsewhere in the world.”

According to Audun Martinsen, Head of Energy Service Research, the US offshore makes up about 8% of the global offshore services market at around $15 billion.

Martinsen said: “Around half of the US offshore services market is brownfield and decommissioning. Companies that count on investments into EOR and intervention will not be very affected by the lease ban. The other half is greenfield developments and exploration, where we are likely then to see a decline in investment if a ban stays. But the impact will vary throughout the years.

“Seismic service providers and offshore drillers will be the most hit, but the ban will also affect others.

“Many of the suppliers in the US GoM are exposed to land or international offshore as well, so a ban will not be too dramatic in the short term, but some US-focused firms will be challenged. However, they have some time to change strategy before this ban really impacts them fully.

“Some of the suppliers (vessel companies and yards) are likely to be ‘compensated’ by a stronger push for offshore wind projects in the US.”

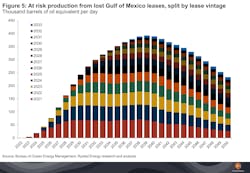

Artem Abramov, Head of Shale Research, added: “If the lease ban gets expended to a permanent drilling ban, we will see a natural decline in the GoM as soon as operators work through the existing inventory.

“This varies from operator to operator. For example, Shell and Murphy already permitted their development programs for the next two-three years. Others have a one-year lifetime of permits.

“Then, basically from 2023, GoM oil production will enter into the decline phase 10-15% per year if permitting is banned today. Then there won’t be much oil coming from the basin in the early 2030s.”

01/27/2021