Norwegian directorate calls for increased frontier drilling, production boosting technologies

Offshore staff

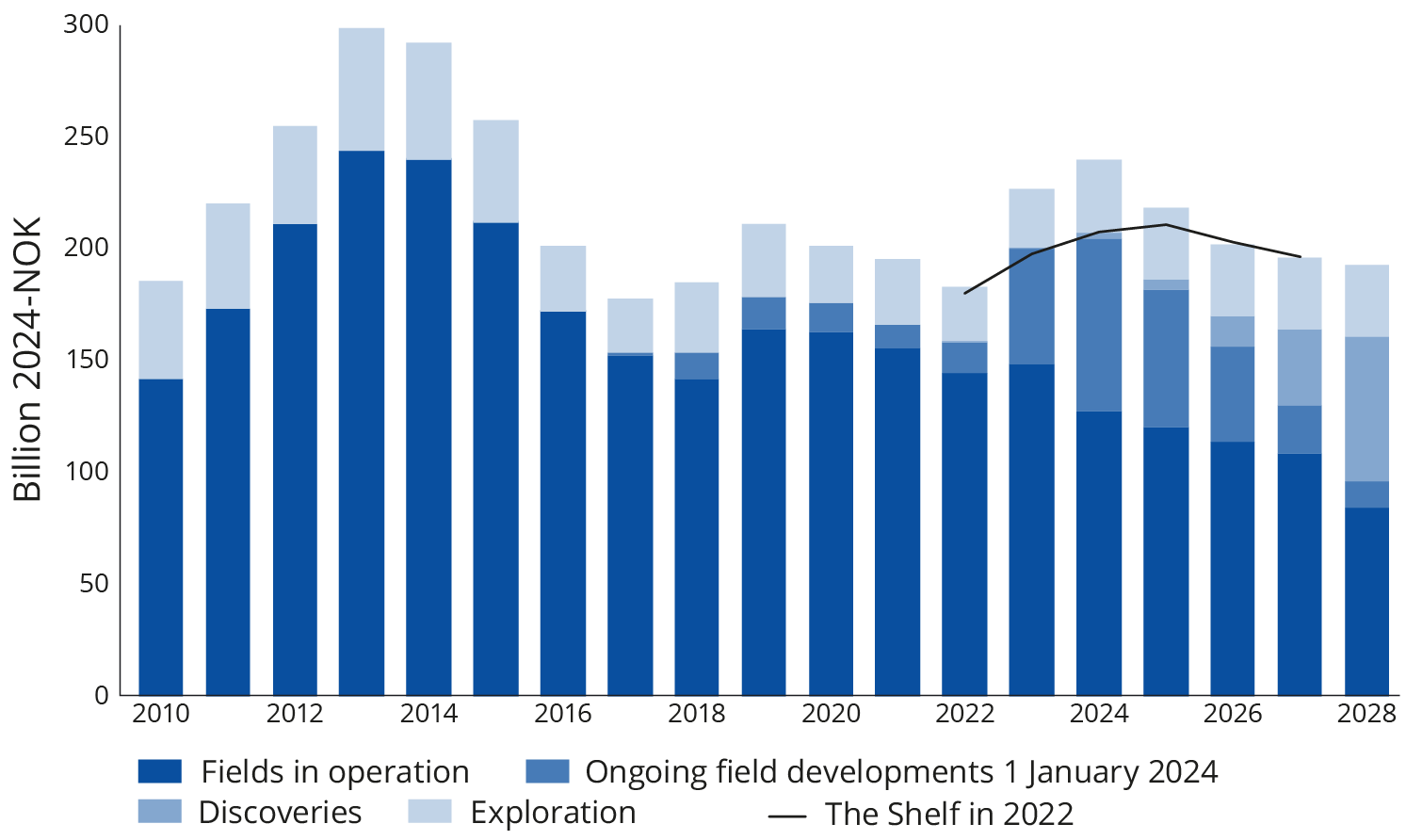

OSLO, Norway — The Norwegian Offshore Directorate (formerly the Norwegian Petroleum Directorate) foresees a relatively large increase in investments across the Norwegian Continental Shelf this year.

This is due to a combination of high activity levels in the industry, a weaker Norwegian currency and cost inflation. Operators of certain oil and gas projects have accelerated investments and several fields have gained approval for extended lifetimes, necessitating spending on upgrades.

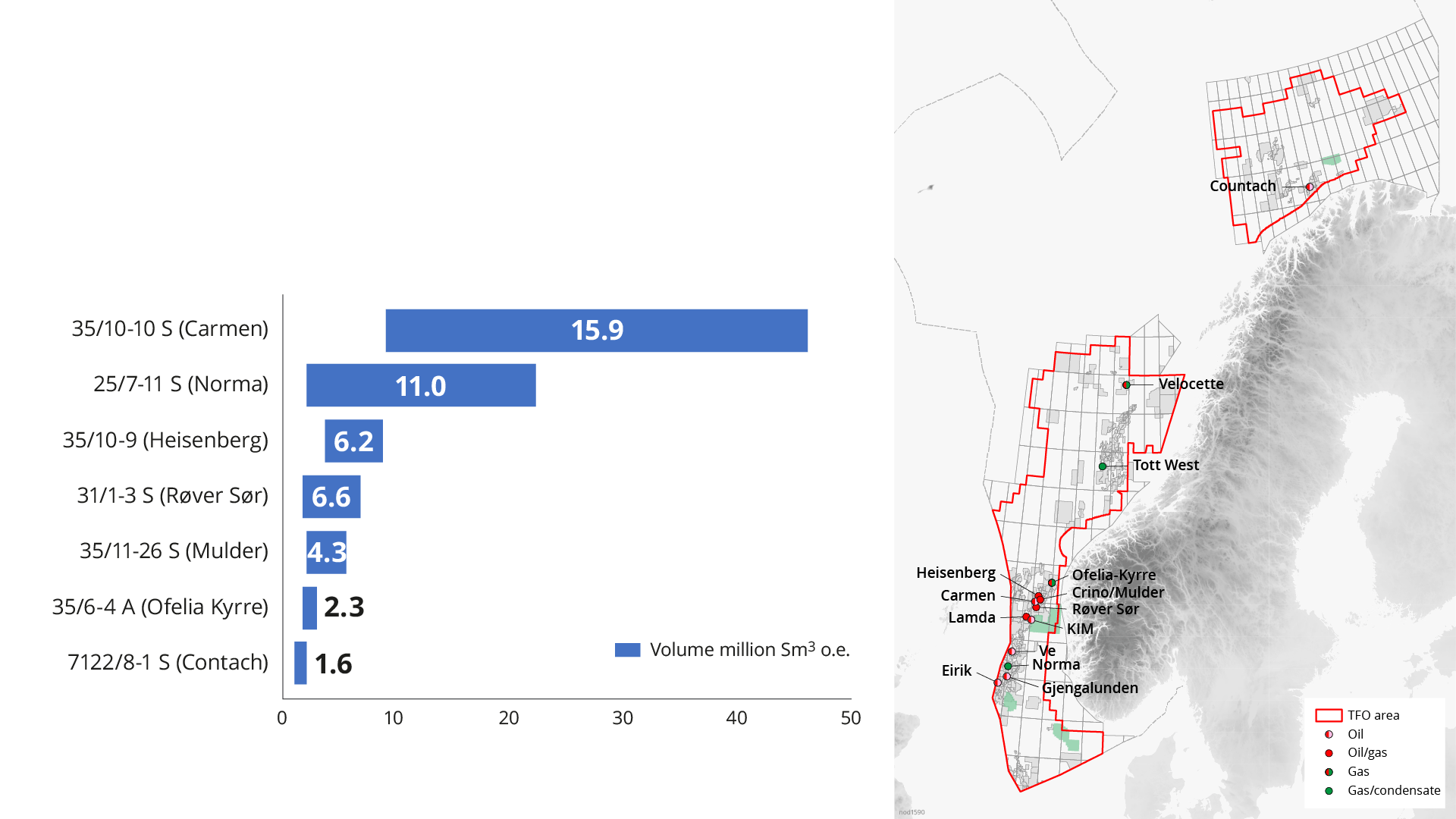

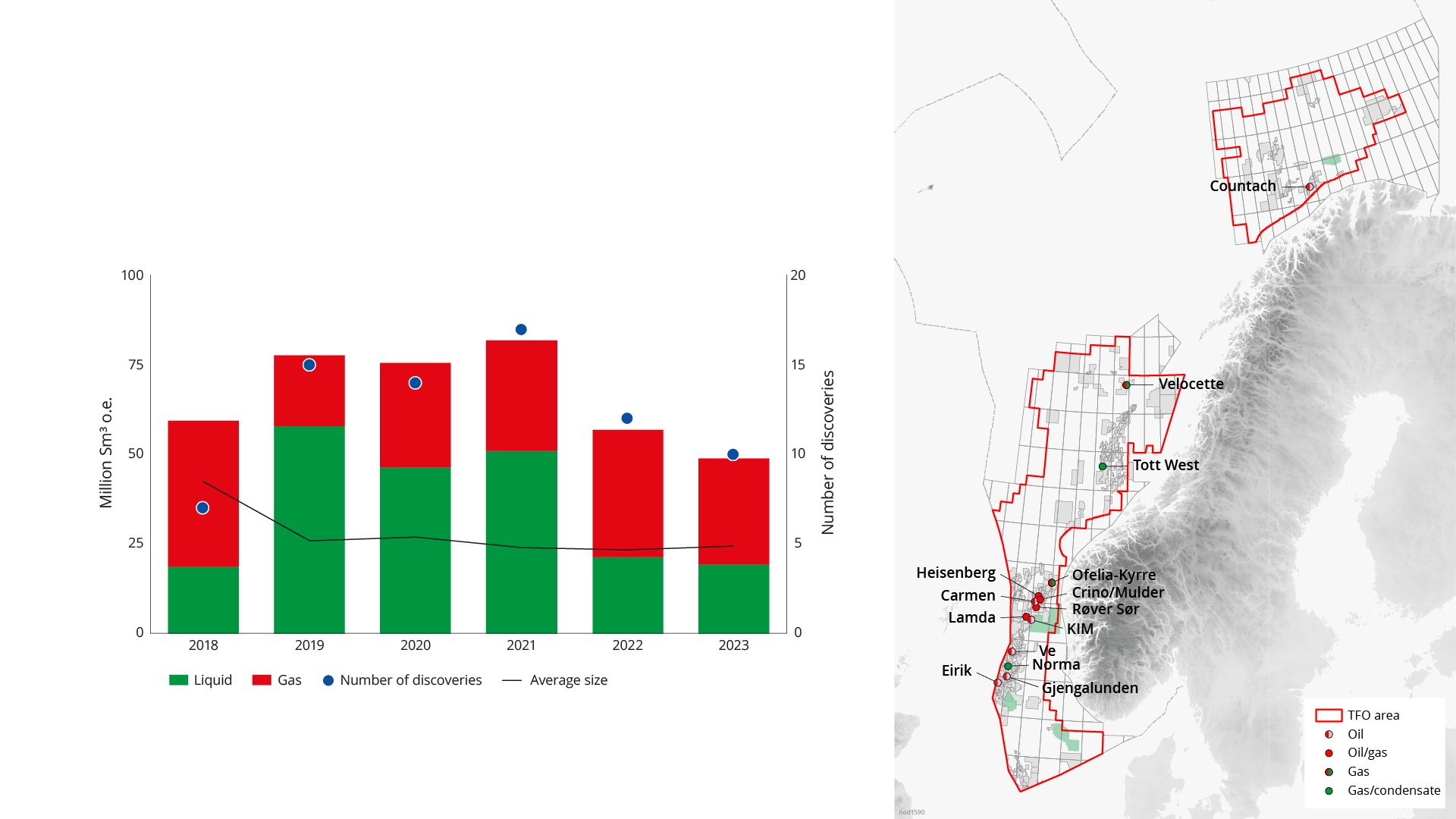

In 2023 the industry spudded 34 exploration wells across the shelf, leading to 14 discoveries: 11 in the North Sea, two in the Norwegian Sea and one in the Barents Sea. The largest was Carmen in PL 1148, thought to contain 9 MMcm to 46 MMcm of oil.

However, the Norwegian Offshore Directorate (NOD) wants to see more active exploration of frontier areas to realize more of the resource potential. That means a commitment to testing new ideas in these regions.

During 2023, 99 commercial geophysical surveys took place across the shelf, including six in the Barents Sea, three of which were drilling site surveys.

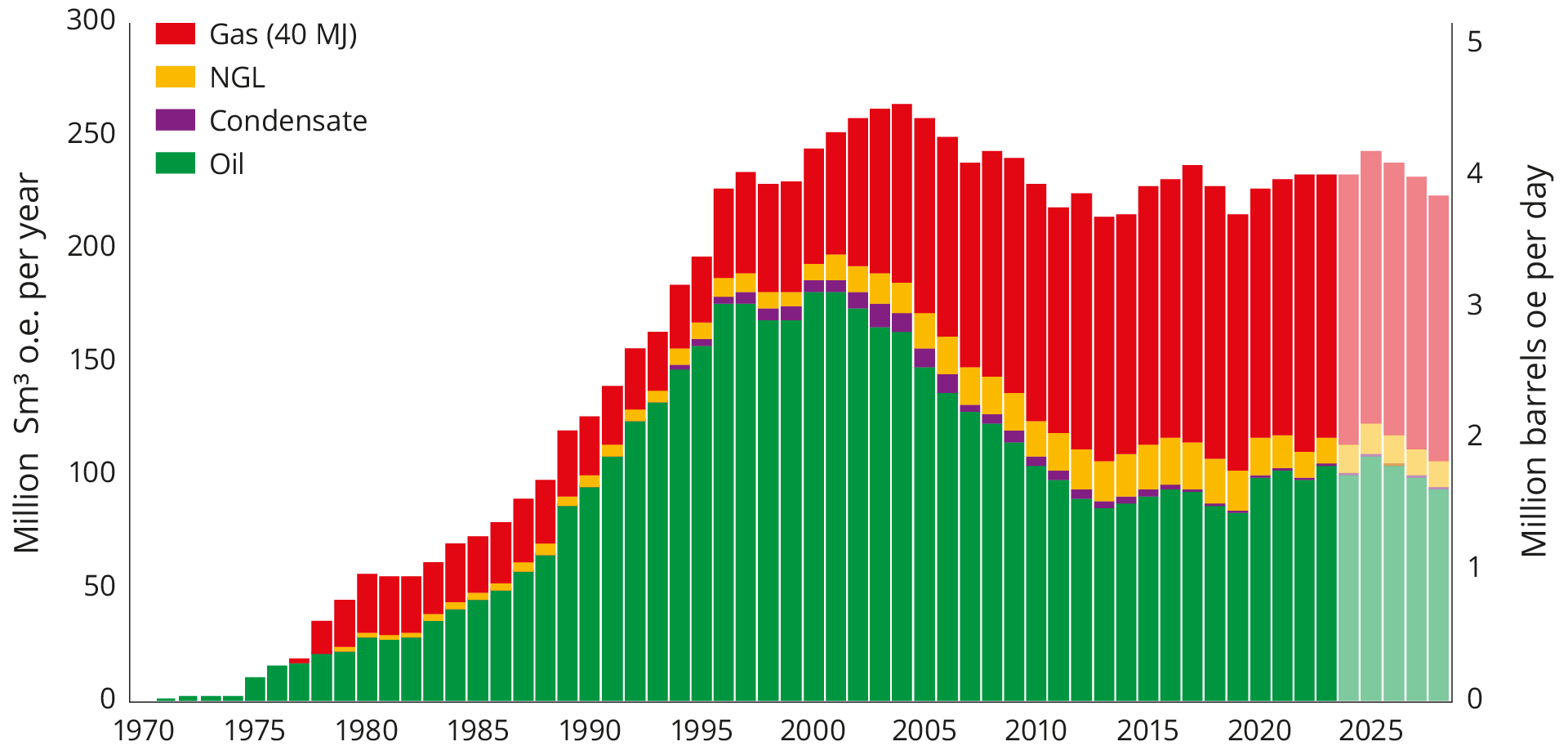

At year-end 2023, there were 92 fields in operation. Atla, Flyndre, Heimdal, Skirne and Vale all shut down over the course of 2023, while Bauge, Breidablikk, Fenja and Tommeliten A came on stream.

Norway’s gas production last year was lower than expected due in part to unplanned and extended maintenance shutdowns at various onshore facilities and offshore fields. Another factor was delayed well deliveries and others not delivering the anticipated production.

As for implementation of new technologies, the priority for the NOD are those that can contribute to discovering and producing more resources and others that reduce emissions. The NOD is seeing the impact of certain initiatives in electrical subsea systems, a pilot for injecting low salinity water, and an increased focusing on the potential in tight formations.

Equinor’s plan for development and operation (PDO) of the Eirin subsea tieback in the central North Sea was the only one submitted in 2023. The authorities also received applications for PDO exemptions for the Brage Cook project on the Brage Field and Solan/Ludvig at the Gullfaks Sør Field in the northern North Sea.

Both should be developed with wells drilled from existing infrastructure.

Last year, a group assembled by the NOD identified 20 areas on the Norwegian shelf that could technically suit further development of offshore wind, while co-existing with other industries.

This month Norway’s parliament (Storting) endorsed the government’s proposal to open parts of the shelf to mineral activity. A final resolution will follow in the form of a royal decree.

The potential resolution will lead to the licensing authorities initiating a process to announce and award permits pursuant to the Seabed Minerals Act.

At the same time, the NOD expects mapping of seabed minerals to continue. The Ministry of Energy holds administrative responsibility for seabed minerals on the Norwegian shelf, with the NOD providing support through performing the impact assessment and coordinating academic studies.

01.29.2024