Atlantic provinces pioneer Canada’s offshore wind development

Editor's note: This story first appeared in the September/October 2023 issue of Offshore magazine. Click here to view the full issue.

By Judy Murray, Contributing Editor

As Canada works to decarbonize its economy, it is increasing its focus on offshore wind development.

In May 2023, a bill was introduced to parliament to amend the Canada-Newfoundland and Labrador Atlantic Accord Implementation Act and the Canada-Nova Scotia Offshore Petroleum Resources Accord Implementation Act, and expand the mandates of the Canada-Nova Scotia Offshore Petroleum Board (C-NSOPB) and the Canada-Newfoundland and Labrador Offshore Petroleum Board (CNLOPB). The CNSOPB and CNLOPB, which currently regulate all aspects of offshore oil and gas projects—including licensing, exploration, production, and decommissioning—will be renamed “energy regulators” and their authority expanded to offshore renewable energy projects, including offshore wind.

Canada has more than 30 years of experience regulating and developing offshore oil and gas resources, and according to Natural Resources Canada (NRCan), which is responsible for energy matters at the federal level, it will leverage the similarities to advance the regulatory regime for offshore wind.

Building on oil and gas industry experience

CNLOPB Director of Communications and Public Engagement Lesley Rideout said her organization is positioned to take on its new responsibilities, noting that a lot of the skills and knowledge required to regulate oil and gas activities are transferrable to offshore wind.

“Managing change in any organization is challenging, but the CNLOPB has the experience, technical skills, administrative capacity and competency to regulate this new expanded mandate,” she said.

“We also recognize the differences between the two industries, such as the footprint of operations and the risk profile,” Rideout continued, noting that the staff already are completing training in renewable energy and participating in discussions with international regulators that have transitioned from oil and gas to overseeing renewable energy regulation to capture lessons learned.

Christine Bonnell-Eisnor, CEO of the CNSOPB, said her organization has taken a comparable tack, pointing to similarities in the geotechnical studies and assessment of metocean conditions, the approach to risk management, environmental considerations, and the need to coexist with fisheries and other industries. “It’s the same ocean,” she said. “Eighty to ninety percent of what we do is directly transferrable to offshore wind.”

Similarities are important, but managing the differences will be critical to the success of the new industry. “Each section of the ocean is unique, and each project is unique,” Bonnell-Eisnor said. “We are involved with international regulators and are learning from our regulatory peers.”

Sandra Farwell, director of marine renewables and clean innovation in the Nova Scotia Department of Natural Resources and Renewables, said her team is approaching this challenge in the same way. “It is important to understand the business models and how projects are financed, developed, and operated, and it is important to understand that the recipe for a viable project in one jurisdiction may not necessarily lead to a viable project in another,” Farwell said.

This is one reason her department has invested in developing the Offshore Wind Roadmap, an evergreen document that outlines activities that will support identifying optimal wind energy areas, along with an eventual approach to site selection and issuing seabed licenses, support mechanisms, and processes for interested parties to provide input on an ongoing basis.

“The first module, released in spring 2023, focuses on establishing lines of sight by mapping the federal and provincial regulatory path and summarizes much of what we have learned through early observations across the sector as well as how our offshore wind resource stacks up,” she explained.

The second module, due out in spring 2024, will focus on the supply chain and infrastructure opportunities. The third module, to be published in fall 2024, will summarize findings from engagement with Mi’kmaq and indigenous peoples, the fisheries industry, environmental organizations, and the research community as well as other interested parties.

“We are at a very early stage in policy development, but we know the value of offshore wind in meeting climate targets while achieving economic growth,” Farwell said. “Developing this resource helps Canada, but it also supports the global transition to clean energy.”

Nova Scotia already has announced ambitious plans, publishing a goal of issuing seabed licenses with the government of Canada for 5 GW of electricity from offshore wind by 2030. The first call for bids for offshore leases is scheduled for 2025.

Applied science

Sven Scholtysik, director of research of Net Zero Atlantic, explained how this not-for-profit is liaising with the federal government on behalf of the Atlantic Canada region, sharing data, knowledge, and information to facilitate sound strategic decision-making for the energy transition. “We want to identify the important research questions and get the right team of experts together to address those questions,” he said.

Net Zero Atlantic leads applied research and contributes to projects that enable the region’s transition to a carbon-neutral future through collaboration with academia, governments, private sector, Indigenous Peoples and other non-government organizations. To that end, the organization provides credible and objective data and support services.

One way Net Zero Atlantic is hoping to identify research questions and potential decarbonization pathways is through its Atlantic Canada Energy System Model, which examines all six energy sectors in the four Atlantic provinces. “The model identifies techno-economically optimal decarbonization pathways and delivers the lowest-cost solution for every ‘what-if’ scenario,” he explained. “The data generated are used to get a better understanding of the system and will help us identify which technologies will be best for future energy generation.”

Moving into the water

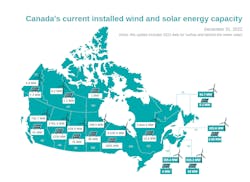

In 2001, Canada had no onshore wind power installed. Today, it is ranked eighth in the world, with 15 GW of installed onshore wind capacity and is applying lessons learned onshore to fast track offshore development.

The federal government is taking steps to establish a competitive environment for clean energy and offshore wind development. The budget issued in March 2023 introduced the Clean Technology Investment Tax Credit (worth up to 30% of the capital cost of investments in clean electricity generation systems) and the Clean Hydrogen Investment Tax Credit (worth up to 40% of capital costs for projects producing hydrogen with a carbon intensity below 0.75kg CO2/kg H2). The budget includes a commitment from the Canada Infrastructure Bank to invest at least Cdn $10 billion through its Clean Power priority area and at least Cdn $10 billion through its Green Infrastructure priority area to support clean electricity and clean growth infrastructure projects.

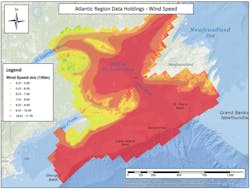

The budget also provides new investments to NRCan to conduct an offshore wind grid integration and transmission study and undertake government-led marine data collection campaigns to further the understanding of geophysical, metocean, wildlife, and environmental considerations, which will help inform planning for future licensing rounds in Atlantic Canada.

According to Abigail Lixfeld, senior director of renewable and electrical energy at NRCan, these investments complement the Regional Assessments of Offshore Wind Development in Nova Scotia and Newfoundland and Labrador, which were launched in March 2023 to identify optimal areas for wind development as well as key constraints, and provide lessons learned from other jurisdictions that will improve impact assessments and regulatory review of future offshore wind projects.

Meanwhile, Marine Renewables Canada (MRC), a national industry association, is facilitating offshore wind development as an extension of work initiated in 2004 to advance wave, tidal, river current, and offshore wind energy. Elisa Obermann, Executive Director, said considerable work has gone into policy advocacy and policy development over the last 10 years with federal and provincial governments to develop some of the foundational legislation and regulations that are being introduced to support offshore wind.

For now, MRC’s focus is on ensuring that marine renewable energy becomes more prevalent in the energy mix and helping Canada establish a competitive advantage by capitalizing on and maximizing the reach of its mature maritime supply chain. The association works closely with its member companies, which include suppliers, technology companies, project developers, community and municipal representatives, and the provincial governments of Nova Scotia and Newfoundland and Labrador.

MRC has set up an Offshore Wind Working Group to provide advice to government about best practices and communicate industry priorities. “The developers in the group have worked in offshore wind internationally and have critical experience to bring forward,” Obermann said. The association also has established an International Business Development Plan—an evergreen document that is periodically revisited and revised—that examines international market intelligence, renewable energy targets, timelines, and policies and identifies gaps and areas for improvement to inform Canadian policy and business development.

“Canada has some of the best wind resources in the world,” Obermann said. “This is a huge asset that could not only help meet the demands of domestic electrification but also produce clean energy for export.”