The Cantarell Project, designed to substantially increase output capacity of heavy crude oil from Mexico's only supergiant oil producing complex, is moving ahead briskly. When work is completed, the offshore field is expected to provide state-owned oil-company Petroleos Mexicanos (Pemex) with over a million b/d of additional capacity by year-end 2000. Among recent major developments, a nitrogen-injection secondary-recovery project started up and is considered vital to pressure maintenance on the field.

Cantarell has long been a global star performer, producing close to one million b/d on average over the past 20 years. Recent output on Cantarell has been in the 1.2-1.4 million b/d range, but capacity will soon reach 2 million b/d. The project was conceived in 1995, at a time of much higher expectations for growth in demand for crude oil. Additional oil-export income also seemed a priority for Mexico to get over a temporary financial crisis at that time.

Since then, global oil output restrictions, in which Mexico participates along with OPEC countries, has meant that all the new capacity being added on Cantarell may not be used anytime soon. However, Pemex will have what company CEO Rogelio Montemayor calls "operational flexibility," allowing for output of heavy Maya-type (19-22 API) crude to rise or fall in line with market conditions. It does, at least, seem likely that Cantarell will have considerable spare capacity for some time, despite recent improvement in oil demand. However, capacity on the field may, at some future point, compensate for a decline in output on many of Pemex's other fields, onshore and offshore.

The first broad-based study analyzing finding and development (F&D) cost components by strategy area for companies operating in the Gulf of Mexico has been completed by Ziff Energy Group. The analysis covers activity on the shelf and slope out to a water depth of 1,500 ft.

Despite the severe industry climate in l999, a strong mix of independents and majors active in the Gulf of Mexico participated in the study to assess in great detail individual and collective results in preparation for the price recovery. The study covers the 1996-98 period, and analyses linkages between the use of key technologies and actual economic performance in each of the specific strategies. The study also examines which technologies are successful in each strategy area.

The Gulf of Mexico is the "breadbasket" of US gas supply, providing about 25% of total. There has been much controversy regarding the outlook for gas supply from the US Gulf, and whether it will soon decline sharply, as has been forecast several times during the past decade. Certainly there has been much corporate asset portfolio activity, with a number of majors and even independents selling or swapping out of certain regions of the Shelf and generally opting to focus activity on the shelf, and/or shift spending to deepwater. Mobil's sale of 23 shelf fields to Vastar in 1998, Shell's sale of 22 fields and 16 undeveloped blocks to Apache in 1999, and Texaco's sale of 82 blocks to Anadarko in 1999, are but a few examples of this trend.

The study, analyses capital spending and reserves data for each of seven strategy areas which represent the major exploration and development plays in the offshore Gulf of Mexico Shelf and Slope area. This more precise approach to the analysis of finding and development costs provides results that are not available looking solely at publicly available corporate level data.

Total industry drilling activity remained relatively stable over the three-year period, during which a total of 3,246 wells were drilled in the Gulf of Mexico shelf and slope area. Nearly half of the activity took place in the mature Central Plio/ Pleistocene area, followed by a quarter in the Central Miocene. One third of the new wells were classified as "exploratory," of which 432 (36%) were classified as "commercial." Of the wells classified as "development," two thirds were successful.

Study participants invested over $5 billion during the period, which resulted in the addition of over 700 million boe of proved reserves. Upward revisions to drilling discoveries accounted for 10% of this total. Drilling expenditures accounted for 75% of total spending; obviously, drilling is an area for further evaluation. Costs associated with platforms and facilities accounted for only 14% of the total, reflecting the comprehensive infrastructure available on the shelf. Costs associated with leasing and prospect evaluation accounted for the remaining 11%.

Finding and development (F&D) costs varied significantly from one strategy area to another. In the mature strategy areas, F&D costs ranged from $5.20/boe to $8.50/boe, with an average cost of $6.90/boe for the shelf and slope area in general. Production replacement on a boe basis averaged 90% over the three-year period. Gas replacement remained weak at 75%, but oil replacement was surprisingly strong at 118%. Participants re-invested an average of $6.00/ boe of production over the study period.

Value versus cost

Project economics, with conventional economic indicators, were determined for 23 actual oil and gas plays within the strategy areas. These evaluations considered exploration and development capital spending, product quality, reserves, productive capability and durability, operating costs, royalties, and typical cycle times that can range from two to five-plus years.

These full cycle evaluations were compared against the F&D costs associated with finding and developing the reserves in each area. This approach pools proprietary data by strategy area from all participating companies in order to measure the relative value of each strategy by comparing F&D costs directly to the value of the resources developed.

In the most active Central Plio/Pleistocene strategy area, the average F&D cost was $6.40/boe, with production replacement averaging 100%. Expenditures on exploratory drilling increased over the period to 10%.

On the map, the shaded horizontal band indicates the range of costs, dependent on individual play characteristics, that will provide a 10% rate of return. Based on this analysis, four of the companies, as well as the average participant performance, are achieving a better than 10% rate of return, with the remaining four achieving at least 10%, based on play characteristics.

Four of the companies in the Central Plio/ Pleistocene sample are achieving full production replacement and a rate of return of more than 10%, with three achieving significant growth.

Technology impact

As an integral part of the exploration and development process, technology can have a significant impact on F&D costs, in many cases improving results, but in some cases adding unnecessarily to costs with little benefit. Schlumberger, technical consultant for the key technology applications portion of the study, and Ziff Energy conducted a technology survey designed with two goals:

- Identify the technologies that are consistently considered being of prime importance in each of the strategy areas

- Differentiate the technology utilization by companies adding low-cost reserves and those that are less successful.

The survey analyzed four key technology areas in the F&D process: geophysics, drilling engineering, petrophysics, and data management. Several of the key findings were that:

- Virtually all acquired seismic data is speculative.

- The acquisition and integration of core data into prospect interpretation correlates with lower F&D costs by exploration and production (E&P) companies.

- Companies that spend time and involve all team members in drilling planning see a reward in lower F&D costs.

- Data management accounts for 30-50% of an E&P professionals' time.

Through this type of study, participating companies are able to:

- Identify true areas of competitive advantage among the various Gulf of Mexico strategies

- Optimize the allocation of capital

- Measure real value added by E&P activities versus peers and industry

- Examine net present value of resources developed for each strategy area, reflecting production rates, finding and development costs, and typical cycle times

- Identify successful technologies of prime importance in each of the strategy areas

- Compare production replacement by F&D with overall industry performance, for both oil and gas reserve replacement, for each strategy area being pursued

- Compare capital spending levels to peers and the industry, for each strategy

- Develop full cycle models of field performance.

To assess the focus and balance of a company's portfolio, it is imperative to understand the full cycle risk and reward factors of each of the strategies and options available. The study presents real results of the industry, for a variety of exploration, exploitation, and development strategies.;

The first broad-based study analyzing finding and development (F&D) cost components by strategy area for companies operating in the Gulf of Mexico has been completed by Ziff Energy Group. The analysis covers activity on the shelf and slope out to a water depth of 1,500 ft.

Despite the severe industry climate in l999, a strong mix of independents and majors active in the Gulf of Mexico participated in the study to assess in great detail individual and collective results in preparation for the price recovery. The study covers the 1996-98 period, and analyses linkages between the use of key technologies and actual economic performance in each of the specific strategies. The study also examines which technologies are successful in each strategy area.

The Gulf of Mexico is the "breadbasket" of US gas supply, providing about 25% of total. There has been much controversy regarding the outlook for gas supply from the US Gulf, and whether it will soon decline sharply, as has been forecast several times during the past decade. Certainly there has been much corporate asset portfolio activity, with a number of majors and even independents selling or swapping out of certain regions of the Shelf and generally opting to focus activity on the shelf, and/or shift spending to deepwater. Mobil's sale of 23 shelf fields to Vastar in 1998, Shell's sale of 22 fields and 16 undeveloped blocks to Apache in 1999, and Texaco's sale of 82 blocks to Anadarko in 1999, are but a few examples of this trend.

The study, analyses capital spending and reserves data for each of seven strategy areas which represent the major exploration and development plays in the offshore Gulf of Mexico Shelf and Slope area. This more precise approach to the analysis of finding and development costs provides results that are not available looking solely at publicly available corporate level data.

Total industry drilling activity remained relatively stable over the three-year period, during which a total of 3,246 wells were drilled in the Gulf of Mexico shelf and slope area. Nearly half of the activity took place in the mature Central Plio/ Pleistocene area, followed by a quarter in the Central Miocene. One third of the new wells were classified as "exploratory," of which 432 (36%) were classified as "commercial." Of the wells classified as "development," two thirds were successful.

Study participants invested over $5 billion during the period, which resulted in the addition of over 700 million boe of proved reserves. Upward revisions to drilling discoveries accounted for 10% of this total. Drilling expenditures accounted for 75% of total spending; obviously, drilling is an area for further evaluation. Costs associated with platforms and facilities accounted for only 14% of the total, reflecting the comprehensive infrastructure available on the shelf. Costs associated with leasing and prospect evaluation accounted for the remaining 11%.

Finding and development (F&D) costs varied significantly from one strategy area to another. In the mature strategy areas, F&D costs ranged from $5.20/boe to $8.50/boe, with an average cost of $6.90/boe for the shelf and slope area in general. Production replacement on a boe basis averaged 90% over the three-year period. Gas replacement remained weak at 75%, but oil replacement was surprisingly strong at 118%. Participants re-invested an average of $6.00/ boe of production over the study period.

Value versus cost

Project economics, with conventional economic indicators, were determined for 23 actual oil and gas plays within the strategy areas. These evaluations considered exploration and development capital spending, product quality, reserves, productive capability and durability, operating costs, royalties, and typical cycle times that can range from two to five-plus years.

These full cycle evaluations were compared against the F&D costs associated with finding and developing the reserves in each area. This approach pools proprietary data by strategy area from all participating companies in order to measure the relative value of each strategy by comparing F&D costs directly to the value of the resources developed.

In the most active Central Plio/Pleistocene strategy area, the average F&D cost was $6.40/boe, with production replacement averaging 100%. Expenditures on exploratory drilling increased over the period to 10%.

On the map, the shaded horizontal band indicates the range of costs, dependent on individual play characteristics, that will provide a 10% rate of return. Based on this analysis, four of the companies, as well as the average participant performance, are achieving a better than 10% rate of return, with the remaining four achieving at least 10%, based on play characteristics.

Four of the companies in the Central Plio/ Pleistocene sample are achieving full production replacement and a rate of return of more than 10%, with three achieving significant growth.

Technology impact

As an integral part of the exploration and development process, technology can have a significant impact on F&D costs, in many cases improving results, but in some cases adding unnecessarily to costs with little benefit. Schlumberger, technical consultant for the key technology applications portion of the study, and Ziff Energy conducted a technology survey designed with two goals:

- Identify the technologies that are consistently considered being of prime importance in each of the strategy areas

- Differentiate the technology utilization by companies adding low-cost reserves and those that are less successful.

The survey analyzed four key technology areas in the F&D process: geophysics, drilling engineering, petrophysics, and data management. Several of the key findings were that:

- Virtually all acquired seismic data is speculative.

- The acquisition and integration of core data into prospect interpretation correlates with lower F&D costs by exploration and production (E&P) companies.

- Companies that spend time and involve all team members in drilling planning see a reward in lower F&D costs.

- Data management accounts for 30-50% of an E&P professionals' time.

Through this type of study, participating companies are able to:

- Identify true areas of competitive advantage among the various Gulf of Mexico strategies

- Optimize the allocation of capital

- Measure real value added by E&P activities versus peers and industry

- Examine net present value of resources developed for each strategy area, reflecting production rates, finding and development costs, and typical cycle times

- Identify successful technologies of prime importance in each of the strategy areas

- Compare production replacement by F&D with overall industry performance, for both oil and gas reserve replacement, for each strategy area being pursued

- Compare capital spending levels to peers and the industry, for each strategy

- Develop full cycle models of field performance.

To assess the focus and balance of a company's portfolio, it is imperative to understand the full cycle risk and reward factors of each of the strategies and options available. The study presents real results of the industry, for a variety of exploration, exploitation, and development strategies.;

The first broad-based study analyzing finding and development (F&D) cost components by strategy area for companies operating in the Gulf of Mexico has been completed by Ziff Energy Group. The analysis covers activity on the shelf and slope out to a water depth of 1,500 ft.

Despite the severe industry climate in l999, a strong mix of independents and majors active in the Gulf of Mexico participated in the study to assess in great detail individual and collective results in preparation for the price recovery. The study covers the 1996-98 period, and analyses linkages between the use of key technologies and actual economic performance in each of the specific strategies. The study also examines which technologies are successful in each strategy area.

The Gulf of Mexico is the "breadbasket" of US gas supply, providing about 25% of total. There has been much controversy regarding the outlook for gas supply from the US Gulf, and whether it will soon decline sharply, as has been forecast several times during the past decade. Certainly there has been much corporate asset portfolio activity, with a number of majors and even independents selling or swapping out of certain regions of the Shelf and generally opting to focus activity on the shelf, and/or shift spending to deepwater. Mobil's sale of 23 shelf fields to Vastar in 1998, Shell's sale of 22 fields and 16 undeveloped blocks to Apache in 1999, and Texaco's sale of 82 blocks to Anadarko in 1999, are but a few examples of this trend.

The study, analyses capital spending and reserves data for each of seven strategy areas which represent the major exploration and development plays in the offshore Gulf of Mexico Shelf and Slope area. This more precise approach to the analysis of finding and development costs provides results that are not available looking solely at publicly available corporate level data.

Total industry drilling activity remained relatively stable over the three-year period, during which a total of 3,246 wells were drilled in the Gulf of Mexico shelf and slope area. Nearly half of the activity took place in the mature Central Plio/ Pleistocene area, followed by a quarter in the Central Miocene. One third of the new wells were classified as "exploratory," of which 432 (36%) were classified as "commercial." Of the wells classified as "development," two thirds were successful.

Study participants invested over $5 billion during the period, which resulted in the addition of over 700 million boe of proved reserves. Upward revisions to drilling discoveries accounted for 10% of this total. Drilling expenditures accounted for 75% of total spending; obviously, drilling is an area for further evaluation. Costs associated with platforms and facilities accounted for only 14% of the total, reflecting the comprehensive infrastructure available on the shelf. Costs associated with leasing and prospect evaluation accounted for the remaining 11%.

Finding and development (F&D) costs varied significantly from one strategy area to another. In the mature strategy areas, F&D costs ranged from $5.20/boe to $8.50/boe, with an average cost of $6.90/boe for the shelf and slope area in general. Production replacement on a boe basis averaged 90% over the three-year period. Gas replacement remained weak at 75%, but oil replacement was surprisingly strong at 118%. Participants re-invested an average of $6.00/ boe of production over the study period.

Value versus cost

Project economics, with conventional economic indicators, were determined for 23 actual oil and gas plays within the strategy areas. These evaluations considered exploration and development capital spending, product quality, reserves, productive capability and durability, operating costs, royalties, and typical cycle times that can range from two to five-plus years.

These full cycle evaluations were compared against the F&D costs associated with finding and developing the reserves in each area. This approach pools proprietary data by strategy area from all participating companies in order to measure the relative value of each strategy by comparing F&D costs directly to the value of the resources developed.

In the most active Central Plio/Pleistocene strategy area, the average F&D cost was $6.40/boe, with production replacement averaging 100%. Expenditures on exploratory drilling increased over the period to 10%.

On the map, the shaded horizontal band indicates the range of costs, dependent on individual play characteristics, that will provide a 10% rate of return. Based on this analysis, four of the companies, as well as the average participant performance, are achieving a better than 10% rate of return, with the remaining four achieving at least 10%, based on play characteristics.

Four of the companies in the Central Plio/ Pleistocene sample are achieving full production replacement and a rate of return of more than 10%, with three achieving significant growth.

Technology impact

As an integral part of the exploration and development process, technology can have a significant impact on F&D costs, in many cases improving results, but in some cases adding unnecessarily to costs with little benefit. Schlumberger, technical consultant for the key technology applications portion of the study, and Ziff Energy conducted a technology survey designed with two goals:

- Identify the technologies that are consistently considered being of prime importance in each of the strategy areas

- Differentiate the technology utilization by companies adding low-cost reserves and those that are less successful.

The survey analyzed four key technology areas in the F&D process: geophysics, drilling engineering, petrophysics, and data management. Several of the key findings were that:

- Virtually all acquired seismic data is speculative.

- The acquisition and integration of core data into prospect interpretation correlates with lower F&D costs by exploration and production (E&P) companies.

- Companies that spend time and involve all team members in drilling planning see a reward in lower F&D costs.

- Data management accounts for 30-50% of an E&P professionals' time.

Through this type of study, participating companies are able to:

- Identify true areas of competitive advantage among the various Gulf of Mexico strategies

- Optimize the allocation of capital

- Measure real value added by E&P activities versus peers and industry

- Examine net present value of resources developed for each strategy area, reflecting production rates, finding and development costs, and typical cycle times

- Identify successful technologies of prime importance in each of the strategy areas

- Compare production replacement by F&D with overall industry performance, for both oil and gas reserve replacement, for each strategy area being pursued

- Compare capital spending levels to peers and the industry, for each strategy

- Develop full cycle models of field performance.

To assess the focus and balance of a company's portfolio, it is imperative to understand the full cycle risk and reward factors of each of the strategies and options available. The study presents real results of the industry, for a variety of exploration, exploitation, and development strategies.;

The first broad-based study analyzing finding and development (F&D) cost components by strategy area for companies operating in the Gulf of Mexico has been completed by Ziff Energy Group. The analysis covers activity on the shelf and slope out to a water depth of 1,500 ft.

Despite the severe industry climate in l999, a strong mix of independents and majors active in the Gulf of Mexico participated in the study to assess in great detail individual and collective results in preparation for the price recovery. The study covers the 1996-98 period, and analyses linkages between the use of key technologies and actual economic performance in each of the specific strategies. The study also examines which technologies are successful in each strategy area.

The Gulf of Mexico is the "breadbasket" of US gas supply, providing about 25% of total. There has been much controversy regarding the outlook for gas supply from the US Gulf, and whether it will soon decline sharply, as has been forecast several times during the past decade. Certainly there has been much corporate asset portfolio activity, with a number of majors and even independents selling or swapping out of certain regions of the Shelf and generally opting to focus activity on the shelf, and/or shift spending to deepwater. Mobil's sale of 23 shelf fields to Vastar in 1998, Shell's sale of 22 fields and 16 undeveloped blocks to Apache in 1999, and Texaco's sale of 82 blocks to Anadarko in 1999, are but a few examples of this trend.

The study, analyses capital spending and reserves data for each of seven strategy areas which represent the major exploration and development plays in the offshore Gulf of Mexico Shelf and Slope area. This more precise approach to the analysis of finding and development costs provides results that are not available looking solely at publicly available corporate level data.

Total industry drilling activity remained relatively stable over the three-year period, during which a total of 3,246 wells were drilled in the Gulf of Mexico shelf and slope area. Nearly half of the activity took place in the mature Central Plio/ Pleistocene area, followed by a quarter in the Central Miocene. One third of the new wells were classified as "exploratory," of which 432 (36%) were classified as "commercial." Of the wells classified as "development," two thirds were successful.

Study participants invested over $5 billion during the period, which resulted in the addition of over 700 million boe of proved reserves. Upward revisions to drilling discoveries accounted for 10% of this total. Drilling expenditures accounted for 75% of total spending; obviously, drilling is an area for further evaluation. Costs associated with platforms and facilities accounted for only 14% of the total, reflecting the comprehensive infrastructure available on the shelf. Costs associated with leasing and prospect evaluation accounted for the remaining 11%.

Finding and development (F&D) costs varied significantly from one strategy area to another. In the mature strategy areas, F&D costs ranged from $5.20/boe to $8.50/boe, with an average cost of $6.90/boe for the shelf and slope area in general. Production replacement on a boe basis averaged 90% over the three-year period. Gas replacement remained weak at 75%, but oil replacement was surprisingly strong at 118%. Participants re-invested an average of $6.00/ boe of production over the study period.

Value versus cost

Project economics, with conventional economic indicators, were determined for 23 actual oil and gas plays within the strategy areas. These evaluations considered exploration and development capital spending, product quality, reserves, productive capability and durability, operating costs, royalties, and typical cycle times that can range from two to five-plus years.

These full cycle evaluations were compared against the F&D costs associated with finding and developing the reserves in each area. This approach pools proprietary data by strategy area from all participating companies in order to measure the relative value of each strategy by comparing F&D costs directly to the value of the resources developed.

In the most active Central Plio/Pleistocene strategy area, the average F&D cost was $6.40/boe, with production replacement averaging 100%. Expenditures on exploratory drilling increased over the period to 10%.

On the map, the shaded horizontal band indicates the range of costs, dependent on individual play characteristics, that will provide a 10% rate of return. Based on this analysis, four of the companies, as well as the average participant performance, are achieving a better than 10% rate of return, with the remaining four achieving at least 10%, based on play characteristics.

Four of the companies in the Central Plio/ Pleistocene sample are achieving full production replacement and a rate of return of more than 10%, with three achieving significant growth.

Technology impact

As an integral part of the exploration and development process, technology can have a significant impact on F&D costs, in many cases improving results, but in some cases adding unnecessarily to costs with little benefit. Schlumberger, technical consultant for the key technology applications portion of the study, and Ziff Energy conducted a technology survey designed with two goals:

- Identify the technologies that are consistently considered being of prime importance in each of the strategy areas

- Differentiate the technology utilization by companies adding low-cost reserves and those that are less successful.

The survey analyzed four key technology areas in the F&D process: geophysics, drilling engineering, petrophysics, and data management. Several of the key findings were that:

- Virtually all acquired seismic data is speculative.

- The acquisition and integration of core data into prospect interpretation correlates with lower F&D costs by exploration and production (E&P) companies.

- Companies that spend time and involve all team members in drilling planning see a reward in lower F&D costs.

- Data management accounts for 30-50% of an E&P professionals' time.

Through this type of study, participating companies are able to:

- Identify true areas of competitive advantage among the various Gulf of Mexico strategies

- Optimize the allocation of capital

- Measure real value added by E&P activities versus peers and industry

- Examine net present value of resources developed for each strategy area, reflecting production rates, finding and development costs, and typical cycle times

- Identify successful technologies of prime importance in each of the strategy areas

- Compare production replacement by F&D with overall industry performance, for both oil and gas reserve replacement, for each strategy area being pursued

- Compare capital spending levels to peers and the industry, for each strategy

- Develop full cycle models of field performance.

To assess the focus and balance of a company's portfolio, it is imperative to understand the full cycle risk and reward factors of each of the strategies and options available. The study presents real results of the industry, for a variety of exploration, exploitation, and development strategies.;

Field outline

The Cantarell complex consists of four adjacent fields, known as Akal, Chac, Nohoch, and Kutz, with Akal providing about 90% of crude oil output. It is located in the Bay of Campeche, Gulf of Mexico, 50 miles NNW of Ciudad del Carmen. Water depths are roughly 120-130 ft. Cantarell is considered to be the sixth largest oil field in the world, with proven/probable hydrocarbon reserves of about 13.5 billion boe, about 26% of Mexico's total oil reserves.

Mexico's total crude oil output in 1999 was 2,906,000 b/d, 5.3% below 1998 levels, due to Mexico's commitments with OPEC. Cantarell accounted for 1,228,000 b/d, down from 1,312,000 b/d in 1998. However, agreements with OPEC have since allowed oil output to rise again and Cantarell has been producing close to 1,400,000 b/d recently. This level was also reached briefly on Cantarell over two years ago, before Mexico entered into output agreements with OPEC.

Heavy oil production from offshore fields in Campeche Bay made up over half of total Mexican crude oil output volumes in 1999, as the nearby Ku-Maloob-Zaap complex provided 282,000 b/d and Ek-Balam field another 45,000 b/d. Offshore light crude output from the Caan, Abkatun, Pol, Chuc, and Taratunich fields and from the Tabasco Littoral, accounted for another 683,000 b/d. Some of the light crude fields, particularly Abkatun, which used to be the most important offshore field after Cantarell, have suffered serious declines in recent years. Total output in the Mexican offshore area, therefore, was 2,237,000 b/d in 1999, with onshore fields providing just 668,000 b/d.

Objectives, progress

The Cantarell Project is about "optimizing final recovery of oil reserves" and getting maximum economic value from these reserves, Pemex officials say. The scope and nature of the project are remarkable. Authorized investments for the 1997-2001 period are close to $7.82 billion dollars, and $2.71 billion dollars more has been authorized for the 2002-2012 period, meaning total expenditures already authorized amount to $10.5 billion.

Short-term goals of the project include de-bottlenecking existing facilities, reducing gas flaring, and increasing crude oil storage for export through the use of an FSO vessel, which should guarantee offshore crude oil loading even during bad weather. Longer-term goals include increasing production handling capability, drilling additional development wells, and building new wellhead platforms, production complexes, and pipelines.

Investments up to year 2002 are related to 38 EPC (engineering, procurement, and construction) contracts plus purchase orders, almost all of which have now been assigned. Many of them have gone to foreign firms, which generally operate locally with a Mexican partner. About half of these EPC contracts have been completed and the rest are at various stages of completion. The 38 contracts encompass the development of 28 new platforms in the Campeche Bay offshore arena, plus two new production complexes (known as Akal B and Akal L), over 250 miles of underwater pipelines, 205 new producing wells, and 9 nitrogen injection wells, plus a large number of service contracts.

Approaching halfway

Overall, the project is currently roughly running on schedule and is now close to halfway complete in terms of the $7.13 billion in investments to be made in the 38 EPCs. Works projects have been divided into groups, with progress, as of March 1, as follows:

- Platforms for production, gathering and risers and living quaters - 88%

- Pressure maintenance systems (nitrogen injection) - 98%

- Pipelines - 77%

- Gas compression infrastructure - 47%

- New production complexes - 34%

- Rehabilitation and modernization of production complexes - 56%.

In March earlier this year, 113 of the 205 producing wells had been drilled, 31 of them with a wider diameter (9 5/8-in., instead of 7-in.), which has greatly enhanced oil flows. The wider-diameter wells are considered to be an important complement to nitrogen injection in increasing well productivity and recoverable reserves. A total of 63 such wells is contemplated.

Some delays, particularly on new production complexes and a group of underwater pipelines, have occurred, largely due to financial problems at some of Mexico's main EPC companies, which have been involved on these contracts. The companies have faced critical problems due to credit restrictions in the troubled Mexican banking system and also because of the complexity of the Cantarell Project itself, which involves many large works projects being carried out simultaneously in a very restricted space on an oil field which has to keep producing large amounts of oil, in order for Mexico to meet its oil-export commitments.

Pemex-Exploration and Production has put several strategies and contingency plans into operation to reduce interference among the many works contracts. Where local companies have been unable to comply, projects have been reassigned or re-tendered and it is hoped much of the lost time can be made up. Meanwhile, progress on several fronts should allow Pemex to reduce gas flaring very significantly on Cantarell around mid-year.

Nitrogen injection

Pressure maintenance, to be undertaken as early as practical, was diagnosed for increasing oil-production capacity and ultimate oil recovery from Akal. Nitrogen injection was chosen due to cost considerations and to its inert, non-flammable, non-corrosive nature. It was considered advantageous in costs, especially since natural gas produced in the area is required for consumption in the domestic market.

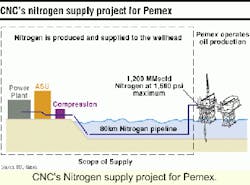

The nitrogen-injection project, based on an onshore air separation unit (ASU) and a 50-mile pipeline taking nitrogen to an offshore injection platform, started up recently.

The ASU and related facilities, which cost close to $1 billion and are one of a kind in the world, were built and will be owned and operated by the Cantarell Nitrogen Company (CNC), a joint venture of BOC Holdings, Marubeni, Westcoast Energy, Linde, Empresas ICA, and Fluor Daniel. The joint venture has a 15-year nitrogen-supply contract from Pemex, worth almost $2.7 billion at current prices.

The facilities are situated on the Atasta peninsula, the closest onshore location to Cantarell. The ASU and compression facilities also required the construction of a 306 MW power plant. The first of the plant's four 300 MMcf/d generation and compression modules went into operation at the end of April 2000 and the other three will come on line consecutively at three-monthly intervals thereafter.

The giant nitrogen injection platform, from which the 1.2 MMcf/d of nitrogen will be pumped into the Cantarell oil field, was positioned earlier this year in offshore Campeche. The nitrogen-injection superstructure was built by Industrias del Hierro, a subsidiary of Mexico's Empresas ICA, which has a large construction yard at Mata Redonda in Veracruz state. The cost of the platform, including engineering, construction, and supply of materials and equipment, was $25.5 million. Five of the nine wells for nitrogen injection have been drilled.

Nitrogen pipeline

Also completed was the laying of the pipeline which will take the nitrogen from the onshore production complex to the superstructure. It is a 59-mile, 36-in.-diameter gas pipeline, which runs from Pemex's compression station on Atasta peninsula to the Nohoch-A production complex.

Construction of the line was carried out by Corporacion Mexicana de Mantenimiento Integral (Commisa), a joint venture of Brown & Root and Grupo R, a Tampico, Mexico-based engineering firm. The cost of the pipeline was $146.2 million. The line also can be used to supply natural gas for pneumatic pumping to producing wells in the Cantarell field.

A pipeline between the nitrogen plant and the injection platform was built for CNC by Mexican company CCC Fabricaciones y Construcciones, which is now majority-owned by Global Engineering. Two major drilling and production platforms for the Akal complex were also installed and handed over to Pemex for production. Both were built by Industrias del Hierro and cost a total of $62.5 million. All of the above suggests that the nitrogen-injection infrastructure on Cantarell has largely been completed.

Other main contracts

Of the 38 EPC contracts, a total of 36 are for new infrastructure and oil-related services in Campeche Bay. One of the two others is the nitrogen supply contract, worth just under $2.7 billion, while the other is the 10-year lease on the Ta'kuntah FSO (floating storage and offloading vessel). The vessel, with a lease price of $421 million, provides permanent storage capacity of 2.2 million bbl for loading onto tankers.

Among the major contractors on the Cantarell Project are Commisa and the Brown & Root-Grupo R venture. This consortium won four EPC (engineering, production, and construction) contracts worth $1.5 billion in all, two for compression and oil stabilization platforms, one for offshore pipelines, and one for the nitrogen supply pipeline.

Another company with major participation is Construcciones Maritimas Mexicanas, a joint venture of McDermott and Mexico's Protexa, which is carrying out contracts worth approximately $200 million for modernization of the Akal production platforms and installation of platforms and bridges.

CCC Fabricaciones y Construcciones took three contracts for a total of $156 million for a drilling platform, a group of 12 offshore pipelines, and the oil pipeline running from Akal to the FSO.

Cabyl, a joint venture of Enron and Mexico's Cigsa took three contracts worth close to $300 million for offshore living quarters platforms, while U.S. firm Demar also won a $111 million contract for platform work. Industrias del Hierro won contracts for $72 million for two drilling platforms and the nitrogen-injection platform.

Local construction firm Bufete Industrial, now facing bankruptcy, had won contracts for $428 million for platforms and pipelines, but could not carry them out in time, so they will be re-tendered. One of Bufete's platform contracts, worth $190 million, remains in the early stages. Another incomplete contract, for 26 underwater pipelines, is being divided into four projects.

Of the 38 EPC contracts, 26 should be completed by year-end, yet some of the others will roll on as far as year 2002. This is the case of Commisa's major platform contracts. The pending platform contract which had been awarded to Bufete, plus an automization contract integrating communications and data on all platforms, which was won by Honeywell, for a bid of $36 million.

Strategic program

Offshore work by Pemex has traditionally been concentrated almost totally in the search for oil in the Campeche Bay area. However, given expectations of fast-growing demand for natural gas in coming years, Pemex is beginning to implement what it calls a Strategic Gas Program (2000-2008), aimed at ensuring that there is enough domestic supply in order to meet most of that demand. The program will focus on exploration and production of dry gas.

Investments of $450 million are planned to go into the program this year. These initial investments, largely to be made in seismic studies, will not greatly increase production this year, but are aimed at providing basic information for work in the coming years.

Most efforts in the program will be in onshore fields, along Mexico's Gulf coast. However, development of new offshore fields will also be considered. Over the next few years, private and foreign companies are expected to compete for service work on the Strategic Gas Program, as is currently the case in all major exploration and production projects at Pemex.

Over the last five years, domestic demand for natural gas has grown 4.4% annually, and has been met by a 32% increase in Mexican gas output, largely due to the Burgos Basin dry gas project in northeastern Mexico.

However, demand is projected to increase by 9% yearly over the next decade, largely due to a 16.2% projected annual increase in the use of gas in thermal power plants. More gas will be required for commercial and residential use, and due to new environmental requirements.

Mexico has proven reserves of 30 Tcf and possible total reserves of 81 Tcf of natural gas, according to official figures, but about 79% of these reserves are wet. In the short-to-medium term, Pemex's priority will be exploration, in order to identify and produce dry gas.

According to initial calculations, the Strategic Gas Program will add 3.2 Bcf/d of output by year 2008 to production coming from existing areas, allowing PEP to produce a total of 7.6 Bcf/d. This would cover most domestic demand, yet Mexico will still be a net importer of gas, with imports being brought in for logistical reasons over the US border.

Three offshore areas are considered among potential areas for finding dry gas:

- Lamprea offshore area - adjacent to the southern part of the Burgos Basin, a major onshore dry-gas producing area in north-eastern Mexico

- Lankahuasa offshore basin - off the Vera Cruz coast.

- Tabasco Littoral area - whose discovery caused some excitement several years ago.

Current output on the Tabasco Littoral is still no more than 80,000 b/d of oil and 140 MMcf/d of gas. The littoral is the key offshore area in the Strategic Gas Program. In addition to very light crude oil, it offers a very high gas-to-oil ratio.