Jeremy Beckman, Editor, Europe

Foreign operators are making a comeback offshore Italy. A new group of companies is applying for blocks in the Adriatic and Ionian seas, with the encouragement of the country’s licensing bureau.

Although Italy is Europe’s third largest producer of oil and gas, most new activity in the past decade has focused onshore at fields such as the prolific Val d’Agri in the south.

Offshore, Eni’s dominance has been virtually unchallenged since Shell and BG exited their licenses earlier this decade.

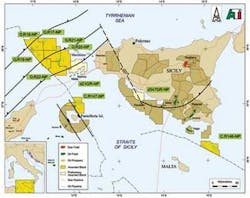

Northern Petroleum’s offshore licenses to the west and south of Sicily.

Eni’s offshore oil production comes mainly from the Vega field off southern Sicily, and Aquila off the coast of Puglia. It also produces gas from numerous fields in the northern Adriatic, although expansion has been constrained for environmental reasons. In recent years, it has made further small gas discoveries such as Argo offshore Sicily, and Benedetta in the Adriatic.

However, there are numerous other “stranded” fields in Italian waters, and the government is keen to monetize those fields. Some have been made available in the newly awarded concessions, such as Ombrina Mare off the central eastern coast. Here, London-based Mediterranean Oil & Gas was preparing to spud an appraisal well early in 2008 in an attempt to prove reserves of up to 90 MMbbl.

Farther south, another British company, Northern Petroleum, is re-evaluating Eni’s Rovesti and Enterprise’s Giove oil discoveries offshore Brindisi in Puglia. The company also has proven gas accumulations in a permit offshore Calabria, close to Sicily.

Of all the newcomers, Northern is by far the most committed to offshore exploration, having acquired operatorship of 11 licenses in the Sicily Channel, the southern Adriatic, offshore Calabria, and the Tiber Delta in the Tyrrhenian Sea since 2004. All are shared with Northern’s joint venture partner in Italy, ATI Oil. The partnership also has three onshore exploration licenses in the Po Valley, and another on the Adriatic coast.

Funding trials

Northern was formed in 1995 and became the second listed company on Britain’s Alternative Investment Market (AIM) the following year. Its original focus was three northern Russia concessions in the western Siberian Timan-Pechora region.

“These permits were excellent geologically,” says Northern’s chief executive Derek Musgrove, “and Timan-Pechora is now a highly productive exploration area. But the board ran into problems over the lack of infrastructure and the structure of the deal for the licenses, which had been issued without an open tender. By 1997-98, the company was making zero progress with Russian businessmen, and was shortly afterwards effectively squeezed out by Lukoil.”

Northern was left virtually bankrupt, its share price having clattered to a nominal value. At that point, Musgrove and various associates were trying to attract funding to form an Italian exploration company. “But this was 1998-99,” he explains, “at the start of the dotcom boom, and the investment sector at that time was not interested in oil and gas exploration. The general feeling, based on forecasts by the likes of BP, was that the oil price would stick at $10-12/bbl for some time to come.

“We were told there was no money for a new company with no history - to raise funds, we would have to ‘find a shell’. So to get our business moving forward, we had to mount a rescue of someone else’s business, which in this case was Northern Petroleum.”

Thanks to contributions from oil industry peers and others, the new board raised enough money to get Northern up and running again, and a settlement was eventually reached concerning the exit from the Russian licenses. More substantial funding came through re-positioning Northern as a western Europe E&P specialist. Currently, the company has production interests in onshore fields in the UK and the Netherlands, as well as exploration interests in Italy and French Guiana.

License opportunities

Having participated in 2000 with a small interest in the Colombo-1 minor gas discovery, Northern made its first concerted pitch for Italian licenses in 2002, five years after Italy’s energy ministry eased restrictions on licensing the Po Valley area to foreign bidders. This followed the ruling that Eni’s regional monopoly of prospective domestic blocks ran counter to the Treaty of Rome, forcing the company to divest up to 75% of its Po Valley exploration acreage.

The initial opportunities came onshore in the Po Valley in the far north, an important gas production center since 1952. Following de-regulation of the country’s power generation sector, gas prices in this region, one of the highest GDP areas in Europe, shot up, and are currently the highest on the continent, according to Musgrove.

The Rovesti and Giove oil discoveries lie close to Eni’s producing Aquila field, and could be produced via an FPSO.

Northern was alerted to these openings by Barry Lonsdale, a British geologist with long experience in Italian E&P. Lonsdale’s role in the discovery of Conoco’s Murchison field in 1978 in the UK North Sea led to his subsequent transfer to Rome to head Conoco’s search for hydrocarbons offshore Italy.

In the early 1980s, Conoco farmed out a percentage of its licenses to Esso, to co-finance a four-well drilling program. In the event of a discovery, Esso would take over as operator. But following the oil price plunge of the mid-’80s, Esso withdrew, followed shortly afterwards by Conoco.

Lonsdale moved to BHP, assuming responsibility for the company’s onshore Italy operations, says Musgrove, “getting them into the license that became the Tempa Rossa oil field in the southern Appenines, although BHP withdrew after he departed.” Lonsdale later teamed up with Mario Panebianco, an advisor to the oil industry, and a specialist in Italian license trading.

Together, they set up deals for around 17 foreign companies, including Burmah, Lasmo, Triton, TCPL, and Sovereign. “It worked well until 1999-2000,” says Musgrove, “by which point globally almost everyone had stopped exploring. Suddenly no one wanted Italian licenses.

“However, knowing what I wanted to do, Barry asked to use Northern to apply for permits in the Po Valley on a 70:30 basis. We carried this arrangement to the point where the licenses were awarded. But then the process grew bigger than expected, the two parties going from half a dozen onshore and offshore licenses and applications to 24 by 2006. Eventually, we resolved this issue by forming a separate company, ATI, run with Barry from our London offices.” Mario Panebianco is also on board as Northern’s general representative in Italy.

Negotiation procedures

“Our business philosophy,” Musgrove explains, “involves identifying a quantum change that we can bring to an exploration or production asset compared with what happened under the previous incumbent. In Italy, opportunities exist to do this because of the licensing regime. The exploration term for each license is a 12-year maximum. Unlike in the UK sector of the North Sea, the only thing you get to keep after that period is the area encompassing a discovery that you have applied to put in production, the latter also requiring a development plan.

“So in theory, everything turns over every 12 years, which means that if there is a real estate opportunity, you can go after it. But you must own the surrounding licenses in the play to do deals – so our strategy involves getting hold of substantial license positions.”

Northern first applied for offshore permits around southern and western Sicily in 2003. “Although we were a junior company,” he explains, “our acceptability as an offshore operator was probably aided by the fact that at that juncture, exploration worldwide was still so low.”

Today in Sicilian waters, the company operates eight licenses with two more awaiting award, all with the participation of ATI. Six are contiguous permits off the island’s western edge in the Sicily Channel, three adjoining the median line with Tunisia. They include the areas previously licensed to Gulf, Eni, and Shell, and cover most of the projected extension in Italian waters of the Apennine-Maghreb thrust belt, which stretches from oilfields in the southern Apennines such as Monte Alpi in Val d’Agri and Tempa Rossa, through the Gagliano gas field onshore Sicily, and onwards into Algeria.

During fall 2006, Northern commissioned Norwegian contractor Seabird Exploration to acquire 540 km (335 mi) of 2D seismic over five of the licenses, using theM/V Northern Explorer. The plan was to integrate much of the data with newly re-processed data-sets. These had been acquired typically with 2.4 km (1.49 mi) long streamers, compared with a 6 km (3.73 mi) spread for the new survey.

In the Sicily Channel, the focus was over the G.R.17.NP., G.R.18.NP, and G.R.19.NP permits. Regional modeling suggests the Lower Tertiary reservoirs are the most promising targets, with the Cretaceous containing the primary source rock. Northern’s geologists have identified several billion barrel-plus prospects developed as drape features over underlying thrust anticlines.

Another new 200 km (124 mi) 2D survey over the C.R147.NP permit in the Straits of Sicily, again on the median line, confirmed two significant prospects with potential reserves of 400 MMbbl and 200 MMbbl. There also appears to be a geological analogy with Lundin Petroleum’s Oudna field in Tunisian waters to the southwest, which came on stream in 2006 at around 25,000 b/d of oil.

The third, a 550 km (342 mi), 2D survey covered license C.R146.NP in the Ionian Sea just south of Edison’s multi-billion barrel Vega oil field off Sicily’s southeastern tip. The area within the permit is on trend with the Liassic carbonate platform edge extending southeast from Vega. The new data improved imaging of the younger volcanic sequences that had constrained previous exploration. More detailed mapping of the Liassic and deeper Triassic also has revealed three strong prospects, and numerous other leads.

“We have been helped by access to high processing capacity desktop computing for interpretation,” Musgrove points out, “which wasn’t available for the original surveys.”

Northern also holds preliminary awards for one license adjoining Sicily’s southwest coast, and another in the Sicily Channel, which surrounds Nilde, a depleted 10-20 MMbbl oil field produced by Eni via an FPSO, and the undeveloped Narciso and Nara discoveries. “These were relinquished by Eni – we have access to their data sets, but have not yet been awarded a full license.”

Northern is looking for farm-in partners to finance wells on at least two of the newly identified prospects, one being a large structure in CR.146.NP up-dip of a well with oil shows close to Maltese waters. The other is in CR.147.NP, near the boundary with Tunisia. Both are in water depths close to 100 m (328 ft).

“West of Sicily, most of the prospects are in 200-800 m [656-2,624 ft] of water,” Musgrove says. “In the 1980s, when Eni and also Gulf exited the region, drilling in these depths was considered frontier engineering in the extreme. It’s commonplace now, of course, and any discoveries could easily be developed using FPSOs with subsea completions and lateral wells.”

The company has shared some of its new findings with operators on the Tunisian side of the offshore thrust play, including Anadarko, which like Northern currently is interpreting a newly acquired seismic survey. The two parties have also been discussing rig-share opportunities.

Stratic Energy recently sold its interest in another license in this region to an ex-employee now running an Australian company, which may also be interested in participating, according to Musgrove. “In the Italian offshore there has never been any drilling in the thrust belt, apart from one well, but that was not on the same targets. So these would be high-risk wells.”

Carbonate potential

After Sicily, Northern widened its net to the Durres basin in Italy’s southern Adriatic sector: the gas-rich near-shore northern area is virtually off-limits to exploration, due to problems with subsidence in the Venice area.

Two preliminary licenses awarded in February 1996 were converted to full offshore licenses in mid-2007. FR.39.NP and FR.40.NP contain three undeveloped carbonate oil and gas discoveries: Giove, Medusa, and Rovesti, all on trend with Eni’s nearby Aquila oil field.

Agip drilled Rovesti in 1978. “They had two prospects – it was a toss of a coin,” Musgrove explains, “as the real purpose of the well was to test the deepwater capability of theDiscoverer Seven Seas drillship. But the resultant oil discovery was considered uneconomic at the time.”

UK independent Enterprise Oil drilled Medusa and Giove respectively in 1996 and 1998, in partnership with Triton. Enterprise was acquired soon afterwards by Shell and Triton by Amerada Hess. Neither new owner was interested in pursuing development on expiration of the licenses in 2000. Shell, in fact, opted to join the exodus from Italy, only retaining its interest in the Monte Alpi field. “Being optimistic, we decided to take these two licenses on – there were no other bidders.”

The Giove-1 well had intersected a 64 m (210 ft) gas column before a gas kick led to abandonment of the well. Giove-2 encountered the base of the gas column and also a 94 m (308 ft) column of 16º API oil within Eocene carbonates at a depth of 1,051 m (3,448 ft). But this well too had to be abandoned following a seabed gas leak.

Analysis at the time suggested 180 MMbl of in-place oil, although only a small percentage appeared recoverable, and not economic at Enterprise’s estimate of oil at $9.80/bbl. However, a recent review by independent consultancy Blackwatch Petroleum Services suggests the reservoir contains 19.67 MMbbl of recoverable oil. Assuming a $70/bbl Brent crude price, the field’s value today could exceed $260 million.

A separate review of Rovesti by the same consultants suggests probable recovery here of 33.56 MMbbl. Rovesti’s crude is deeper-lying, and also lighter, at 25-30º API. Development via an FPSO with subsea wells could cost around $600 million, Blackwatch reports, giving a field value of close to $530 million at $70/bbl. It also estimates the potential oil in place in six other drilling prospects identified by Enterprise on the two licenses at 1.26 to 6 Bbbl.

There could be further targets in three adjacent offshore licenses, for which Northern holds preliminary awards. According to Northern’s geologists, the southern Adriatic is under-explored, despite most of the wells to date being discoveries. There are analogies to Mexico’s prolific Golden Lane and Poza Rica trend, which includes the multi-billion barrel Poza Rica field.

Northern would like to start appraising Rovesti later this year, but needs a farm-in partner to bear the costs, ideally with a rig already contracted. The previous operators drilled vertical wells into the three carbonate discoveries: a development might employ lateral wells, although Northern would prefer to put in a template first for a well test before committing to this course. If all goes to plan, first oil might be feasible in 2010.

Calabria gas corridor

Early in 2006, Northern also gained its first preliminary award offshore Calabria, in the “toe” of Italy’s boot. The 730 sq km (282 sq mi) license (D.59F.R-NP) includes three undeveloped gas fields discovered by Agip/Eni in Pliocene and Miocene sandstones, at depths ranging from 700-1,500 m (2,296-4,921 ft).

Fedra, Fiorenza, and Florida were drilled in the 1980s and 1990s, the Florida well encountering a 119 m gas column. Eni commissioned a 3D seismic survey across the entire license area: this revealed more potential gas structures, in the form of amplitude anomalies and flat spots, along a steeply dipping slope in water depths from 200-1,000 m (656-3,280 ft).

Before Northern can appraise the three gas fields with a view to development through existing facilities, it must file an environmental impact assessment in order to secure a license. Closer to the shore, Eni produces gas from the 3 tcf Luna field. “If we proceed to development,” says Musgrove, “it would be better for us to tap into their pipeline system, rather than apply for a landing permit elsewhere in Calabria.

“We have now identified 18 drillable prospects across our various licenses around Italy, and our main task is to start drilling them. Many are separated and segregated prospects. If money were no object, we would like to drill six to seven offshore prospects over the next two years, and four to five onshore. But money is an issue, so we may have to move more slowly.

“The current rig market is difficult, although the rig situation is easing in this area with various other operators’ programs in the Mediterranean and Black Sea finishing. And other exploration failures offshore Libya, allied to the trend to convert FPSOs to drillships, are working to our benefit in bringing rigs to the market.”