Recompletions keeping US Gulf output up; 190 leases in deepwater qualified for production

James Dodson

James K. Dodson Co.Leonard Le Blanc

Editor

With the rising day rates commanded by all drilling units in the US Gulf of Mexico, taking a unit out of service for shipyard work is costly. Shown in drydock is Sundowner's Dolphin 110 jackup (Photo courtesy Ingalls Shipbuil-ding).The US Gulf of Mexico harbors a revealing contrast: mobile rig utilization is at maximum, while the number of exploration and development wells drilled is down by almost 22% in the first quarter of 1997, compared to the same period in 1996. No - the industry isn't in decline, although more than a few producers are hoarding rigs. Contractors are drilling as fast as possible, but the wells, for a variety of reasons, require more time to drill.

In addition to a decline in wells drilled in the first quarter of this year compared to the same period in 1996, drilling permit applications received by the US Minerals Management Service have declined 28% over the same period. Also, the list of lease extension applications for undrilled leases continues to grow. A total of 3,931 leases were undrilled as of April 30, 1997.

The shifts in the three parameters - wells drilled, drilling permits applied for, and lease extensions - are signs that producers are working as fast as the rig fleet will allow. Also, producers have been reluctant to release rigs on contract expiration, and this factor has been instrumental in driving up rig rates.

Many producers, mostly independents, are using rigs under contract for development drilling only, a not-surprising choice as long as crude oil remains above $18/bbl (WTI) and natural gas above $2/Mcf (Henry Hub). In recent years, about 60% of drilling units have been involved with development operations, including re-completions and re-entries on producing fields for which a full-size rig is preferable. In fact, re-completions in 1997 are up 11%, according to first quarter comparisons.

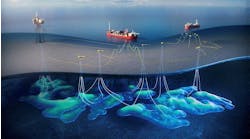

However, there is now an overhang of 2,088 undrilled long-term leases in depths exceeding 1,000 ft obtained with sizable bonus bids in lease sales over the past two years and held by monthly rent payments. Prospects for many of these new deepwater leases are excellent. There are more than 190 leases in 1,000 ft or deeper qualified for development.

Batch drilling

In order to cope with the severe shortage of drilling units in deepwater and the large number of leases held, producers are conducting batch drilling operations. Wells are drilled only to certain selected depths, rather than drilling to targets, so that broad geological trends can be examined. The selected depths are usually far short of the original target interval or intervals to minimize time on the well.The procedure allows an operator with a high-cost rig or a limited contract period to examine a large number of tracts in a short time period. The wells are plugged or suspended while an analysis of all the wellbores is undertaken. The most interesting wells are then re-entered and drilled to the target intervals. Extensions of selected leases for additional drilling and development are applied for when needed.

This process is made possible by the availability of 3D seismic, vertical seismic profiling, much improved reservoir evaluation while drilling, and modeling tools. While the technology is convenient to the procedure, producers are taking every available step to prevent relinquishment of undrilled deepwater leases with interesting geological targets simply because of a shortage of drilling equipment.

For rigs in shallower water, the fact that day rates are moving up each time rig contract renewals come up has encouraged some operators to refrain from all but the most necessary drilling. If new rig day rates are accounted for in the re-development of some shallow water fields in the Gulf of Mexico, the projects fall out of profitability, a factor that could encourage a switch back to exploration drilling or curtailment of all drilling.

Cost inflation

Have oil and gas producers seen these conditions before, and are simply choosing to slow drilling activity in order to stabilize day rates and allow rig newbuilds and upgrades to come onto the market? Some producers have adopted a wait-and-see attitude, while others are pursuing rigs regardless of day rates out of concern over shrinking rig choices and rising oil and gas prices.Mobile rig relief, in the form of rig upgrades (4-12 months out of service) and newbuilds (24-48 months fabrication time) is too far off to make an impact in the next two years. Higher day rates are beginning to discourage upgrade work, since contractors cannot justify pulling an asset with strong earnings out of service for a marginal gain. Some upgrade plans have already been scaled back.

Rising day rates aren't the only factor driving cost inflation for producers. New drill pipe, casing, some types of drilling fluid chemicals, downhole tools, wellheads, valves, and other types of equipment - which are all experiencing price appreciation - now are slipping into serious backorder conditions.

Undrilled leases

Bringing new drilling capacity online will take time, and if it does not materialize quick enough or at day rates compatible with planned drilling costs, there could be record relinquishments of undrilled leases after the year 2000.Of the 900-1,000 wells drilled each year in the US Gulf, less than 400 are drilled for exploration purposes. Today, 3-D seismic has lessened the number of exploration and development wells required, but in the end, there is no escaping the fact that the wells have to be drilled.

The shortage of drilling units capable of drilling in water depths exceeding 3,000 ft is critical. The number of undrilled leases in water depths exceeding 2,700 ft water depths as of April 30, 1997 totaled 1,701.

Undrilled leases in all water depths set to expire as of April 30 of this year totaled 223 in 1997. Of this number, 45% (101) are in depths greater than 2,999 ft. The situation is nearly as critical in 1998, in which 171 leases (43%) in water depths exceeding 2,999 ft out of a total of 392 undrilled leases (as of April 30) for all depths remain undrilled.

The fact that 155 leases expiring in 1999 are undrilled, and 1,204 leases expiring in the 2000-2007 time period are in the same situation suggests that at least 10-15 more deepwater mobile rigs are needed. Not included are 343 OCS Sale 166 tracts yet to be acted upon in water depths greater than 2,999 ft.

Just as interesting is the situation in water depths under 351 ft. There are 1,573 undrilled leases at this time , not including 309 OCS Sale 166 tracts not yet acted upon. There are only 314 undrilled leases expiring in the years 1997-2002 located in water depths of 351-1,200 ft. Relinquishments of undrilled leases could climb in the next 2-3 years, but the number will greatly depend on US gas demand and gas prices.

Wells drilled

The drilling rate in the US Gulf of Mexico during the first quarter of this year is down 62 wells (22%) from the number recorded during the first quarter of 1996. On an annualized basis, a projection of first quarter drilling would produce 986 wells for 1997, compared with 1,091 for all of 1996.A number of factors contributed to the first quarter slowdown and some factors may impact the remainder of 1997:

Overall, first quarter 1997 development drilling was down by 37 wells, and 25 fewer exploratory wells were drilled.

- Sale preparation: Both major and independent operators slowed permit applications and drilling to prepare bids for tracts in the March, 1997 OCS lease sale, which set 10-year high records. The Western OCS sale upcoming may also encourage operators to slow drilling acitivity.

- Budget maintenance: As day rates began to escalate during lease negotiation, some operators scaled back the number of wells planned during early 1997.

- Deeper water: Both fixed and floating mobile drilling units are drilling in deeper water. Drilling in deepwater can double the amount of rig time for each well.

- Platform drilling off: The number of wells drilled on platform units dropped by 34% in the first quarter, due to batch drilling programs.

At least some portion of the falloff in development drilling is due to technology, which has reduced the number of development wells needed. Horizontal, extended reach, and multi-lateral drilling are all having the largest impact on development drilling.

Wells permitted

Well permits granted by the US Minerals Management Service for the US Gulf of Mexico in the first quarter of 1997 closely track the drop in drilling activity compared with the first quarter of 1996.Permits granted fell by 28% in the first quarter, due largely to a drop of 52 permits for platform wells. Mobile rig drilling permits are down only 18% for the first quarter, proportionally lower than the 28% drop in permits for all wells. Development well permitting fell by 34% in the first quarter of this year compared with last year, and exploratory well permitting was off by only 19%.

Another interesting factor concerning first quarter data is that the number of drilled leases for which permits have been granted has dropped by 65%, meaning that most exploratory permits are for new undrilled leases.

Well intervals

Well intervals completed are becoming a more important efficiency factor to track rather than wells drilled. Smaller reserve accumulations put a premium on tapping as many intervals as possible with a vertical or directional borehole, especially development wells drilled from platforms with a limited number of well slots. Directional wells are designed to intersect more than one productive interval and to maximize exposure and production from any of the encountered intervals.A comparison of intervals drilled versus oil and gas production also provides some indication of a company's production efficiency, although it could be misleading if an operator has more exploration than development underway.

A ranking of 111 operators in the US Gulf of Mexico by well intervals compiled for the month of September 1996, for example, shows Chevron has tapped 2,452 producing intervals, compared with the next closest operator - Shell - which has 1,415. Following behind are Mobil, with 819, Exxon with 680, Unocal with 674, Pennzoil with 630, Conoco with 556, and Texaco, with 501. Vastar, Murphy, Samedan, Norcen, Marathon, and Amoco follow closely behind.

Shell is a clear leader in terms of production volume, ranking number one in both oil and gas production. Chevron is second in both categories.

There are a number of discontinuities in the ranking list of 111 operators. For example, Pogo Producing ranked 42 in number of intervals drilled, but produced enough gas to rank 33. Anadarko ranked 47 in well intervals, buy 39 in gas produced. Coastal ranked 48 in well intervals and 36 in oil produced. Zilkha ranked 52 in well intervals, but 14 in amount of gas produced and 32 in amount of oil produced. Flextrend Development ranked 77 in well intervals, but 31 in oil produced and 38 in gas produced.

Another interesting feature of the ranking was that the top 40 operators accounted for 92% of all the intervals recorded through September 1996, and was producing 93% of total oil production and 87% of total gas production from those intervals. Seventy-one other operators have the remaining eight percent of well intervals and the remaining oil and gas production.

Field maturation

While deepwater offers a new exploration and development play, the shallower US Gulf continues to mature. Water disposal is becoming a serious issue for producers. Every bbl oil equivalent (BOE) produced includes 47% water on a total volume averaged basis. Since well completions are designed to eliminate or push back water production, the rate of water production to total production is an indication of field maturation. Wells are usually shut in intermittently or the completion interval is shifted when water production becomes too costly to handle.In 1996, US Gulf producers produced 562 million bbl of water, compared with a 1.186 billion BOE (361 million bbl of oil and 4.9 billion Mcf of natural gas). In 1990, the production rate of water was 45% of every BOE, and 42% in 1985.

What is so significant about today's rate of water production is that is it more than twice the rate produced in 1980 (24%). To dramatize the changes in US Gulf production historically, 1970 BOE production contained only 15.6% water; 1960 production contained 8% water; and in 1960, water production averaged 1%.

While unwanted as a produced fluid, water is valuable in place in the reservoir as a pressure driver. Hence, the interest in re-injecting produced water in the reservoir. However, the process becomes uneconomic at high production volumes. In addition, oil and gas production rates must be carefully controlled so as to avoid water coning in the reservoir and premature water-out of the wells. Many of the workovers underway in the US Gulf involved re-positioning of completions in the wellbore to prevent high water production flows.

The future

In most respects, the US Gulf must be viewed as two separate provinces - very deep water, and everything else.Deepwater exploration and development is a separate play, since per-well production rates rival those of the North Sea during peak discovery years, and producers are not about to slow down in developing company-building reserves.

Exploration and production in deepwater will be driven by the availability of drilling rigs, and not necessarily day rates. Rig additions for very deep water are still some years off. There are now 32 operators holding 1,995 leases in water depths greater than 2,999 ft, and more are expected to join this group after the tract awards from OCS Sale 166. There are only eight operators that have drilled one or more wells in water depths greater than 2,999 ft. These eight have drilled a total of 165 wells in 2,999-ft-plus depths.

Activity in the middle depths (656-2,000 ft), an area which includes the flextrend and a number of interesting salt structures, have slowed perceptibly in recent years. The upgrading of semisubmersibles to drill in depths exceeding 3,000 ft, where there is a shortage of drilling rigs, has removed a ready supply units that were designed originally for 500-2,000 ft water depths, and driven day rates for lesser rated rigs up.

Activity on the shelf (656 ft and under) depends heavily on the US price of gas, since most of the production there is gas with short reservoir lives and most of the activity is conducted by price-sensitive independents. Despite a general maturation of exploration on the shelf, 3-D seismic has provided much better information about reservoirs and adjacent reserve accumulations.

Field re-development and directional drilling from existing platforms is now the prevailing activity in shallow water and the reason why development drilling continues to dominate exploration drilling in US Gulf activity. But, there are 1,320 undrilled leases expiring in the 1999-2002 time period in less than 351 ft water depths.

If global consumer demand for oil and gas continues to grow, the boom in the US Gulf that is now producing tight conditions for operators and support contractors and services will grow into dramatically greater shortages and costs for everything by the turn of the century. Even if demand levels off , oil and gas reserve depletion will keep conditions tight for a number of years to come. There is no relief in sight, or put another way - the party is just beginning.

Copyright 1997 Oil & Gas Journal. All Rights Reserved.