Judy Maksoud • Houston

Asia-Pacific

Australia has been working hard to create a more attractive investment environment for foreign companies.

Late last year, Australia's Ministerial Council on Energy approved the Australian Energy Regulator, which replaces 17 state-based regulators and a maze of legislation. The new agency was scheduled to be in effect July 1, 2004.

The council also approved the creation of the Australian Energy Market Commission, which will develop the market to guarantee electricity supply. The AEMC was also to take off on July 1.

More recently, the Australian government introduced a taxation incentive designed to encourage petroleum exploration in Australia's remote offshore areas. Designated areas are more than 100 km from an existing commercialized oil discovery and cannot be adjacent to an area designated in the previous year's acreage release. The ruling applies to the annual offshore acreage releases for 2004 to 2008.

This measure allows an immediate uplift to 150% on petroleum resource rent tax (PRRT) deductions for exploration expenditure incurred in the designated areas. The 150% uplift applies to pre-appraisal exploration expenditure in the initial term of the exploration permit granted for a designated area. Uplifted expenditure will also retain access to the transferability and annual uplift provisions of the PRRT.

Australia has 40 offshore basins that show signs of hydrocarbon potential, but half remain unexplored because of the cost and risk of exploration.

This measure lowers the cost of petroleum exploration in frontier areas and provides an incentive to explore Australia's remote offshore areas.

Under this incentive, the Minister for Industry, Tourism, and Resources may allocate up to 20% of each year's offshore petroleum exploration acreage release areas as designated frontier areas.

Asia-Pacific

CNOOC Ltd. has seen more positive results in Bohai Bay. Early in 2Q, the company revealed the successful results of appraisal well Jinzhou (JZ) 25-1S-4D, which confirmed the oil and gas pay zones in JZ 25-1S structure.

JZ25-1S-4D, drilled in 26 m of water to a TD of 2,022 m, is in the Liaodong area.

According to Zhang Guohua, CNOOC Ltd. senior vice president, "Following recent successful BZ 34-1 appraisal wells, the positive results on JZ 25-1S-4D further demonstrate the reserve potential of Bohai Bay. Further wells are planned. I look forward to these future well results that will indicate reserve size there."

CNOOC owns 100% interest in the discovery.

Americas

ExxonMobil Corp. is getting set to begin exploration offshore Colombia. The company's affiliate, ExxonMobil de Colombia S.A., together with Ecopetrol and Petrobras, signed a participation agreement in mid May to begin exploration.

The agreement covers the 11-million-acre Tayrona block, off Colombia's northern coast in the Caribbean Sea. Petrobras will be operator during the exploration phase, and ExxonMobil will be operator for the development phase in the event that gas is discovered on the block.

ExxonMobil has operated in Colombia since the early 1900's.

Europe

Statoil recently awarded a charter worth $49 million to Ocean Rig for the use of the semisubmersible Eirik Raude in the Barents Sea. Work is to be carried out in three exploration areas over an estimated 155 days.

Statoil will operate one well each in areas G and F, while Hydro plans to drill one in area C.

Ocean Rig's Eirik Raude will drill the Glitne field in the Barents Sea.

null

Statoil and Hydro signed the letter of intent to drill the three wells in April, but the rig that will be used was only determined in May.

Plans call for the first well to be spudded in late fall. The Eirik Raude will also carry out a minor job for Hydro on the Troll field in the North Sea before moving to the Barents Sea. The Troll work is included in the charter's overall value.

A second award for two deepwater wells and one optional well followed the initial contract and will further Statoil's exploration campaign in the Barents Sea.

OMV (Albanien) Adriatic Sea Exploration GmbH, a subsidiary of OMV, has signed a production-sharing contract with the Albanian government for a new offshore exploration license.

Plans are in place to acquire a 400-sq-km 3D survey over the newly licensed Durresi block. Meanwhile, over the next four years, the company will reprocess 1,000 km of existing 2D seismic data.

OMV began onshore E&P activities in Albania in 1991 and now has interest in blocks 1, 4, and 5. The newly acquired block is the company's first offshore license in the region.

OMV will operate the block with 50% interest. Swedish partner Lundin Petroleum holds the remaining 50%.

Middle East

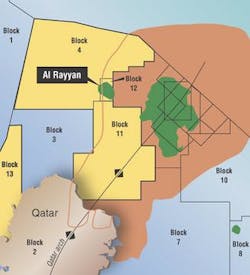

Anadarko Petroleum Corp. has signed an oil and gas exploration and production sharing agreement with Qatar Petroleum for offshore block 4.

The 3,132-sq-km contract area is 40 km from the northern coast of Qatar and lies adjacent to the Anadarko-operated Al Rayyan oil field in block 12.

The terms of the agreement call for an initial five-year exploration phase during which Anadarko, in partnership with QP, will undertake a work program comprising technical studies, seismic reprocessing, acquisition of 2D and 3D seismic data, and exploratory drilling.

"Block 4 is an important addition to Anadarko's existing portfolio of exploration opportunities in Qatar. The block is situated within some of the world's most prolific petroleum systems, and has remained relatively unexplored for the last 30 years," Jim Emme, Anadarko's vice president of exploration and business development, said. "Qatar has become a focal point for growing our strategic asset base in the Middle East."

Anadarko's newly awarded block 12 offshore Qatar is adjacent to the Anadarko-operated Al Rayyan oil field.

null

Anadarko acquired its position in Qatar through the purchase of Gulfstream Resources in 2001. In 2002, with the purchase of BP's interests in blocks 12 and 13, Anadarko increased its working interest from 65% to 92.5% and became the operator. Anadarko also holds a 49% interest in block 11, operated by Wintershall. With the addition of block 4, Anadarko will hold interest in over 1.5 million gross acres in Qatar.

Anadarko holds a 100% interest in block 4.

Central Asia

China continues to look outside its borders for E&P opportunities.

In late May, the government of Kazakhstan reportedly signed an agreement with China that will allow Chinese oil companies to participate in exploration and development on the Caspian Sea's continental shelf.

The two countries are also looking into plans for a natural gas pipeline from Kazakhstan to China. An agreement signed by China and Kazakhstan in 1997 for a 3,000-km oil pipeline has resulted in a 448-km segment in operation, with construction of the remaining section of the pipeline scheduled to begin this year.

Africa

China is also making plans to invest in West Africa. CNOOC has signed a deal with Morocco to participate in offshore oil and gas exploration. This is the company's first offshore agreement in the region, though CNOOC has profitably invested in Sudan and has gotten involved in onshore deals in northern Africa and Gabon since the beginning of 2004.

Also off Morocco, Vanco Energy Co. began operations in early May on the Shark B-1 deepwater exploration well 130 km off the coast. The drillship Saipem 10000 is drilling the well, which has a planned TD of 4,162 m.

The Shark B-1 well is the first deepwater well offshore Morocco.

The Vanco Group is made up of operator Vanco Morocco Ltd. with 33.75% interest, Eni Morocco B.V. with 30% interest, Moroccan national oil company Onarep with 25%, and CNOOC Morocco Ltd. with the remaining 11.25% interest.

UK independent Tullow Oil Plc has expanded its presence offshore West Africa with the take-over of South Africa-based Energy Africa. Tullow, which has been active offshore Côte d'Ivoire, Cameroon, and Gabon, will acquire interest in licenses in Egypt, Morocco, and Mauritania as well as development projects in Equatorial Guinea, Namibia, and Congo.

In early May 2004, Energy Africa's board of directors announced that Tullow intended to acquire all of the issued share capital of Energy Africa for $500 million. The Energy Africa board released a statement resisting the take-over, noting that the timing is not favorable to stockholders in the company. Despite that, Tullow has announced that other shareholders, representing about 25.3% of the issued share capital of Energy Africa, have irrevocably agreed to accept the offer. Reportedly, the holders of 90.5% of the issued share capital of Energy Africa are irrevocably committed to accepting the offer.

ChevronTexaco's Angola block 0 concession, held by subsidiary Cabinda Gulf Oil Co. Ltd., has been extended beyond 2010 to 2030 by state oil company Sonangol.

Comprising 36 major fields, including Takula and Malongo, the 2,155-sq-mi concession lies off the coast of Cabinda Province. Average production from block 0 is 400,000 b/d of oil.

The extension agreement formalizes a previously concluded heads of agreement governing the flow of investment to major block 0 capital projects, including the Sanha gas condensate development, which continues on schedule and will cut routine flaring on the block by half when it comes fully onstream in early 2005. In addition, with the extension now signed, Cabgoc will be able to redouble its efforts around other strategic business aims.

ChevronTexaco's chairman and chief executive officer, Dave O'Reilly, said, "This agreement is the latest highlight in ChevronTexaco's long-term partnership with Angola and underscores our commitment to a country where we have had a presence since the 1930s. It also sends a strong message to the international business community – that we have found Angola to be a good place to invest."

Cabgoc has confirmed it is moving forward with plans to open an office in Cabinda City in 2005.

Cabgoc operates block 0 with 39.2% interest. Partners include Sonangol with 41%, Total with 10%, and Eni with 9.8%.