While global pandemics and falling oil prices are taking the steam out of upstream capex, two Gulf of Mexico operators are moving forward with their deepwater development plans.

Chevron has contracted Wood to deliver engineering design for its Anchor deepwater development in the Gulf of Mexico.

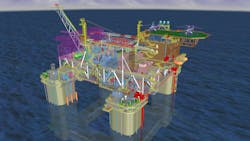

The scope of the project included the preliminary front-end engineering and design (FEED), FEED, and now entails detailed design of Anchor, a wet tree development that will use a semisubmersible floating production unit (semi-FPU).

Anchor is the industry’s first deepwater high-pressure development to achieve a final investment decision.

The project will be led by the company’s engineering teams in Houston, with the contract awarded under an existing 10-year master services agreement with Chevron.

Under the scope of work, Wood is delivering a fully integrated design for the topsides and subsea system, incorporating risers, production flowlines, export pipelines, and flow assurance analysis.

KBR has been awarded the FEED contract for the semi hull; South Korea’s Daewoo Shipbuilding & Marine Engineering (DSME) will build the semi hull; and US-based Kiewit will build the topsides.

OneSubsea, which signed a 20-year subsea equipment and services master contract with Chevron in July, has a contract to provide engineering and qualification for subsea equipment on the field.

The Anchor discovery is in Green Canyon block 807, located about 225 km (140 mi) offshore Louisiana in more than 1,500 m (4,921 ft) of water.

With an operating pressure of 20,000 psi, it is one of the first ultra-high-pressure projects in the world. The semi-FPU is expected to have a production capacity of 75,000 b/d of oil and 28 MMcf/d of gas, with the potential for future expansion.

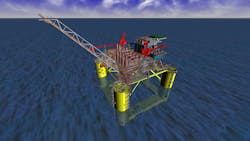

Meanwhile, Shell has contracted Sembcorp Marine Rigs & Floaters Pte. Ltd. to build and integrate the topsides and hull of an FPU for the Whale field in the Gulf of Mexico.

The agreement precedes a final investment decision (FID) for the full Whale project, which is expected to be made next year by Shell. It paves the way for the Whale FPU to move ahead and take advantage of synergies from Shell’s Vito FPU, currently under construction at Sembcorp Marine’s Tuas Boulevard Yard. Shell has stated that Vito will apply a new, simplified host design and subsea infrastructure. In addition, the development assumes a break-even oil price below $35/bbl.

The Whale FPU comprises a topsides module and a four-column semisubmersible floating hull, with a combined weight of 25,000 metric tons. Slated for completion in 2022, it will operate in the Alaminos Canyon block 772.

Like the Vito FPU, the entire Whale FPU topsides will be integrated and commissioned on ground level at Tuas Boulevard Yard in order to minimize work-at-height risks for the workers, Sembcorp Marine said. The completed FPU topsides will then be raised and attached to a 51-m (167-ft) tall hull, using a pair of gantry cranes that can lift up to 30,000 metric tons.

The cranes will enable the company to integrate the topsides and hull in one lift, according to William Gu, Sembcorp Marine Head of Rigs & Floaters.

Subsea 7 to engineer Murphy’s deepwater GoM tiebacks

Murphy Exploration and Production Co.—USA has contracted Subsea 7 to provide the subsea installation services for the Samurai and Khaleesi/Mormont developments in the Green Canyon area of the Gulf of Mexico.

This contract covers the tieback of seven subsea wells to the King’s Quay FPS that will be moored about 282 km (175 mi) south of New Orleans.

The project scope includes engineering, procurement, construction, installation, and commissioning of all subsea equipment including PLETs, PLEMs, umbilicals and distribution hardware, production and export flowlines and jumpers, as well as the wet tow in the Gulf of Mexico to the fields and mooring system installation of the semisubmersible FPS.

Project management and engineering will start immediately at its offices in Houston. Fabrication of the flowlines and risers will take place at the company’s spoolbase in Ingleside, Texas, with offshore operations occurring in 2021.

Craig Broussard, vice president for Subsea 7 US, said: “Subsea 7 will provide a single point contract for the SURF and mooring work scopes on this project, which allows for improved management of the interface risk.”

Shell mulls Mars crude oil pipeline expansion

Shell Midstream Partners LP expects to take final investment decisions on expanding its Mars crude oil pipeline system in the Gulf of Mexico in the first half of the year, according to a Reuters report.

Shell has seen significant interest from oil producers as the 600,000 b/d system nears capacity, and the company is working toward finalizing agreements with them for additional capacity on the system, executives said in a conference call with analysts. “Our outlook, as always, on the Gulf of Mexico remains bullish,” said Chief Executive Kevin Nichols. Production in the area has grown 9% year-over-year, and is up over 57% since 2014, Nichols added.

The company does not want to comment on the specifics of expected added capacity or what it would spend on the project on the Mars corridor, a 260-km (163-mi) crude oil pipeline originating approximately 209 km (130 mi) offshore in the Gulf of Mexico. It transports crude from the Mississippi Canyon-area to Clovelly, Louisiana.

“When we get to the point of definitive agreements and bringing it online, which is estimated around mid-2021, we’ll give guidance in customary fashion at that point,” said Steven Ledbetter, vice president of commercial for Shell Midstream.

Shell also said Amberjack Pipeline Co. has signed a dedication and connection agreement with Chevron’s Anchor project, which is expected to produce oil in 2024. The project is expected to open up 75,000 b/d of crude oil production, which will be transported on the Amberjack pipeline. Amberjack Pipeline Co. is a joint venture between Shell Midstream Partners and Chevron Pipe Line Co. •