Offshore staff

OSLO, Norway – Panoro Energy has entered agreements to acquire interests held by Tullow Oil in producing fields offshore Gabon and Equatorial Guinea.

The transaction involves an initial cash consideration of up to $140 million and an aggregate contingent consideration of up to $40 million.

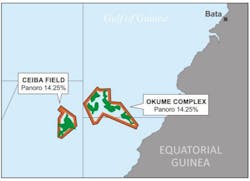

It would give Panoro a 14.25% stake in the Trident Energy-operated block G offshore Equatorial Guinea, and an additional 10% in the Dussafu Marin permit offshore Gabon, operated by BW Energy (Panoro already holds 7.5%).

Combined net production gained is around 6,900 b/d of oil, with an estimated reserves life of close to 13 years and exploration potential.

Block G contains six fields currently producing through the Ceiba and Okume complexes. Other partners are Kosmos Energy and state-owned GEPetrol.

Since 2000, Ceiba and Okume have to date delivered almost 450 MMbbl gross, and have a break-even of less than $25/bbl due to low opex and limited capex requirements. The present licenses expire respectively in 2029 and 2034, although Panoro sees potential to continue production from until 2050 or beyond.

Ceiba, discovered in 1999, is in 600-800 m (1,968-2,624 ft) water depth on the slope of the southern Rio Muni basin, and around 35 km (21.7 mi) offshore. The field has been developed in phases with production wells tied back to the Ceiba FPSO via six subsea manifolds and flowlines.

There are currently 16 active producer wells and 10 water injectors.

The Okume complex comprises the Okume, Ebano, Oveng, Akom North and Elon fields, all discovered in 2001-2 and tied back to a central processing facility at one of the Elon platforms.

From there, processed oil is transported via a 25-km (15.5-mi) pipeline to the Ceiba FPSO for export. The fields have a total of 32 active producers and 12 water injectors.

Panoro has been a partner in Dussafu since 2007. The facilities currently generate around 15,000 b/d from four wells at the Tortue field, with two further wells planned this year to increase output to ~20,000 b/d.

The phased development of the Hibiscus and Ruche fields could lift overall production to around 40,000 b/d in 2023, with further growth potential from Hibiscus/Ruche Phase 2.

One firm exploration well is scheduled for the greater Hibiscus structure in 2Q, with options for another.

Tullow said it would use net proceeds from the Equatorial Guinea transaction to strengthen its balance sheet as its looks to reduce its net debt and focus capital on high-return investment opportunities.

02/10/2021