Offshore staff

OSLO, Norway – Development spending offshore Norway will soar in the short-term following the submission of plans for multiple projects late last year, according to Rystad Energy.

The consultancy estimates the overall cost of greenfield investments proposed in 2022 at $42.7 billion. And those projects sanctioned under Norway’s temporary tax regime should help sustain high gas production on the Norwegian Continental Shelf (NCS) through 2030.

Aker BP’s North Sea Yggdrasil Hub (startup in 2027), Shell’s Phase 3 of Ormen Lange (startup in 2025) and Equinor’s Irpa (startup in 2026), both in the Norwegian Sea, will be major contributors.

And NCS liquids production should also be steady going forward, helped above all by the Yggdrasil Hub, Equinor’s Breidablikk (start-up in 2025) and Vår Energi’s Balder Future (start-up in 2024).

But the main suppliers will continue to be major fields sanctioned during the standard tax regime, such as Johan Sverdrup in the North Sea.

Rystad estimates the additional supply of gas in 2028 at about 24.9 Bcm, close to 6.225% of demand in the EU and the UK combined, with Norway accounting for almost one-third of European gas supplies in five years.

Upstream analyst Mathias Schioldborg said, “The outcome of this tax break is threefold: increased investment on the NCS, increased tax receipts when production starts and increased supply to Europe at a critical time. Norway will need to consider if this regime is a one-off to attract investment or if lessons can be learned for the future.”

The government implemented its temporary tax regime in 2020 during COVID-19 and the market downturn to secure future development spending. The measures incentivized operators by boosting the uplift rate on all ongoing investments in 2020 and 2021, and on new projects sanctioned before 2023 up until first oil flows.

Despite a reduction in the uplift rate last year from 2020's 24% to 12.4%, the temporary regime still lifts the net present value and lowers the breakeven prices of development projects.

NCS operators strove to submit their plans of development and operation before the new standard regime took effect at the start of this year.

Of the 35 projects sanctioned within the temporary regime, 24 were sanctioned in 2022, a record for Norway in a single calendar year, with the total value of these projects likely to approach $29 billion.

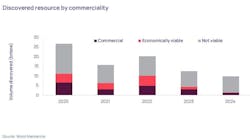

Greenfield spending from the 35 projects should climb steadily over the next three years, to $9.1 billion in 2024, $7.4 billion in 2025 and to $6.3 billion in 2026. The combined resources are estimated at 2.472 Bboe.

Production from the tax window projects should peak at 921,000 boe/d in 2028. Thereafter, based on current plans, production could slip to 818,000 boe/d in 2029, 659,000 boe/d in 2030, then evening out at 254,000 boe/d in 2035.

01.26.2023