Offshore staff

LONDON – The UK is seeking to emulate Norway’s successes in platform electrification to meet decarbonization target.

According to Wood Mackenzie analysts Lucy King and Neivan Boroujerdi, around two-thirds of operating emissions come from power consumption related to production, processing, and liquefaction.

Norway is set to sanction expenditure of close to $5 billion on the next wave of platform electrification over the next two years, with schemes approved by the end of 2022 benefiting from the current temporary tax terms.

Electrification has led to emissions savings of around 25% and kept absolute emissions flat, the analysts add, despite an increase in activity and infrastructure.

Earlier this year, the UK’s North Sea Transition Deal set a target of a 50% reduction in emissions from oil and gas production in the sector by 2030, leading to the focus on platform electrification.

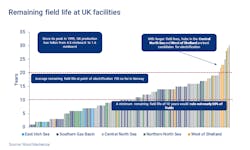

Norwegian fields have typically had 20 years of remaining life prior to electrification. But in the UK the associated costs for a minimum remaining field life of 10 years would rule out nearly 50% of fields, the analysts claim, while 20 years would rule out more than 90%.

Hubs in the UK central North Sea and west of Shetland, where field lives are longer, appear to be the best candidates, but this will still require major investment and swift action to comply with decarbonization targets.

Although carbon prices have increased following the recent gas supply constraints, they remain too low to incentivize electrification. Without cost reductions or funding support, a carbon price of $250/metric ton would be needed to cover the capital cost of a typical UK standalone electrification project, the authors claim.

Therefore, collaboration is a must, with multiple fields and their partners sharing infrastructure. Hub-led solutions could cut costs by 50% on an emissions-saved basis and lower the ‘carbon breakeven’ price to $125/metric ton. Financial assistance from the government, similar to Norway’s NOx fund, could bring it down further.

In the UK there is limited tax relief for such projects compared to Norway. An uplift on capital spend associated with decarbonization could encourage investment, while refunds on tax losses, similar to those for E&A expenditure in Norway, could incentivize companies not in a tax-paying position.

Another issue the UK needs to get to grips with is the lack of infrastructure to power offshore electrification, so grid access and regulation around pricing should be prioritized, the analysts suggest.

Although taking power from the Norwegian grid is an option, access to offshore wind, the costs of which are coming down, could help drive UK platform electrification forward.

11/10/2021