Total pounces on Jura

Total is developing its Jura gas-condensate field in the northern North Sea, just four months after its discovery. With reserves of over 170 MMboe, this appears to be the UK’s largest new field development since Nexen’s Buzzard.

For Total, the main motivation is maximizing throughput in its Alwyn Area infrastructure. Jura’s production will head through a 3-km (1.9-mi) pipeline to the Forvie North subsea wellhead, itself connected to the Alwyn North processing platform. After coming onstream in spring 2008, Jura’s output should peak at 45,000 boe/d. Total plans further exploration in this area on the Jura East prospect.

In the UK central North Sea, Oilexco has delivered yet another discovery with its sustained drilling campaign, this time on the Kildare prospect in block 15/26b. The Canadian operator was awarded the acreage jointly with Nexen under the UK’s 23rd offshore licensing round.

The semisubmersibleOcean Guardian drilled the well to a TD of 14,330 ft (4,368 m), encountering 27.7 m (91 ft) of net pay in Upper Jurassic sands. On test, the well flowed 4,216 b/d of oil and 3.1 MMcf/d of gas via a 64/64-in. choke. The partners plan further drilling to appraise the extent of the oil accumulation.

In the UK’s southern gas basin, EnCore Oil and Star Energy are considering the conversion of three decommissioned fields for use as a seasonal gas store. Esmond, Forbes and Gordon were developed jointly by Hamilton Oil. Esmond, the largest accumulation, had original reserves of 250 bcf. Star plans to acquire low density 3D seismic over the three fields. According to EnCore CEO Alan Booth, “It has long been known that the UK lags much of Europe in the provision of gas storage. This project has the potential to more than double the UK’s gas storage capability.”

However, according to a recent presentation in London by Tullow Oil, storage was not an issue this winter past, due to a sudden influx of gas from new suppliers in Norway and The Netherlands. More of a concern was the resultant depression of UK gas prices, although rates have risen since. High rig rates also worried the company’s chief executive Aidan Heavey. “In our view, these are having a detrimental effect on the mature parts of the UK North Sea, causing some North American companies to scale back their drilling plans,” he said.

Hydro ups recovery target

Hydro has made a small oil discovery southwest of its producing Grane field in the Norwegian North Sea. The semisubmersibleTransocean Winner found oil in Jurassic sandstone, but only traces of hydrocarbons in the primary Tertiary target.

In the Troll production license, Hydro has agreed long-term contracts with Awilco Offshore for two new rigs, to be built by Yantai Raffles Shipyard in China. These should start operating on Troll in 2009 and 2010. Each will drill development wells for a period of at least five years. Hydro’s latest long-term plan for Troll involves increasing oil recovery by 30% to over 2 Bbbl. So far, 113 wells have been drilled to drain the field, many of which are multilaterals with two and six branches.

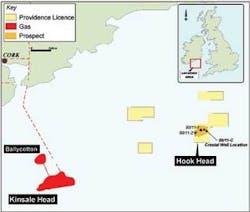

Hook Head awaits Petrolia

Providence Resources plans to re-explore Marathon’s 1971 Hook Head discovery off southern Ireland. The Dublin-based company has secured the semisubmersiblePetrolia for a 50-day slot this summer to drill an appraisal well on the structure’s crest.

Hook Head is a large, mid-basinal anticline beneath 80 m (262 ft) of water in the North Celtic Sea basin. The discovery well logged around 100 ft (30 m) of hydrocarbons in five Lower Cretaceous sandstone layers. Another Marathon well in 1975 successfully delineated more reserves at the structure’s down-dip edge.

Providence newly acquired seismic puts the crest around 2 km (1.2 mi) northwest of the 1971 well, and at a location 70 m (229 ft) higher. The company believes in-place reserves could be around 70 MMbbl, or 250 bcf.

In St. George’s Channel, towards Wales, Providence has gained an extension to its licensing option 05/3 from the Irish authorities until end-September. The acreage contains the Apollo prospect, also identified by Marathon in the 1990s following a 2D seismic survey. New in-house mapping suggests Apollo may hold up to 300 MMbbl in Lower Jurassic sands, with further upside in Upper Jurassic sequences. Marathon’s nearby Dragon discovery from 1994, off west Wales, flow tested at 20 MMcf/d. Providence will use the extension to conduct further subsurface work, and to seek farm-in partners.

Viking set to revive Peak

Lundin Petroleum is combining its UK and Norwegian North Sea businesses into a new company, Viking Oil and Gas. Just over half of Viking’s shares will be offered to investors via a planned listing on the Oslo Stock Exchange.

The new operation will be headquartered in Oslo, with a branch in Aberdeen. With forecast production of over 20,000 boe/d this year, it will rank in the top tier of Norwegian independents after Statoil/Hydro. Lundin puts Viking’s net proven and probable reserves at 96.6 MMboe, with 974 MMboe of net unrisked prospective resources.

Among its undeveloped properties are Peik, formerly operated by Total, which straddles the UK/Norway North Sea median line. Viking owns 50% of the Norwegian side, with further interests in two blocks containing the UK section. Recently, Canada’s Bow Valley Energy farmed in to both sets of licenses.

The latter has become a specialist in cross-border projects in this region, also involved in the current Enoch and Blane developments. The company believes the partners will push for development to start next year, via a subsea tieback to Alvheim or Heimdal on the Norwegian side, or to Bruce or Beryl in UK waters. Another gas discovery in block 9/10b West could also be factored in. Field analysts ScanBoss put Peik’s recoverable reserves at 20 MMboe.