Privatization is slowly stirring Scandinavia's oil and gas sector. In Norway, recent divestments of the state's upstream assets have favored production-hungry indepen-dents. This should ultimately galvanize mature field development, offsetting planned cuts in Statoil's domestic offshore program.

Statoil is focusing more on large overseas markets in readiness for its own part-privatization. The same applies to Denmark's state company, Dansk Olie og Naturgas (DONG), although in this case the change is also stimulating Danish offshore projects.

DONG was formed in 1972 to establish, and subsequently manage, the country's natural gas pipeline system. Currently, it is the monopoly buyer and sole supplier for all Danish North Sea gas, produced mainly by the Dansk Undergrunds Consortium (DUC) of A.P. M ller, Shell, and Texaco, and by Amerada Hess from the Syd Arne field. Supplies are sold throughout Denmark to regional distributors, large industrial users, and to DONG's own 100,000 direct customers. Some quantities are also exported to Germany and Sweden.

Life will get less comfortable for DONG when the government opens the Danish market fully to outside suppliers, probably in 2004, in line with European Union moves to liberalize Europe's energy markets. On the other hand, DONG will also draw strength from last year's revision of Denmark's Natural Gas Supply Act, which allows it to explore for, and produce, oil and gas throughout northwest Europe for the first time.

Full privatization of DONG will be implemented over the next four to five years, although the format has yet to be decided. To compete with much larger companies such as Statoil in European energy markets, DONG needs to grow rapidly. The build-up started this decade with the acquisition of numerous producing interests off Norway. These have raised DONG's daily output over the past year from 20,000 to 50,000 boe.

Production will accelerate further now that DONG has secured operatorship of the Siri complex of fields off northwest Denmark from Statoil. Elsewhere, the company is building a strong exploration position in the Atlantic Margin, and it is also at the forefront of plans to install new offshore gas lines across northern Europe.

Skills transfer

Since 1984, DONG has been a participant in all Danish E&P licenses, with a mandatory stake of 20% in all the currently active 35 concessions, plus in some cases, a commercial stake acquired in the same concessions. Over much of the previous two decades, M ller, and subsequently the DUC, had been the sole acreage holders. The state's interest has persisted, despite the opening up of the Danish shelf in recent years through bidding rounds.

"We have used our position as a mandatory participant to develop our competencies," says Soren Gath Hansen, DONG E&P president. "Today we are a fully-fledged company with all the traditional operator skills in exploration, development, and production, the latter two currently in practice on the Nini/Cecilie field development project. This is new for us in the sense that we haven't operated development or production phases offshore, although we have done this onshore.

"The production operator role has already started following our takeover as operator of the Siri platform. We also have experience on Syd Arne (DONG 35%), where a number of our employees are collaborating with Amerada Hess. Syd Arne is a chalk field which started producing in 1999 and has a predicted 20-year lifespan. We have drilled horizontal wells there for Amerada. We have an agreement to drill all their wells in the Danish sector."

In fact, in the last couple of years, DONG has coordinated all exploration wells within Danish jurisdiction for all the operators - except Mærsk Oil and Gas, which has its own Danish drilling organization - using the same jackup rig, Ensco 70. Last year DONG was ranked as one of the top two North Sea drilling operators benchmarked by Rushmore Associates in Aberdeen, in terms of economy and efficiency. The latest well, managed for Phillips in license 5/98, led to the Svane high-pressure/high-temperature discovery, the deepest to date in the Danish sector.

"We have particular expertise in chalk plays," says Gath Hansen, "built up with Amerada Hess as we have worked to understand the Syd Arne reservoir. Our other emerging specialty is Paleocene plays. As an operator, we are quite confident that we can develop this type of play also."

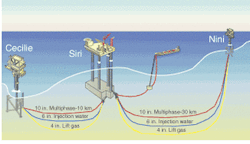

Nini/Cecilie are being developed through wellhead platforms tied back to the Siri production installation. Statoil discovered Siri shortly after the award of license 6/95 in the Danish sector in 1995.

"Until then," says Gath Han-sen, "all hydrocarbons found in the Danish North Sea had been in the Central Graben area." But Siri showed that there had also been migration from the Central Graben into the central northern part of the Danish continental shelf triangle.

Paleocene play

License 4/95, east of Siri, had originally been issued to Wintershall, Mobil, EWE, RWE-DEA, and DONG. Enterprise and Mobil opted out, whereas the Danish company Denerco Oil entered the license after a dry well targeting the Nolde prospect, but based on a different play concept. DONG and Denerco Oil had already been cooperating on Paleocene model studies on other licenses in Denmark. Two years ago, DONG acquired the remaining 50% of the Danish Operating Co. (Danop) from Denerco, and the staff from Danop provides the basis for DONG's current expertise in drilling operations.

During mid 2000, DONG spudded an exploration well on the Nini prospect, 30 km northeast of Siri.

The well found oil in the Paleocene and tested 5,866 b/d from a sandstone reservoir. It was followed by the Nini-2 appraisal well in the southwest of the prospect, which also encountered oil, and Nini-3, drilled 8 km northeast of Nini-1. This well again proved up oil in Paleocene sands, before being terminated in chalk of the Danian age.

"We knew that the Paleocene sands extended south from the Norwegian sector, with hydrocarbons moving east from the Danish Central Graben," Gath Hansen says. "Nini showed evidence of the longest migration seen in the Danish sector. The next step was to find other traps in this area, so we looked to the west, and identified Cecilie."

DONG began drilling the Cecilie Paleocene prospect, 10 km southwest of Siri, in January 2001. This well also encountered oil, and was followed by two side-tracks. The first confirmed the extent of the discovery, but the second, aimed at another target, only indicated oil shows.

"We also drilled one sidetrack on Nini," says Gath Hansen. "The fastest of these was completed in eight days. We could do this because we understood the play, and because our drilling team was far up the learning curve and could benefit from earlier wells drilled in this area. The technical and commercial aspects of this campaign involved drilling a lot of wells back-to-back, in order to save on rig mob/demob costs. That meant we didn't have to start up a new operation for each new well. For probable small or marginal finds like these, you need a low-cost, efficient well program from the outset, otherwise you will never embark on the exercise."

While DONG was reinforcing its commitment to the Danish sector, Statoil was looking for a way out.

"From Statoil's point of view, Siri was past its mid-life, and they had no interest in Nini and Cecilie," says Gath Hansen. "In a few years, the Siri platform would serve mainly as a processing center for our two fields, so both of us agreed that it would be more efficient to have one operator for the entire Nini, Cecilie, and Siri area."

At peak, Siri's reserves, including Siri North, were estimated at around 61 MMbbl, while Nini/Cecilie's are put at 65 MMbbl. "We may drill another exploration well soon on a new prospect close to Nini," Gath Hansen adds. "We think in general we've gauged the potential of these two fields, but we're convinced there are other prospects in the Paleocene play. We have an aggressive strategy for exploration, both here and on other prospects in the Siri 6/95 license."

DONG's DKr-1 billion purchase of Statoil's Danish interests also included interests in the small Lulita oil and gas field, which was developed via two extended reach wells from DUC's Harald platform.

Twin monotowers

Siri was an innovative, fast-track development involving a jackup production platform linked to a wellhead tower, with oil offloaded from a steel storage base on the seabed. Associated gas is reinjected into the reservoir. Last September, an extended reach well was drilled from the platform to tap the Stine-2 accumulation to the east. Development of a related segment, Stine-1, is being considered via subsea wells, possibly using the same 6-in. water injection line that will serve Nini.

DONG's DKr 2.5-billion plan for Nini/Cecilie was recently approved by the Danish authorities. One normally unmanned wellhead platform will be installed on each field, with the first of about 10 development wells scheduled to start early next year. Other partners in the project are Denerco Oil, Denerco Petroleum, and RWE-DEA.

The monotower wellhead platforms, similar to other satellite installations in Denmark, are supported on a triangular substructure with piles driven conventionally through the three legs.

For this project, the platforms will be identical, with each jacket weighing around 1,350 tons, the topsides 500 tons, and the piles 600 tons. Aalborg-based Bladt Industries has awarded Ramb ll the contract for platform design.

The minimal topsides will only include wellheads, chemical injection, and pigging equipment.

The platforms are expected to take nine months to build, with installation scheduled to June 2003. Ramb ll has also been awarded a contract by DONG to engineer tie-ins and modifications to the Siri topsides. New water injection facilities are planned, partly to cope with increased water production in the Siri wells. Other significant modifications include additional separation equipment, additional gas compression capacity, and the installation of a gas dehydration unit. The Nini/Cecilie wellstream will be brought in via 14-in. and 12-in. multiphase pipelines, with gas lift via 4-in. lines, and water injection via 10-in. lines.

Growth in Norway

Between 2002 and 2004, DONG plans to drill up to 13 wells as "operator" on the Danish shelf. They will include two on Paleocene plays and three HP/HT wells with Amerada Hess next year. It also plans to re-examine the potential of Amalie, a small gas-condensate discovery close to the median line with Norway. DONG is also a partner in Trym, on the Norwegian side, and may seek support for a cluster development of these two fields, plus Phillips' Svane discovery, through, for example, Syd Arne or a DUC platform.

"We're still developing our strategy in this area," says Gath Hansen. "We're not focused solely on developing small accumulations off Denmark, although having said that, we do have a competitive advantage in this sector. But we can't develop our business by confining ourselves to this area."

DONG's board has set an annual production growth target of 10%, with an increased gas content. "So we have started expanding elsewhere in the North Sea and beyond," Gath Hansen says.

DONG signaled its intentions in Norway last year by buying the Norwegian independent Pelican, which had producing interests in Statoil's Glitne, and BP's Gyda, Tambar, and Ula fields in the North Sea. Earlier this year, it boosted its stakes in Gyda and Tambar to 34% and 45%, respectively, following a successful bid for some of the State's Direct Financial Interest assets.

"We could also be interested in acquiring operatorship of mature fields like these," Gath Hansen says. "Our next step is to use our position to get into exploration. In last year's Norwegian North Sea licensing round, we picked up operatorship of block 1/3, close to the BP fields. The acreage includes Oselvar, a small Elf find from 1991, which we may look to develop."

In the much less explored Norwegian Sea, DONG is more interested in partnering opportunities, such as the 30% of PL2/84 covering three blocks that it was awarded this year in the 17th round with Phillips as operator. In this part of the shelf, Gath Hansen says, "we can transfer our experience from our work on our one Faeroese and two UK Atlantic Margin licenses." In all three, Amerada Hess is the operator.

Last year the Faeroes Partnership (Amerada Hess, DONG, BG, and Atlantic Petroleum) recorded the island's first offshore discovery with a well on the Marjun prospect. BG did not participate in the discovery, which was a sole risk operation by the remaining partners.

Hydrocarbons were found by drilling beyond the original target depth of 3,800 m. Now the group is lining up another well across the median line in UK waters in search of a possible extension to Marjun. Another group comprising Amerada Hess, DONG, ChevronTexaco, and OMV is also planning a well near the UK Faeroese border on the UK side, further north than the Marjun find.

Off Greenland, DONG has participated in recent and hitherto unsuccessful exploration efforts. Despite Statoil's withdrawal, DONG remains committed, having bought 50% of the state company Nunaoil.

"You have to look at the sheer size of this area," Gath Hansen says. "You wouldn't, for example, give up on mid-Norway just because of one dry well."

DONG is interested in transferring its gas industry competence to both Greenland and the Atlantic Margin, should future finds warrant it. LNG schemes figure in DONG's thinking. There are known stranded gas deposits west of the Shetland Islands that have so far defeated developers.

Line studies

In Denmark, DONG is also reassessing its position in gas provision.

"Although we have 100% of that market now," says Gath Hansen, "we are expecting competition to emerge." In the short term, DONG needs to find an outlet for the surplus gas it is committed to under its exclusive take-or-pay contract with the DUC. But from 2008 onwards, domestic demand is expected to outstrip declining Danish production. So imports will be required from Norway or Russia.

In anticipation, DONG has been involved in talks concerning several new trunklines in the North and Baltic Seas. Work on the proposed 230-km BalticPipe between eastern Denmark and Niechorze on the Polish coast has stalled, following Poland's recent reassessment of its import needs. There is some doubt over Denmark's capacity to supply the 16 bcm over eight years, which is the basis currently under discussion with Polish state company POGC. No decision will be taken on the project before year-end.

Another option for DONG could be to install spur lines between the Danish offshore trunklines and the long-distance Norwegian lines, taking gas through the North Sea and south to Germany (Norpipe, Europipe I and II) From 2008, reverse flow could be instituted to take Norwegian supplies into Denmark.

"The next step might be to extend the system westward with a new 400-km trunkline to the UK," Gath Hansen says. "Such a line would cost DKr 4 billion to build, and would need a throughput of 3-4 bcm/yr."