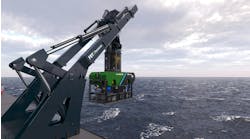

(Left)Seismic acquisition in the Caspian could be the start of a long-term engagement in Kazakhstan for Statoil.

(Right)Statoil and BP will benefit when AIOC brings fresh production on stream from Azerbaijan fields next year.

Last year saw Statoil make good progress towards its aim of establishing overseas activities as an important source of income, prompting the company to set itself new targets. "Discoveries in Denmark, Nigeria and Vietnam, the acquisition of Ireland's Aran Energy, good progress in Azerbaijan and interesting projects in Venezuela mean that we've laid a good foundation for a substantial production of oil and gas outside Norway within a few years," said a satisfied chief executive Harald Norvik.

The company has now set itself the target of producing 200,000 b/d of oil equivalent by 2005, a considerable advance on its previous aim of delivering 170,000 boe/d by 2010. It is now looking to achieve an operating profit by 1998 instead of 2000.

Statoil is active in more than a dozen foreign countries. In five of these - Nigeria, Angola, Azerbaijan, Kazakhstan and Vietnam - its participation is through its alliance with BP. Elsewhere - in the UK, Denmark, Eire, the US, Venezuela, Namibia, Thailand, China and Russia - it operates on its own.

Some of its activity is close to home, among its North Sea neighbors. In Denmark it made the best oil strike for years in the shape of the Siri discovery, with estimated reserves of 150 MMbbl of oil. it is now embarking on a fast-track development aiming at first oil in 1998. This may involve floating production of some kind, perhaps the submerged turret production concept developed by Statoil itself. Early planning for the Siri development is in the hands of a team which is also responsible for the Lufeng development in China, Oyo-1 in Nigeria, and Connemara in Eire. "These fields have a lot in common," says Lars Gunnar Dahle, the public affairs manager for International E&P. "For example, they seem appropriate for some form of floating production, though Siri may have sufficient reserves and the right kind of water depth to justify a fixed platform." With the agreed take-over of Aran Energy, which followed the Irish company's successful defense against a hostile bid from Arco last year, Statoil has become the leading acreage holder across the Atlantic Margin, according to Dahle. Properties acquired in recent months include Connemara, a small stake in Schiehallion west of the Shetlands, and seven 15th licenses off mid-Norway, some in waters up to 1,400 metres deep.

Operating abroad often brings a new political dimension to the tasks facing the company. After the execution last year of political activists in Nigeria, Statoil was criticized in some quarters for its presence in that country. "When we went into Nigeria in 1992, it seemed to be on the track to improvements. We still consider the long-term perspective as positive in terms of democratic development," Dahle says. "And after all, it's impossible for an oil company to go in and out of a country every other year." Nor does Statoil want to leave - it made a commercial oil discovery with its first exploration well, Oyo-1, and in February spudded a second.

Diplomatically Statoil is usually sure-footed, but appeared to be on the verge of a blunder earlier this year when it emerged that it was considering participating in an offshore project in Myanmar. It quickly assured the public that it had no plans to invest in that country before positive political developments took place.

The company's policy is to follow the lead given by the government, according to Dahle. "We don't want to go into Myanmar now as government policy supports the opposition," he says. It also shuns on principle Iran and Iraq, and a handful of other countries which it declines to name.

On the other hand, official policy is in favor of doing business with China, and Statoil has now returned there, taking over the operatorship and a 75% interest in Lufeng 22-1. The field is under development, with start-up scheduled for 1998.

Political considerations are also to the fore in Azerbaijan, where Statoil has an 8.6% stake in the Azerbaijan International Operating Co., which is developing the Chirag and Azeri Fields and the deepwater part of Gunashli. Agreements have been made to establish export routes through Russia and Georgia, which should allow initial production of 70-80,000 b/d to get under way next year. The real rewards will come with full-scale production of 700,000 b/d early in the new century. On the other side of the world Statoil has become involved in Venezuelan projects to export orimulsion and syncrude to the US. There is still debate about orimulsion's environmental acceptability, but Dahle says that if an adverse ruling results from the public inquiry currently under way in Florida, the contract will not go ahead.

This year Statoil plans to spend man million kronar on its overseas activities, but is still on the look-out for further attractive opportunities.

Copyright 1996 Offshore. All Rights Reserved.