Gene Kliewer - Technology Editor, Subsea & Seismic

The Asia/Pacific offshore business offers a host of scenarios for oil and gas operators. Deep water, remote operations, oil and natural gas discoveries, NOCs, IOCs, independents, language barriers, huge distances, and more all overlaid with a triangle of demand reaching from China to Australia to India. It is this demand which makes the Asia/Pacific region an element in operations equations around the world. China and India, in particular, are viewed as the “X” factors in the world’s energy future. The one consensus, however, is that demand for hydrocarbons by consumers will grow faster in the Asia/Pacific region than anywhere else in the world.

The other role that the region fills on the world stage is that of construction contractor for leading-edge deepwater FDPSO/FPSOs, drillships, and semisubmersible rigs to LNG and oil tankers and service and supply vessels.

With that in mind, this discussion centers on exploration and production. Domestic and international operators are active in every prospective area of the region and are meeting with some success. Following are some examples:

Australia

The Delegate of the Joint Authority of the Offshore Area of the External Territory of Ashmore and Cartier islands has offered Nexus Energy a production license designated AC/L9 in relation to the Crux liquids project in the Browse basin, offshore Western Australia.

The license would have an indefinite term and apply to the entire area previously defined by the AC/P23 exploration permit covering the Crux field and the Auriga and Caelum structures. The award of the production license is the final regulatory approval milestone to permit sanction of the Crux liquids project. Nexus is in talks with Single Buoy Moorings for the supply and operation of an FPSO for Crux.

Since completing drilling at its 100%-owned West Seahorse field in the Gippsland basin last year, 3D Oil has undertaken a comprehensive evaluation of the field’s subsurface. The revised evaluation provides an update and an increase to the reserves provided in August 2008.

“A combined 2P reserves and best estimate contingent resource (P50) of 8.7 MMbbl of recoverable oil is now interpreted to exist at West Seahorse,” says Noel Newell, MD of 3D Oil. “3D Oil is actively reviewing options to develop West Seahorse, including seeking an appropriate joint venture partner.”

West Seahorse contains three separate oil zones: the N1 (Top Latrobe), the N2.6, and the P1 (both intra-Latrobe) formations. Reservoirs are thick, stacked fluvial channel sandstones and expected to have high flow rates, supplemented by strong water drive, typical of Gippsland basin Latrobe Group reservoirs.

Both N1 and N2.6 currently produce commercial volumes of oil in Seahorse field, operated by the joint venture of Esso Australia Resources and BHP Billiton Gippsland Basin.

Anzon Australia Pty. Ltd. operates the Basker-Manta-Gummy (BMG) Joint Venture with 40%. Partners include Beach Petroleum Ltd., 30%; CIECO Exploration and Production (Australia) Pty. Ltd., 20%; and Sojitz Energy Australia Pty Ltd., 10%.

BMG JV has decided to revise the development plan and schedule for the ROC-operated BMG project. In 2009 and 2010, the BMG JV will focus on enhancing the production performance of the Phase 1 oil project. Development commitments for the Phase II gas project have been reduced for this year.

The rigOcean Patriot gives BMG JV the option to workover existing B3 and B5 wells plus the option to drill and complete the B7 development well. A 60-90 day Ocean Patriot work program is scheduled for May start.

Woodside has made a discovery with the Martell-1 exploration well in permit WA-404-P in Western Australia’s Carnarvon basin. The well was drilled to TD of 3,330 m (10,925 ft) and wireline logs indicate a gross gas column of about 110 m (361 ft) in good quality reservoir sandstones, the company says. Pressure testing is under way and further drilling on the structure is expected later this year.

A 250-sq km (97 sq mi) 3D seismic survey in the Carnarvon basin offshore Western Australia by PGS Australia Pty Ltd. for MEO Australia Ltd. is scheduled to be under way at this time. TheOrient Explorer is the vessel and MEO says the $3.4-million survey, including processing, is in WA-360-P and is designed to map the extension of the Artemis Prospect being matured for drilling in 2010.

Chevron has announced the results of a seven-well exploration and appraisal program in Wheatstone and Iago fields on the northwest shelf off Australia. Following the completion and analysis of the appraisal program, the fields are estimated to hold enough natural gas to supply both an LNG facility and domestic gas project.

Wheatstone is in WA-253-P and WA-17-R, 125 mi (200 km) north of Onslow in water depths of around 650 ft (200 m).

The adjacent Iago field spans WA-17-R, which is wholly owned by Chevron Australia, and WA-16-R, in which Shell Development (Australia) Pty Ltd. has a one-third share, with Chevron holding the remainder.

During 2009, Chevron plans a drilling program with two rigs scheduled on multiple exploration and appraisal wells in its operated acreage.

“The Wheatstone project, together with Gorgon, is an important part of Chevron’s strategy to develop its large natural gas resource base in Australia and be a leading supplier of LNG,” says George Kirkland, executive vice president, Chevron Global Upstream and Gas. “In support of these two major capital projects, the company intends to undertake its largest-ever drilling campaign in Australia.”

Bengal Energy now has a 100% working interest in exploration permit AC/P47 a 3,485-sq km (1,345-sq mi) Timor Sea block on the Northwest Shelf of Australia.

Permit AC/P47 has only one well, drilled in 1973, downdip and off-structure of what Bengal says is a large area of structural closure encompassing high quality Triassic reservoir rocks. Bengal estimates this structure to be up to 90 sq km (35 sq mi) in area and 150 m (492 ft) thick. The Vulcan graben to the east is an established producing area.

Based on existing seismic data, Bengal believes there is a probability of equivalent light oil source strata extending to the flanks of AC/P47. Most of the permit has water depth of less than 400 m (1,312 ft), varying between 50 m (164 ft) and 900 m (2,953 ft).

The permit will have an initial six-year term, divided into two three-year phases. The first year of the program involves reprocessing of 985 sq km (380 sq mi) of 2D marine seismic data. In years two and three, Bengal has committed to acquire and process a 750-sq km (290-sq mi) 3D seismic survey.

New Zealand

First oil has been achieved from Maari, New Zealand’s largest oil field, off Taranaki’s south coast. The field, operated by OMV New Zealand, is a joint venture with Todd Energy, Horizon Oil International, and Cue Taranaki. Over its 10-15 year life, Maari is expected to produce 50 MMbbl of oil. Peak production of 30,000 b/d is expected in 2010.

A drilling rig is on the Maari wellhead platform to drill a total of eight wells -- five production and three water injectors. Two wells have been completed; the second is being hooked up to the production facilities. The other production wells will progressively come onstream over the next few months, the companies say.

Production testing was done to ensure that the FPSORaroa is ready to process the field’s output. The vessel is anchored 1.5 km (0.9 mi) from the wellhead platform, Tirotiro Moana. The first offtake is expected next month.

Field development, including some further appraisal drilling, is expected to be completed by the third quarter of this year.

The semisubmersible drilling rigKan Tan IV has been secured for operations in the offshore Taranaki basin, says Australian Worldwide Exploration (AWE).

AWE has agreements for the rig to drill four exploration wells. The rig will be contracted by AWE as part of a consortium of Australian companies to drill both in New Zealand and in southeast Australia starting in the second quarter.

AWE will have a total time contracted sufficient to drill four exploration wells in New Zealand. Additional rig time is expected to be available for follow-up exploration or appraisal drilling. AWE expects to drill the large Hoki oil prospect in permit PEP 38401 as the first well of its New Zealand campaign and also drill at least two oil prospects near the producing Tui oil field.

A seismic survey is under way offshore New Zealand 300 km (186 mi) northwest of Northland in the Regina basin. CGGVeritas, using itsPacific Titan, plans to gather 1,500 km (932 sq mi) of data exclusive for Crown Minerals and another 4,000 km (2,485 mi) that will be available non-exclusively.

“This is the first seismic data survey since the government decided to reverse the previous administration’s decision to stop data acquisition,” says Energy and Resources Minister Gerry Brownlee.

China

CNOOC has outlined its exploration and development plans for 2009. The company’s total capital expenditure is planned to reach $6.76 billion, an increase of 19% year-over-year. Of the total, $4.38 billion is for development, $1.11 billion for exploration, and $1.12 billion for production. Total targeted net 2009 production is 225-231 MMboe (at WTI $60). Net for 2008 is estimated at 194-196 MMboe (at WTI $100).

The company expects 10 new projects worldwide to come onstream, eight of them offshore China.

Exploration offshore China calls for drilling of more than 80 wells and acquisition of more than 30,000 km (18,641 mi) of 2D seismic and 9,200 sq km (3,552 sq mi) 3D seismic data offshore China and overseas.

The company says more than 20 development projects are planned for this year.

Among the projects under way is Ledong 22-1/15-1. Platform 22-1 is installed offshore and terminal construction is under way. The jacket for Platform 15-1 is in place and the topside module construction is on-going. Peak production for Ledong is estimated at 150 MMcf/d of gas. Installation offshore is on-going at platform CEP. The jacket and module are complete and once installed the platform is expected to peak at 23,000 b/d of oil.

Looking at exploration, CNOOC says there are five areas of interest in Bohai Bay including the Yellow River Mouth, Sag, and Bozhong Trough. In the South China Sea, eastern exploration seeks to expand the Huizhou oil production and western exploration aims to expand into new areas in Weixinan. The shallow South China Sea is a gas-prone environment.

Earlier this year, CNOOC announced two discoveries, one in Bozhong at BZ 2-1 and the other at Qinhuangdao at QHD 29-2.

BZ 2-1 is west of Bozhong Sag, about 6 km (3.7 mi) southeast of BZ 3-2 oil field. BZ 2-1-2 penetrated oil pay zones with total thickness of 50.9 m (167 ft) on its way to TD of 3,910 m (12,828 ft) in water depth of about 26 m (85 ft). The well tested at an average rate of 1,270 b/d of oil and 393 Mcf/d of natural gas via 11.91-mm (47/100-in.) choke. BZ 2-1 is another breakthrough in Bozhong Sag since QHD 35-2, which was found last year. The new discovery further proved the exploration potential in Bozhong Sag.

Another new discovery, QHD 29-2, is southeast of Qinnan Sag. The discovery well QHD 29-2-1 is on structure, with a TD of 3,991 m (13,094 ft). It encountered oil pay zones with total thickness of 34.7 m (114 ft) and gas pay zones of 47.9 m (157 ft). The water depth averages 27 m (89 ft).

A drillstem test of four layers flowed an average rate 3,930 b/d of oil and 15.2 MMcf/d of natural gas.

“These delightful results brought a brilliant start up for the company’s independent exploration activities in 2009,” says Zhu Weilin, executive vice president of CNOOC and general manager of Exploration Department. “Both of the structures are on large scale with thick oil pays, and contain light crude. It is of the significance to improve the current heavy oil dominant asset profile in Bohai Bay.”

The Bozhong (BZ) 28-2S oil field is onstream, according to CNOOC. Production began with 4,000 b/d of oil via four wells. The main development facilities include one central platform, 49 wells, and one FPSO. Production is expected to ramp up to 25,000 b/d of oil by 2011.

BZ 28-2S, together with the adjacent BZ29-4, BZ28-2SN, and BZ34-1N, is subject to joint development to maximize the commercial value, the company says.

New production has begun from PanYu (PY) 30-1 gas field, according to CNOOC. The field is producing about 30 MMcf/d of natural gas. PY30-1 is in the Pearl River Mouth basin in the eastern South China Sea, about 240 km (149 mi) southeast of Hong Kong.

CNOOC has implemented a joint development plan for PY30-1 and the HuiZhou (HZ) 21-1 oil and gas field. The PY/HZ project was divided into two phases. In Phase I, HZ21-1 began production. PY 30-1’s start-up successfully concludes Phase II.

The development facilities include one integrated platform and three subsea pipelines. Natural gas from PY30-1 will be piped to an onshore gas processing terminal in Zhuhai. Gas production will increase gradually to a stable 93 MMcf this year. The field’s peak production is expected to reach 60 MMcf/d.

According to the company’s 2009 plan, there will be five new projects coming onstream in Bohai Bay. The early start-up of BZ28-2S will serve to accelerate the development of the other four projects, the company reports.

Husky Energy has hit pay with its first appraisal well on the Liwan 3-1 field in the South China Sea. TheWest Hercules drilled the Liwan 3-1-2 well on a structure with 55 sq km (21 sq mi) of mapped closure. The well, which was logged, encountered 36 m (118 ft) of net gas pay over the main reservoir zone, the company says.

The well flowed at an equipment-restricted rate of 53 MMcf/d of gas, indicating future deliverability could be in excess of 150 MMcf/d, the company says. Husky Energy is determining the extent of the discovery and the reservoir flow capacity.

TheWest Hercules has been chartered for three years with extension options. Upon completion of this well, the rig will drill a second appraisal well before moving on to drill additional exploration wells in the area.

The front-end engineering and design for Liwan development is being prepared for tender and is expected to begin once results are obtained from the next appraisal well.

Primeline Energy Holdings has entered into a technical services contract with CNOOC Research for the preparation of the overall development plan (ODP) for the Lishui 36-1 discovery on block 25/34 in the East China Sea.

The total budget for the ODP is estimated to be $5.5 million which includes a lump sum for the work to be undertaken by CNOOC Research and CNOOC China Ltd.-Shanghai, and the costs of the third-party studies and surveys.

The companies expect ODP development to take six to eight months, subject to survey work progress. It is currently estimated that the ODP will be submitted to Primeline and CNOOC for approval in August before submission to the appropriate Chinese state authorities.

As part of the ODP, Primeline and CNOOC are working with the Wenzhou Municipal Authority to secure the land for the offshore pipeline landing point and gas processing terminal.

Production has begun from Platform B, part of Peng Lai (PL) 19-3 blocks’ Phase II project in Bohai Bay. Platforms D and E are expected to come online this year.

The second phase of PL, carried out simultaneously with the first, includes a 190,000 b/d FPSO and five fixed production platforms tied to a central fixed riser and utility platform.

Thirty-six mi (58 km) of subsea pipeline were installed to interconnect these facilities. Fluor designed the flowlines so early production could go to the existing FPSO. After the new FPSO is onsite, the flowlines will be reconnected for permanent installation.

The first phase of the project involved the basic design package for an early production facility which consisted of a new fixed production platform tied to a newly modified and refurbished FPSO.

Fluor has provided engineering services throughout the project, which includes conceptual engineering, front-end engineering and design (FEED), and detailed engineering. Fluor has also provided procurement services for three wellhead platforms and construction support in fabrication yards in Shanghai, Tanggu, and Singapore.

India

India’s Oil and Natural Gas Corp. (ONGC) reports seven new prospects and six new finds offshore for its fiscal 2008. So far in 2009, ONGC records nine more offshore discoveries. In 2008, four of the prospects and the six finds were in the western offshore area. In ’09, six of the discoveries are on the eastern side in the Krishna Godavari basin.

According to its major projects list, more than $5 billion is destined for offshore development spending on seven projects going forward.

ONGC’s board of directors has approved spending of its share of the $329-million Hydra project under the Panna Mukta Joint Venture. ONGC will contribute $131.6 million of the total.

The project calls for installing two wellhead platforms and associated pipelines, plus the drilling of nine wells. These additional facilities will give recovery of 14.50 MMbbl of oil and 21.39 bcf of gas from the PK and SWP areas of Panna field over a period of 11 years.

Panna-Mukta field is operated by a Joint Venture of ONGC (40%), RIL (30%), and British Gas Exploration and Production India Ltd. (BGEPIL) (30%).

Development of PL Area under the Panna-Mukta JV involves the un-drained area “PL” in the southern part of the main field. The estimated cost of the project, including pre-development cost is $ 186.41 million (ONGC share $ 74.6 million). Incremental recovery of the order of 8.26 MMbbl of oil and 12.25 bcf of gas is anticipated in this plan.

ONGC has awarded Vantage Drilling a five-year contract for the ultra deepwater drillshipPlatinum Explorer, currently being constructed by Daewoo Shipbuilding & Marine Engineering in Okpo, Korea.

The rig, following completion of shipyard construction, is scheduled to mobilize to India in 4Q 2010. Expected revenues over the five-year contract term, excluding revenues for mobilization of the rig, are approximately $1.1 billion.

ONGC has approved the second phase of Mumbai High North (MHN) Redevelopment project, scheduled to be completed in 3Q 2012.

Phase II aims to further improve recovery from Mumbai High. The company plans to drill 73 new wells and sidetrack 38 sick/poor producers. Development of small reservoirs (L-II and L-I) has been integrated with the main reservoir (L-III) to improve overall oil production and development economics, the company says.

CGGVeritas’Symphony vessel has set a 3D seismic production record by acquiring 2,490 sq km (961 sq mi) of data in January. The record came during a survey for Santos offshore east India towing 12 Sentinel solid streamers.

Looking ahead, plans for more exploration licensing offshore India may reflect the current world economic view. While India had planned its largest ever auctions of oil and gas blocks for mid-April, it may execute that auction in phases in order to gauge buyer interest.

India imports about 75% of its crude oil and wants to pursue more local production in order to reduce that percentage.

Last year, it awarded 44 oil and gas blocks to bidders in the seventh round of auctions under the New Exploration Licensing Policy.

“We’ve thought that more blocks will be ready to be offered this time,” says R.S. Pandey, state Petroleum secretary. India is aiming for coverage of 80% of its sedimentary basin by 2012.

The Petroleum Ministry also is talking with the Finance Ministry to restore tax incentives for gas exploration. The provision for a seven-year tax exemption for gas producers was removed early last year by the government.

Philippines

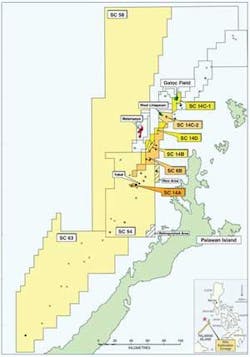

Kairiki Energy has a conditional agreement to farm-out a 17% interest in the inboard portion of Service Contract 54 in the Philippines. Kairiki will retain 23% in the inboard portion of SC 54 (to be named SC 54A) and 40% in the remainder of SC 54 (to be named SC 54B). SC 54 is in the northwest Palawan basin in water depths ranging from 30 m to 1,100 m (98 ft to 3,609 ft) and covers an area of 5,418 sq km (503 sq mi).

Reserves at the recent Yakal and Tindalo oil discoveries in SC 54 offshore the Philippines are estimated at up to 10.7 MMbbl and 24.5 MMbbl, respectively, reports Nido Petroleum Ltd. and joint-venture partner Kairiki Energy Ltd.

An analysis of drilling data, oil samples, and pressures and wireline logs from the Yakal-1 and Tindalo-1 discovery wells, which intersected the target Nido Limestone formation, indicate the oil columns are 78-93 m (256-305 ft) and 124-144 m (407-472 ft), respectively.

The Joint Venture now plans to build static and dynamic reservoir models based on the Isis depth mapping of the 3D seismic data over the two discovery structures.

Shell Philippines Exploration (SPEX) has awarded Hallin Marine a $20-million contract for the new subsea operations vessel Ullswater. The 78-m (256-ft) vessel is being mobilized to support SPEX’s Malampaya shallow water platform maintenance program and will operate in its DP-2 mode, providing support and accommodation to the project’s construction crews. The contract, which begins immediately, is a firm charter with potential to extend on location through 2010.

Vietnam

Serica has reached agreement with Australian Worldwide Exploration (AWE) on the terms of a farm-out of part of Serica’s interest in the block 06/94 Production Sharing Contract (PSC) offshore Vietnam. The agreement is subject to the waiver of a pre-emptive right held by PetroVietnam, the Vietnamese State oil and gas company, and to the approval of the government of Vietnam.

Under the agreement, AWE will bear Serica’s 33.33% share of the costs of the three-well drilling program in the PSC, subject to a financial cap, in order to earn an interest of 23.33% in the PSC, with Serica retaining a 10% interest.

The drilling rigOcean General is expected to arrive in block 06/94 for the Tuong Vi exploration well in June. The second and third exploration wells on the block are to be drilled in 2010.

The company says a 58-km (36-mi) offshore and onshore pipeline has been laid and tested in the Kambuna field development (Serica 50%). The offshore platform topsides are installed and offshore hook-up and commissioning are in progress. First gas is scheduled for June.

Salamander Energy Plc and PetroVietnam Exploration Production Corp. Ltd. are scheduled to sign a production sharing contract for block 31 offshore southern Vietnam. Salamander will be operator with 60% interest.

Block 31 covers more than 5,000 sq km (1,931 sq mi) adjacent to Salamander’s Cuu Long River Delta 01 block. Salamander says existing 2D seismic data indicates Lacustrine source rock and multiple play types.

“When taken together with block DBSCL-01, we now operate a 13,000-sq km (5,019-sq mi) swath of acreage across graben systems which we believe are analogous to the highly prolific Cuu Long basin, which lies to the east of our blocks,” says James Menzies, CEO of Salamander. “We look forward to exploring this area with our partner, PVEP, and are conducting geological and geophysical studies ahead of exploration drilling in 2010.”

Almost five years ago, American Technologies Inc. Petroleum (ATIP) began to drill the Yen Tu-1X well to 1,932 m (6,339 ft), and encountered hydrocarbon zones in two Miocene formations and the carbonate basement. The well, which represents the first oil discovery in North Vietnamese waters, was plugged and abandoned.

Since, ATIP has drilled four exploratory wells in the Yen-Tu, Ha Long, Thai Binh, and Ham Rong blocks, resulting in three oil and gas fields. In June 2008, the company began testing of the Ham Rong 1X well in the Song Hong basin offshore northern Vietnam south of Hai Phong City in water depths between 25 and 30 m (82 to 94 ft). Drilling began at Ham Rong 1X in June 2008 to test the hydrocarbon potential of the area’s pre-tertiary fractured and karstified carbonate basement, as well as the Miocene channelized clastics reservoir.

The well was drilled to TD of 3,700 m (12,139 ft) and encountered hydrocarbon zones in carbonate basement formations. Drillstem testing showed a commercial open-flow rate.

Following the successful testing at Ham Ron 1X, the Yen Tu 1X field was reopened, and is currently being tested. Well results are expected to be made public within the next two months, the company says.

PetroVietnam has approved the application for two appraisal areas within block 16-1, according to the Hoang Long Joint Operating Co. (HLJOC). The company, which operates block 16-1 in Cuu Long basin, will submit documentation for formal governmental approval.

The Te Giac Den (TGD) appraisal area encompasses 150 sq km (58 sq mi) including the HT/HP discovery well Te Giac Den 1X-ST1 on prospect E, and the analogous E South prospect. This area borders the southern boundary of the Te Giac Trang (TGT) field where pre-development activity is under way.

The Voi Trang appraisal area, the award of which is conditional upon a successful reserve assessment report of the commerciality of the previous discoveries in the awarded area, encompasses the Voi Trang discovery and several adjacent leads, and covers an area of approximately 100 sq km (39 sq mi).

Upon receiving governmental approval, work will begin to reprocess the 3D seismic over the TGD appraisal area in anticipation of drilling a well in 2010. The assessment report on Voi Trang is to be complete by the end of the second quarter of this year.

“PetroVietnam’s agreement for the approval of the Te Giac Den appraisal area in the HT/HP play area is a very significant development for SOCO in that it affords us the opportunity to incorporate our previous drilling results with re-processed seismic and to plan an effective drilling program to return to this highly prospective area,” says Ed Story, president and CEO of SOCO.

Thailand

Chevron has awarded Global Industries a $44-million contract to install platforms and pipelines as part of a development in the Gulf of Thailand. Global Industries Offshore (Thailand) will use itsComanche barge for the project, which will be in water depths of 180 ft to 243 ft (55 m to 74 m). Work is scheduled for completion in October.

The Kingdom of Thailand has approved a 282-sq km (109-sq mi) production license surrounding the Bua Ban field in the shallow waters of the Gulf of Thailand, according to Coastal Energy.

The license is in effect for 20 years, or until production ceases. The Bua Ban field contains an estimated 21.8 MMbbl of proven plus probable reserves based on the company’s 2007 year-end reserves report. Coastal Energy is the operator and owns 100% of the field, contained within its G5/43 block.

The company plans to develop Bua Ban beginning in the second quarter of this year, with first production expected in the third quarter through temporary storage and offloading facilities. Production is expected to average 9,500 b/d of oil by year-end.

This is in addition to the 10,000 b/d of oil planned for the Songkhla field, also in block G5/43, which was developed late last year. The company is installing a MOPU and storage tanker at Songkhla. Installation of permanent production facilities is planned for the second quarter.

Coastal Energy owns a 3D seismic survey covering this trend and has identified nine additional prospects that look similar to the Bua Ban field, the company says. All of these are in the Bua Ban license. One structure, Benjarong Main, was drilled by the Benjarong-1 well, which encountered 105 ft (32) of net pay between 9,954 ft (3,034 m) and 10,379 ft (3,164 m).

Five of the nine prospects are near Bua Ban and the other three are nearer the Benjarong Main structure.

Indonesia

Clough has entered into a binding Heads of Agreement to sell its 82% stake in PT Petrosea Tbk to PT Indika Energy Tbk for $83.8 million. As part of this sale, Indika Energy and Clough have agreed to collaborate through Tripatra, a subsidiary company of Indika Energy, on future joint ventures in offshore oil and gas projects in Indonesia.

TGS-NOPEC Geophysical is acquiring a 9,550-km (5,934-mi) multi-client 2D survey offshore West Sumatra, Indonesia.

The new Sumatra survey is designed to complement the existing Northwest Sumatra and Sunda seismic, bathymetric, and coring data acquired as part of the TGS IndoDeep program. IndoDeep, previously called “Indonesia Frontier basin,” was acquired and interpreted from 2006 to 2008. It includes 34,000 km (21,127 mi) of 2D seismic, 400,000 km (248,548 mi) of multi-beam bathymetric data, and 1,200 core samples covering approximately 1 million sq km (386,102 sq mi) of Indonesia’s deepwater basins.

The initial interpretation of the Northwest Sumatra and Sunda IndoDeep programs indicates the elements of a potential petroleum system are present. The new project includes both long-offset 2D seismic and gravity data acquired by theMV Mezen.

Myanmar

PTTEP International’s participation interest swap with CNOOC Myanmar expired before receiving government approval, making the contract invalid. The company had intended to swap a 20% participating interest in the production sharing contract (PSC) in blocks M3 and M4 with CNOOC Myanmar’s A4 and C1.

PTTEPI (operator) will maintain its holding of 100% participation interest in blocks M3 and M4. Blocks M3 and M4 are in the Gulf of Martaban, Myanmar, covering an area of 18,000 sq km (6,950 sq mi), with gas potential. PTTEP is pursuing geological and geophysical studies for further exploration.

Cyclone response procedure needed

A near-miss has prompted Australia’s National Offshore Petroleum Safety Authority (NOPSA) to issue a safety alert to offshore operators of the need for a Cyclone Response Procedure.

A construction vessel weathered a cyclone because “its operator failed to put in place preparations to retrieve anchors and evacuate from its location in a timely manner,” says NOPSA. No injuries were reported.

Elements recommended for a response procedure include:

- Designation of safe mooring areas

- Escape route/sail away restrictions

- Responses incorporating worst-case weather forecasts

- Helicopter availability

- Required evacuation preparation times for key activities.