Oil and gas commodity markets have forced out most long-term supply contracts. Using geographically diverse suppliers, commodity markets apply a variable premium or discount to prices to reflect supply conditions, relative to demand.

However efficient commodity markets appear to be, commodity brokers thrive on oil and gas price motion, not stability. Price direction is not important. That is why the industry experienced a 30-40% oil price collapse last year based upon slight (0.5-1.5%) over-supply conditions.

Price motion is antithetical to what oil and gas producers seek. And in an effort to address the situation earlier this year, OPEC and non-OPEC producers combined unintended production shortages (Nigeria, Indonesia), voluntary production cuts (Venezuela, Saudi Arabia, et al), and an array of output trims by non-OPEC producers to reduce global crude production by 2-3%. The cuts produced the desired effect.

OPEC and non-OPEC producers learned something from this almost accidental response. They took back at least some measure of pricing power in the oil market, rather than concede it all to the brokers. They aren't DeBeers, the South African conglomerate that works with other producers to keep an artificial floor under diamond prices, but they learned something about cooperation. The question now is whether they can put it to efficient use again in the future.

It's not over - until it's over*

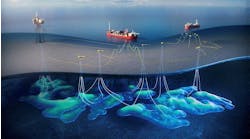

While oil and gas producers were focusing on deepwater opportunities and recovery from low oil prices, geoscientists were concentrating on developing better resolution of faulting planes, salt tectonics, and hydrocarbon prospectivity of very deep formations. This deep imaging is a product of new surveying, modeling, and display tools, coupled with a quantum gain in computing technology.

Mature offshore basins are the immediate target for this new imaging capability. There, reserves in shallow horizons have been depleted, and producers are looking for a reason to keep platforms and pipelines in place. Early applications of this imaging capability are showing up in the US Gulf of Mexico - on the continental shelf, of all places - where the target formations are - unbelievably - crude oil. But natural gas will do, too.

In the past, Gulf of Mexico producers avoided deep drilling on the continental shelf, with the exception of some isolated gas plays. Besides poor imaging and high risk, there were other reasons:

- Poor information return: The combination of too-frequent dry holes and the difficulty of modeling favorable geology encouraged producers to move elsewhere on the shelf rather than drill deeper.

- Lure of deepwater: Producers preferred to pay a premium to get into deepwater E&P, with its' large reserves and shallow pay zones, rather than the relatively higher risk of deep drilling on the shelf.

- Natural gas development: Historically, as shelf producers drilled through commercial gas reserves in the pursuit of deeper targets, the temptation to pull the bit and develop the gas was often too great.

- Workover economics: Even today, when working over producing oil and gas wells on the shelf, producers normally drill out laterally or tie in higher pays. Cost-conscious independents often must ignore deeper targets because field re-development economics don't allow it.

The improvement of deep formation imaging was triggered initially by interest in the structural traps underlying salt bodies. Subsequently, the interest shifted to salt body withdrawals, a geological activity that enhances trapping and sealing. A third inducement was the interest in locating primary reservoirs (most Gulf of Mexico producing horizons are secondary) and migration chimneys in regions that feature high pay zone density.

Along with the known natural gas prospectivity on the shelf, the prospect of additionally locating deep oil is forcing some majors and a number of independents to re-evaluate prospects in a water depth they had largely given up on. So, the Gulf of Mexico continental shelf cannot be written off - until everything above basement rock is imaged effectively.

- With apologies to Yogi Berra (US baseball legend)

Readers wishing to respond to issues presented on this page or elsewhere in Offshore, or offer authored articles or article suggestions, should respond by E-mail ([email protected]) or Fax (1-713-963-6296).