Shallow-water Gulf of Mexico decommissioning market valued at $6.3 billion

Editor's note: This story first appeared in the July-August 2022 issue of Offshore magazine. Click here to view the full issue.

By Mark J. Kaiser * Center for Energy Studies, Louisiana State University

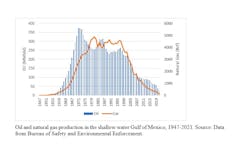

In 2021, the shallow-water Gulf of Mexico produced 23.4 million barrels of oil and 113 billion cubic feet of gas, production levels last seen in the late 1950s. Both oil and gas are long on their decline curves and any reversal via new discoveries is highly unlikely. Although these decline curves may flatten in the near-term with sustained higher oil and gas prices, they will quickly return to their downward trajectories when prices return to their long-run average.

This four-part series reviews the shallow-water Gulf of Mexico decommissioning market and the expected decommissioning cost of operations across each of the main stages of operations based on data collected and evaluated from the Bureau of Safety and Environmental Enforcement (BSEE).

In this first part, we begin by summarizing shallow-water production and decommissioning activity in water depth less than 122 m (400 ft), and then estimate the size of the decommissioning market.

In subsequent parts, decommissioning cost statistics and cost functions will be evaluated for well plugging and abandonment, structure removal, and pipeline decommissioning.

The shallow-water Gulf has been written off before, and at current levels of decommissioning, it will take 20 years before inventories are cleared. The end is nigh, but 20 years is a long time.

Shallow-water production

From 1947-2021, the Gulf of Mexico produced 23.1 billion barrels (Bbbl) of oil and 190 trillion cubic feet (Tcf) of gas, or about 55 billion barrels oil equivalent (Bboe).

The shallow-water Gulf of Mexico in water depth less than 122 m (400 ft) has contributed over half of the cumulative oil and nearly 85 percent of the natural gas produced during this period, 12.3 Bbbl of oil and 160 Tcf of gas, or about 71 percent total boe production.

In 2021, the shallow water Gulf of Mexico produced 23.4 million barrels (MMbbl) of oil and 113 billion cubic feet (Bcf) of gas, production levels last seen in the late 1950s.

About six percent of the Gulf’s oil production and 23% of its gas production in 2021 came from shallow water.

Unlike deepwater oil production, there were no significant Covid-related impacts in 2020-21, and the downward sloping oil and gas trendlines did not noticeably change their descent profiles.

One would expect an uptick in wells spud and production in 2022-23 if prices remain high, and the persistent downward trend will be relaxed somewhat, but percentage changes will be small.

Most gas production in the Gulf is in shallow water, and as shallow-water production declines, total production in the Gulf of Mexico has followed.

Plug and abandonment activity

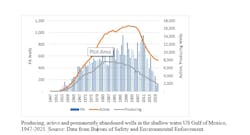

Since 1947, a total of 46,530 wells have been spud in the shallow water Gulf of Mexico, 34,206 wells have been permanently abandoned, and 4,421 wells have been temporarily abandoned (TA), leaving an active inventory of 7,903 wells circa 2022.

Of the 7,903 active wells circa 2022, about 20% are currently producing (1,624 producing wells). Average wellbore production during 2021 was 24,015 boe/well, or 66 boepd/well.

About two-thirds of active wells are in water depth less than 200 ft and about one in five wells are producing.

From 2016-21, permanent abandonments have outpaced spud wells by about 5:1, slightly greater in <200 ft and slightly less in 200-400 ft water depths.

Structure decommissioning activity

A total of 6,944 structures have been installed in shallow water and 5,311 structures removed up through 2021, leaving an active inventory of 1,633 structures circa 2022.

The number of producing wells and active structures are about the same, so average structure production during 2021 was also about 66 boe/day per structure.

From 2017-21, 120 caissons and well protectors and 262 fixed platforms were removed, 383 structures total, or about 76 structures per year. A total of five new structures were installed during the period.

Market size

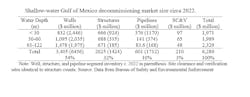

Using BSEE decommissioning cost estimates based on operator-reported data, the shallow-water Gulf of Mexico decommissioning market is valued at about $6.3 billion circa 2022.

Well abandonment accounts for over half the market ($3.4 billion) followed by structure removal operations ($2 billion) at about one-third total market size.

Combined, wells and structures account for 84% ($5.4 billion) of the estimated total $6.2 billion decommissioning cost. Pipeline decommissioning contributes about 10% and site clearance and verification 3% of total cost.

About one-third of decommissioning expenditures are expected to occur in each of the three water depth categories, <30 m, 30-60 m, and 61-122 m.

Average decommissioning cost

Broken out by well status, the 3,712 completed well inventory circa 2022 is expected to cost $2.6 billion and the 2,744 TA wells are expected to cost $840 million to plug and abandon.

On average, across all shallow-water depths, the cost is about $609,000 for completed wells and $306,000 for TA wells.

The majority of structure decommissioning costs is associated with fixed platforms. The 397 shallow-water caissons circa 2022 are expected to contribute $149 million out of a $2-billion work program, or about 7%, with the rest of the cost associated with fixed platforms.