Offshore staff

LONDON – Oilfield service (OFS) companies could be severely impacted if present market conditions continue, according to Wood Mackenzie.

Even at the start of this year, the service sector had been struggling with low margins, over-supply and weak investor sentiment, the consultants pointed out.

Mhairidh Evans, principal analyst in Wood Mackenzie’s upstream supply chain research team, said: “Even more capital discipline from operators will reduce demand significantly in 2020.”

Pre-FID (final investment decision) greenfield projects will likely be the first to be put on hold, and this will have a serious impact on the supply chain.

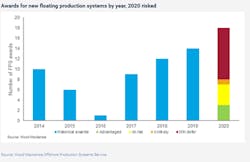

“We had forecast growth in floating production systems (FPS) market for 2020 with up to 18 new contract awards,” Evans said. “Now we expect only a handful to go ahead, which would take the FPS market to 2015/16 levels.

“Our preliminary analysis suggests global upstream capital investment will fall by at least 25% in 2020. “Most of that impact will be through activity reduction, although OFS pricing deflation will play a role.”

Although there have been relatively few immediate reactions from offshore service providers, Wood Mackenzie now expects very low levels of new offshore contracting, she added.

“Requests for concessions on existing contracts seem inevitable. And any operator bold enough to enter into new rig contracts can expect rock bottom rates as the rig market heads towards low utilization levels over the next year.

“We question how much further OFS pricing can reduce though. Stretched balance sheets and low margins were still commonplace for the service sector coming into 2020.

“Companies had already cut so much, it’s hard to identify further savings without drastic measures. This includes refinancing and the restructuring of business models. Headcount cuts and bankruptcies are inevitable.”

Excess capacity is a further issue, as companies holding onto idle assets for ‘just in case’ scenarios will now have to think again, as sub-$40/bbl oil will force profound change in the sector’s footprint, Evans said.

“While there’s short-term pain associated with this, it could ultimately create a more sustainable business for those that survive the downturn.”

03/25/2020